When considering the purchase of a life insurance policy through life settlements or viatical settlements, one critical factor that shapes investment decisions is life expectancy. How do life settlement investors determine life expectancy? In these transactions, life expectancy is estimated by third-party life expectancy report providers who employ physicians that evaluate existing medical records. This analysis helps investors estimate how long the policyholder is expected to live, which in turn affects the value and potential profitability of purchasing the policy.

The Role of Life Expectancy Reports

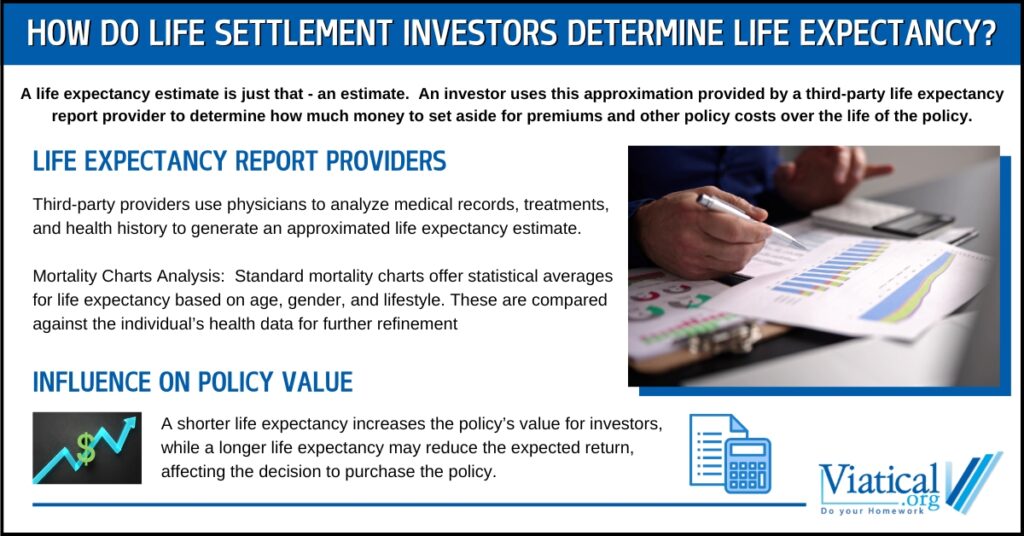

To ensure accurate predictions, life expectancy report providers rely on experienced physicians who conduct comprehensive evaluations of the insured individual’s medical records. These records often include a detailed history of past and current health conditions, treatments, test results, and any relevant medications. Physicians meticulously review this information to estimate the policyholder’s remaining lifespan, creating a vital reference point for investors.

Utilization of Standard Mortality Charts

Investors and report providers also consider standard mortality charts in their analysis. These charts, developed using large-scale population data, provide baseline statistics on average life spans. By comparing an individual’s specific health profile with these population averages, analysts can identify whether the insured’s life expectancy is shorter or longer than what would be expected for their age group. Factors such as age, gender, and lifestyle habits play a significant role in these assessments.

Adjustments for Medical Advancements and Personalized Data

A life expectancy report is not solely reliant on static data. Advances in medical treatments, breakthroughs in disease management, and emerging trends in health care practices can all influence life expectancy projections. For example, if a person has been diagnosed with a condition that has a new, effective treatment, their life expectancy might be adjusted to reflect improved outcomes.

Additionally, personalized data plays a crucial role. Analysts might evaluate the policyholder’s adherence to treatment plans, overall fitness level, and family health history. This information provides a more nuanced prediction that can help investors make informed decisions about acquiring the policy.

Understanding the Importance of Life Expectancy in Investment Decisions

For investors in the life settlement market, understanding life expectancy is essential. A shorter projected life expectancy typically increases the immediate profitability of the investment, as the payout from the policy will be received sooner. Conversely, a longer life expectancy means a longer holding period for the investment, which can affect the overall return.

A Data-Driven Approach

The determination of life expectancy in the life settlements industry is a meticulous process that combines individual medical analysis with statistical tools such as standard mortality charts. The use of third-party life expectancy report providers ensures that each evaluation is thorough and credible, ultimately providing investors with the insights needed to make sound financial decisions.

Understanding how life expectancy is calculated can help investors better appreciate the complexities of the life settlement market and the importance of accurate, data-driven projections. For those considering investing in life insurance policies or evaluating their own policy’s potential for sale, knowing how life expectancy impacts the transaction is crucial.

Ultimately, a life expectancy estimate is just that – an estimate. It is a planning tool to help investors approximate how much money to allocate to paying policy premiums and other expenses over the life of the policy.

To find out if you’re likely to qualify to sell your life insurance policy for cash, please give us a call at 800-973-8258.