When considering the sale of your life insurance policy, the process of selling policy to companies that buy life insurance may seem complex. However, with a clear understanding of the options available and the right guidance, this financial transaction can provide significant benefits, especially when traditional options, such as borrowing against the policy or surrendering it, don’t meet your needs. In this article, we will walk you through the essentials of selling your life insurance policy, explaining the steps, benefits, and potential risks, as well as providing tips for navigating the process smoothly.

What Does It Mean to Sell Your Life Insurance Policy?

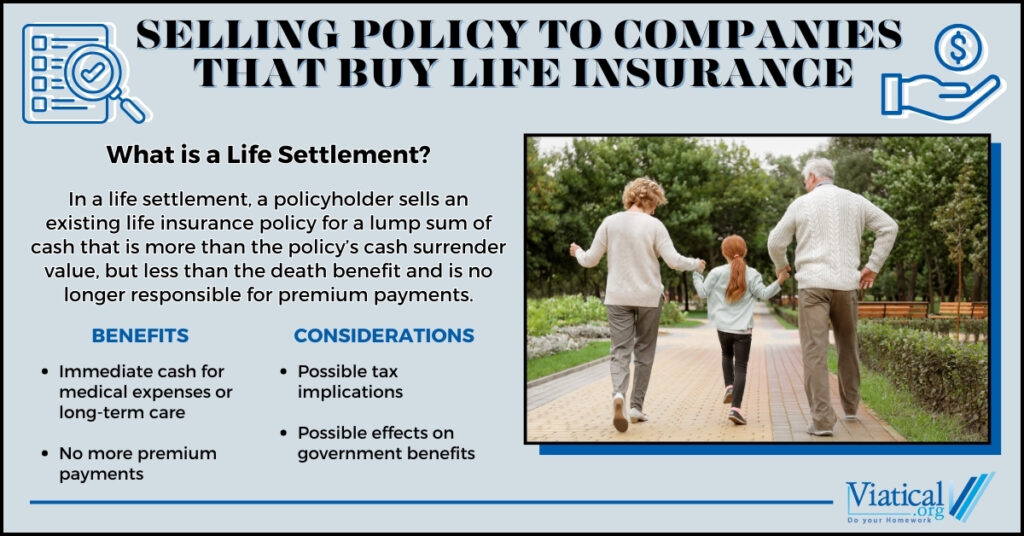

Selling a life insurance policy, also known as a life settlement, involves transferring ownership of your policy to a third party in exchange for a lump sum payment. The buyer assumes the responsibility of paying future premiums and ultimately receives the death benefit when you pass away. These buyers are typically institutional investors, often referred to as life settlement companies, who purchase policies as part of their investment portfolios.

This transaction allows policyholders to unlock the hidden value of their life insurance policy before death, which can be useful for covering medical expenses, long-term care, or simply improving quality of life.

Who Is Eligible to Sell Their Life Insurance Policy?

Not every policyholder is eligible for life settlements. Generally, policies that are most appealing to companies buying life insurance include:

- Permanent Policies: These include whole life, universal life, and convertible term policies.

- Policyholders Over 65: While younger individuals may also qualify under certain circumstances (e.g., if they have serious health conditions), most life settlement transactions occur with policyholders aged 65 and older.

- Policies with High Face Value: Life insurance policies with a death benefit of $100,000 or more are generally preferred by buyers. Policies with lower face values may not be as attractive for settlement companies due to the cost of maintaining them.

- Exceptions: If you are terminally ill, most policies can qualify regardless of age. Smaller death benefit amounts may be considered as well.

While these are typical guidelines, each case is unique. The value of your policy is influenced by factors such as your age, health condition, policy type, and the amount of premiums required to keep the policy in force.

Why Consider Selling Your Life Insurance Policy?

There are several reasons policyholders may choose to sell their life insurance policy rather than keep it:

- High Premiums: If the cost of maintaining your policy has become burdensome and you no longer need the death benefit, selling the policy can relieve you of the financial obligation.

- Medical or Financial Hardship: Unexpected medical expenses or financial hardship can make accessing immediate funds through a life settlement more appealing than maintaining a policy that offers no immediate financial benefit.

- Changing Needs: Perhaps your original reasons for purchasing the policy no longer exist. For instance, you may have bought the policy to protect dependents who are now financially independent.

- Cash for Long-Term Care: As you age, the cost of long-term care or assisted living can be significant. Selling your policy provides a way to fund these expenses while still maintaining your financial independence.

How to Sell Your Life Insurance Policy

If you’ve decided that selling your life insurance policy is the right choice for you, the process typically follows these steps:

- Find a Reputable Buyer: The first step is to identify companies that buy life insurance policies. You can start by consulting a life settlement broker, who will represent your interests and solicit offers from multiple buyers. Always be aware of any contract restrictions or broker fees which are oftentimes 30% or more of your offer. Alternatively, you may choose to work with our platform that will get your policy in front of direct buyers. Your offer is the full amount you’ll receive when selling your policy and there is no need to deduct a broker’s fee from a direct offer.

- Provide Necessary Information: Once you’ve selected a life settlement company to work with, you’ll need to submit information about your life insurance policy and your personal health history. Buyers use this information to determine the value of your policy. The higher your age and the more significant your health issues, the more attractive the policy may be to buyers because it reduces the length of time they expect to pay premiums before collecting the death benefit.

- Receive Offers: After evaluating your policy, buyers will make offers if they find value in your policy.

- Accept the Offer: Once you’ve reviewed your options, you’ll decide whether to accept an offer. Keep in mind that the payout will be less than the policy’s death benefit, but more than the cash surrender value of the policy.

- Transfer Ownership: After accepting an offer, you’ll sign documents to transfer ownership of your life insurance policy to the buyer. From that point on, the buyer will be responsible for paying premiums and will collect the death benefit when you pass away.

Potential Pitfalls to Watch For

While selling your life insurance policy can provide immediate financial relief, there are some potential risks to keep in mind:

- Tax Implications: Proceeds from the sale of a life insurance policy may be taxable, depending on your situation. It’s important to consult with a tax professional to understand how a life settlement will affect your tax obligations. If your policy is sold in a viatical settlement, it is likely that the proceeds will not be taxed.

- Impact on Medicaid or Social Security Benefits: The proceeds from selling your policy could affect your eligibility for certain government benefits, such as Medicaid or Social Security income. Make sure you fully understand the implications of a life settlement on any benefits you receive.

- Less than Expected Payout: While a life settlement can provide more than the cash surrender value, it’s often far less than the death benefit. You’ll need to weigh the immediate financial need against the long-term loss of the death benefit for your beneficiaries.

Frequently Asked Questions About Life Settlements

1. Is selling my life insurance policy a safe option?

Yes, selling a life insurance policy is legal and regulated.

2. Will my beneficiaries be notified?

Once the policy is sold, the beneficiaries you originally designated will no longer receive the death benefit. This is a critical point to discuss with your loved ones before making a final decision.

3. What is the difference between a life settlement and a viatical settlement?

A viatical settlement is similar to a life settlement but is specifically for individuals with a terminal illness. In these cases, the policyholder’s life expectancy is typically two years or less, and they may receive a larger payout compared to a traditional life settlement.

Selling a life insurance policy to companies that buy life insurance can be a viable option for policyholders looking to alleviate financial burdens, fund long-term care, or simply cash out of an unneeded policy. However, as with any major financial decision, it’s important to carefully evaluate the offers, understand the potential tax and benefit implications, and consult with professionals who can guide you through the process.

By doing your homework and learning who buys life insurance, you can make the best decision for your financial future and ensure that you’re receiving fair value for your policy. Please give us a call today to discuss your options and learn if you are likely to qualify. 800-973-8258