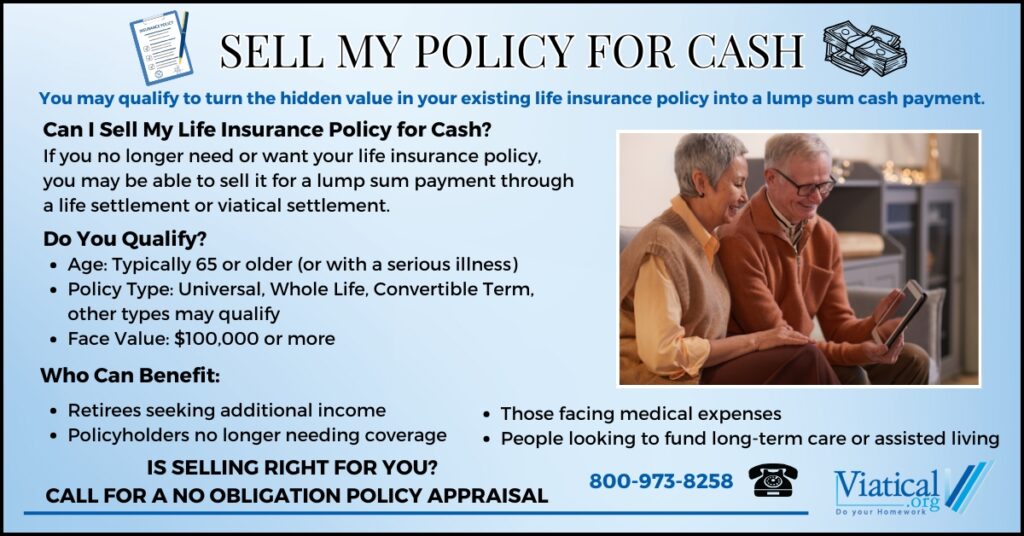

If you’re wondering how to sell my policy for cash, you’re not alone. Many policyholders discover that they no longer need or can no longer afford their life insurance and want to unlock its value. Selling your life insurance policy through a life or viatical settlement can provide you with a lump sum of cash, often far more than surrendering the policy back to the insurance company.

Can I Sell My Life Insurance Policy for Cash?

Yes, in many cases, you can sell your life insurance policy for cash. This process is known as a life settlement or viatical settlement, depending on your health condition and estimated life expectancy. The most common requirements for selling a policy include:

- The policyholder is 65 or older for a life settlement or has a serious medical condition for a viatical settlement.

- The policy has a face value of $100,000 or more (some policies may qualify with a lower face value if the insured is terminally ill)

- The policy type is universal life, whole life, or convertible term life insurance.

How Much Can You Sell a $100,000 Life Insurance Policy For?

The amount you receive depends on several factors, including your age, health, premium costs, and the type of policy you have. Generally, life settlements typically pay 10% to 30% of the policy’s face value, while viatical settlements may offer more for those with serious health conditions.

As an example, George, a 75-year-old in average health, sold his $100,000 Universal Life policy for $7,500 through a life settlement. Since his premiums were moderately high and he was in fair health for his age, buyers offered him a lower percentage of the policy’s face value.

If George had been in poor health but not terminally ill, he might have received $15,000 to $25,000. However, if he had a serious illness qualifying him for a viatical settlement, his payout could have been $40,000 or more.

What Is the Downside of Selling Your Life Insurance Policy?

While selling your policy can provide a significant financial benefit, there are some drawbacks to consider:

- Reduced Payout Compared to Death Benefit – The amount received is always less than the full policy death benefit.

- Impact on Beneficiaries – If your loved ones were relying on the death benefit, they will no longer receive it. Oftentimes, policies are sold because beneficiaries have become financially independent and the policy is no longer needed.

- Possible Tax Implications – Depending on your situation and state laws, part of the proceeds may be subject to taxes. Most viatical settlement proceeds are not taxed. Please consult with your trusted tax professional regarding your unique situation.

- Loss of Coverage – Once sold, the policy no longer belongs to you. You may want to keep your policy if you need the coverage.

How Do I Convert My Life Insurance to Cash?

To convert your life insurance policy into cash, follow these steps:

- Determine Your Policy’s Eligibility – Check if your policy qualifies for a life or viatical settlement based on its type, value, and your health.

- Request a Policy Appraisal – We can help you obtain a no obligation policy appraisal to help you understand your policy’s market value.

- Consider Offers – If value is found and an offer is presented to you, consider how much this would help your financial situation.

- Complete the Sale – Once you accept an offer and contracts and chance of ownership are completed, the buyer takes over premium payments, and you receive a lump sum payout.

Is Selling Your Policy the Right Choice?

Selling your life insurance policy can be a great way to access cash for retirement, medical expenses, or other financial needs. If you no longer need or want your policy, a life settlements or a viatical settlement could be a valuable option.

If you’re considering selling your policy, request a no-obligation appraisal estimate today to learn how much you could receive. 800-973-8258