Many individuals and businesses use premium financing to fund large life insurance policies. While this strategy can provide financial flexibility, it may also lead to challenges if the policyholder can no longer afford loan payments or the policy is no longer needed. In such cases, a premium finance rescue, selling a premium financed policy for cash, may offer a way out—allowing policyholders to sell their policy, pay off the outstanding loan, and potentially walk away with cash in hand.

What Is Premium Financing for Life Insurance?

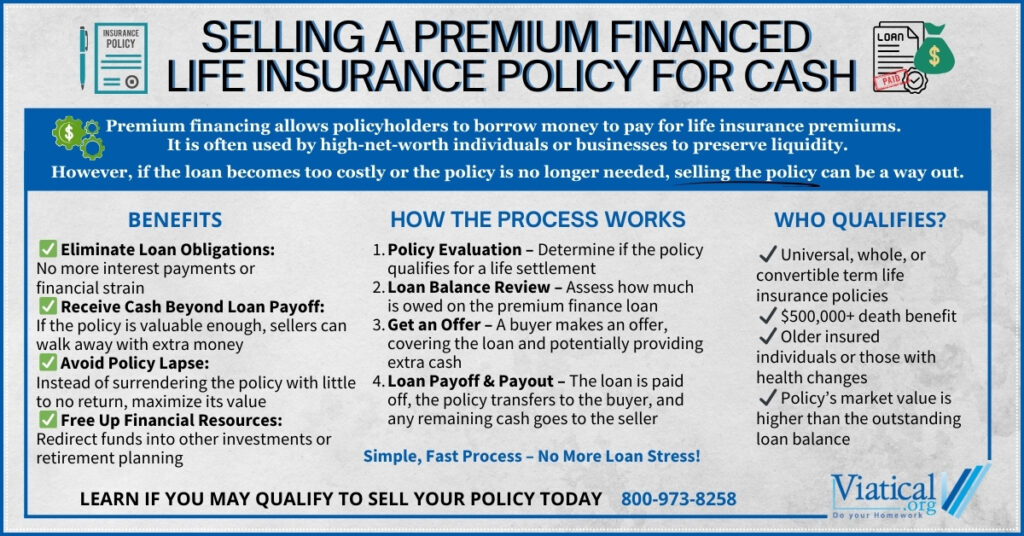

Premium financing is a method used to pay for life insurance premiums using borrowed funds. High-net-worth individuals and business owners often use this strategy to secure large policies without tying up their liquid assets. However, these arrangements come with risks, including:

- Loan repayment obligations – If the policyholder cannot continue servicing the loan, they may risk losing the policy or facing financial strain.

- Interest accumulation – The cost of borrowing can grow over time, making the policy more expensive than anticipated.

- Changes in financial strategy – If the policyholder’s needs change, they may no longer want or need the coverage, leaving them searching for an exit strategy.

How a Premium Finance Rescue Works

A premium finance rescue allows policyholders to sell their policy through a life settlement or viatical settlement, using the proceeds to pay off the loan and potentially retain excess funds. Here’s how the process typically works:

- Policy Evaluation – The policyholder works with a life settlement company to determine the policy’s approximate market value.

- Loan Assessment – The outstanding premium finance loan balance is reviewed to understand how much must be repaid.

- Settlement Offer – If the policy qualifies and there is interest, a buyer will make an offer that includes paying off the loan and potentially providing additional cash to the policyholder.

- Transaction Completion – Upon acceptance, the loan is paid off, ownership of the policy transfers to the buyer, and any remaining funds go to the policyholder.

Benefits of Selling a Premium-Financed Policy

Selling a premium-financed policy through a life settlement or viatical settlement can provide several advantages:

- Eliminate loan obligations – Avoid the burden of loan repayments and potential financial strain.

- Receive cash in addition to loan payoff – If the buyer’s offer exceeds the loan balance, the policyholder can retain the difference as cash.

- Free up financial resources – Redirect capital into other investments, business ventures, or retirement planning.

- Avoid policy lapse or surrender – Policies that lapse or are surrendered often provide little to no return, whereas a settlement can maximize value.

Who Qualifies for a Premium Finance Rescue?

Eligibility for a premium finance rescue depends on several factors, including:

- Policy type – Universal life, whole life, and convertible term policies generally qualify.

- Policy size – Policies with a death benefit of $500,000 or more are most attractive to buyers.

- Insured’s age and health – Older individuals or those with declining health tend to receive higher offers.

- Loan balance vs. policy value – The policy’s market value must be sufficient to cover the outstanding loan while still leaving room for a viable settlement offer.

Finding the Right Buyer for Your Policy

To ensure you receive the best possible offer, it’s essential to work with an experienced life settlements company who understands premium-financed policies. Not all settlement buyers specialize in these transactions, so finding the right buyer can make a significant difference in the outcome.

Is a Premium Finance Rescue Right for You?

If you currently own a premium-financed life insurance policy and are struggling with loan payments or no longer need the coverage, a premium finance rescue may be a smart solution. By selling the policy, you can eliminate debt, avoid policy lapse, and potentially receive a substantial cash payout.

To explore your options, please give us a call today at 800-973-8258. A well-structured premium finance rescue can turn a financial burden into an opportunity.