For those holding a life insurance policy on waiver of premium, the idea of selling a life insurance policy with waiver of premium for cash may not be top of mind. However, this unique status could make the policy highly appealing in the secondary market, offering you an opportunity to access substantial cash that could support your current needs. Here’s how selling a life insurance policy with waiver of premium works and why it may be the perfect time to consider this option.

Understanding the Waiver of Premium Benefit

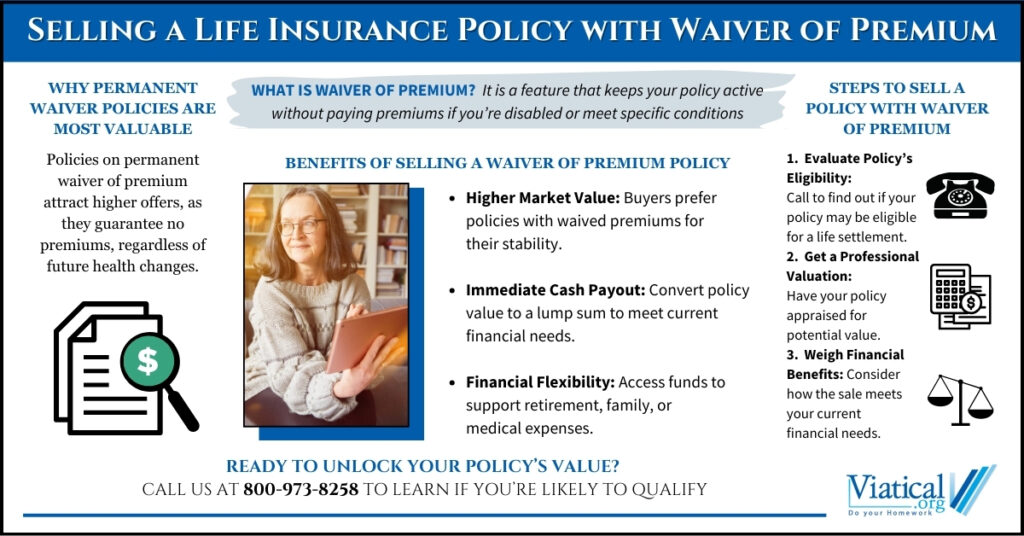

A waiver of premium feature in a life insurance policy generally means that if the policyholder becomes disabled or meets certain qualifying conditions, they can keep the policy active without continuing to pay premiums. For policyholders who no longer need the coverage or prefer immediate financial support, selling a policy on waiver of premium could be a powerful financial strategy.

Why Selling a Policy on Waiver of Premium Can Be Beneficial

- No Ongoing Costs for You: A policy with a waiver of premium continues to grow in value without requiring you to pay additional premiums. By selling, you gain access to cash while transferring the policy’s benefits and responsibilities to the buyer.

- Higher Market Value: In the secondary market, policies on waiver of premium may attract higher offers. Buyers are often more interested because they can acquire an established policy without future premium obligations, making it a valuable asset.

- Immediate Cash Payout: Instead of waiting for the policy’s payout or maintaining it indefinitely, life settlements allow you to convert the value into a lump-sum cash payment. This money can be used for medical expenses, living costs, or other financial goals.

- Flexibility for Changing Life Circumstances: If your original need for the policy no longer applies, selling can allow you to redirect the funds toward current priorities, such as retirement needs or family support.

Why Permanent Waiver of Premium Policies Are Especially Valuable

It’s important to note that not all waiver of premium policies are created equal. Policies on a permanent waiver of premium are especially attractive in the life settlement market. This distinction is crucial because some policies only offer a temporary waiver, meaning the premium waiver lasts only until the insured’s health improves or they return to work. In these cases, the policyholder may eventually be required to resume premium payments.

However, with a permanent waiver of premium, the policyholder is permanently relieved from paying future premiums, regardless of changes in health or work status. This type of policy is seen as more secure and predictable by potential buyers, as they know the policy will remain active without any further financial commitment on their part. As a result, policies with permanent waivers often command higher offers, making them ideal candidates for sale.

Example of Waiver of Premium Policy Sale

Here is a real-life example of the sale of a policy with waiver of premium. A woman in her 70s with some health issues was in need of cash for living expenses and no longer needed her life insurance policy. In most cases, she would have been considered too young and healthy to qualify for a sale or might only have qualified for a very small offer. Due to the fact that her policy was under permanent waiver of premium, she received an offer of over 30% of the policy’s face value. She was thrilled to be able to access the hidden value in a life insurance policy that was no longer needed.

Steps to Selling a Life Insurance Policy with a Waiver of Premium

- Assess Your Policy’s Eligibility: Policies with waiver of premium often hold significant value, but it’s essential to work with an experienced professional to evaluate the current worth and eligibility criteria.

- Get a Policy Valuation: Reach out to life settlement companies or brokers specializing in waiver of premium policies to get an accurate market estimate. A professional assessment can help you understand what buyers are willing to pay.

- Weigh the Financial Advantages: Consider how the sale’s proceeds will benefit your financial situation versus maintaining the policy. In many cases, the immediate cash can relieve financial strain and give you the flexibility you need.

When Selling May Be the Right Choice

If you are no longer in need of the death benefit, or if maintaining the policy no longer aligns with your goals, selling a policy with a waiver of premium can offer a financially viable solution. With careful evaluation, this option may unlock the hidden value of your policy so you can benefit from it when you need it the most.

Please give us a call at 800-973-8258 to learn if your waiver of premium policy might qualify for a life settlement.