A cancer diagnosis often brings not only emotional stress but also financial strain. As medical bills pile up, many individuals consider different options to cover the cost of treatment. One option some policyholders explore is borrowing against their life insurance policy. But should I get a life insurance loan for cancer treatment? While this may seem like an accessible solution, there are important factors to consider before making a decision.

How a Life Insurance Loan Works

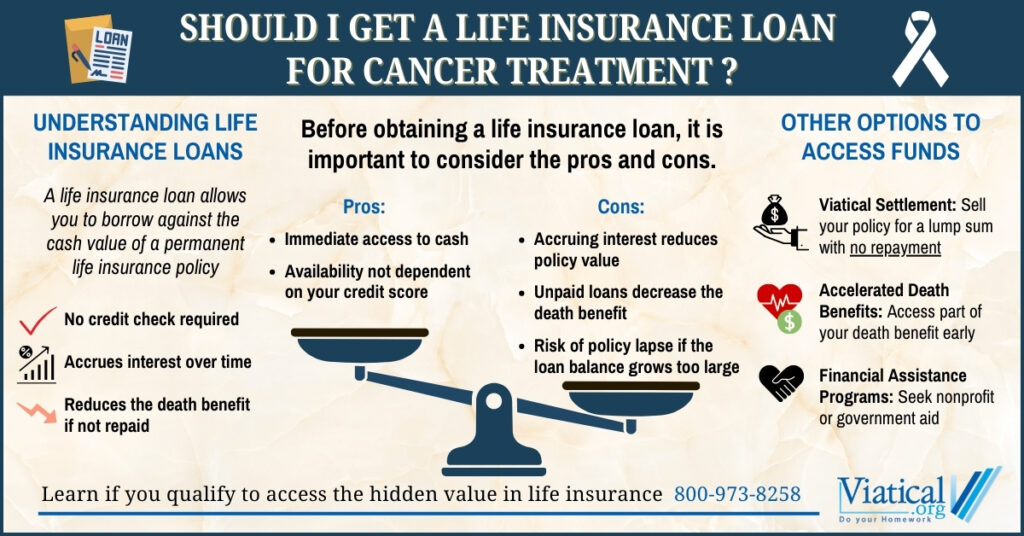

A life insurance loan allows policyholders to borrow against the cash value of their permanent life insurance policy. Unlike traditional loans, this option does not require a credit check or an extensive approval process. Instead, the insurance company lends you money using your policy’s cash value as collateral.

Key Features of a Life Insurance Loan:

- No repayment required during your lifetime – However, if the loan is not repaid, the outstanding balance (plus interest) is deducted from the policy’s death benefit.

- Accrues interest – The insurer charges interest on the borrowed amount, which can reduce the remaining cash value over time.

- Only available for permanent policies – Term life insurance does not accumulate cash value, so policyholders with term coverage cannot borrow against it.

While this type of loan can provide immediate funds for cancer treatment, it may not be the best financial choice for everyone.

Downsides of a Life Insurance Loan

Before taking out a loan against your policy, consider the potential risks:

- Reduced Death Benefit: If the loan remains unpaid, your beneficiaries will receive a smaller payout when you pass away.

- Interest Accumulation: If you don’t pay off the loan right away, interest continues to accrue, which can quickly deplete the policy’s value.

- Risk of Policy Lapse: If the outstanding loan balance grows too large, your policy could lapse, leaving you without coverage.

Given these risks, a life insurance loan should be carefully evaluated, especially when dealing with a serious illness like cancer.

Alternative Ways to Access Life Insurance Funds

If you need money for cancer treatment, borrowing against your policy isn’t the only option. Depending on your situation, you may qualify for:

Viatical Settlements

A viatical settlement allows you to sell your life insurance policy to a third party for a lump sum cash payment. Unlike a loan, this option does not require repayment, and the payout can often be significantly higher than the cash surrender value of the policy. Viatical settlements are available to individuals with a terminal or chronic illness, making them a viable alternative for cancer patients who need financial relief. The payout from a viatical settlement is typically tax free.

Living Benefits (Accelerated Death Benefits)

Some life insurance policies offer accelerated death benefits (ADB), which allow policyholders to receive a portion of their death benefit while still alive if they have a qualifying illness. These funds can be used for medical expenses, living costs, or other financial needs. While this can be a valuable option for those who qualify, not everyone is eligible. Many times, your life expectancy must be no more than 12 months, but this varies by carrier.

Financial Assistance Programs

Before tapping into your life insurance, consider looking into nonprofit organizations, hospital financial aid programs, and government assistance options that may help cover the cost of cancer treatment.

Which Option is Right for You?

When deciding whether to take out a life insurance loan for cancer treatment, consider the following:

- Do you have enough cash value in your policy to borrow against?

- Can you afford the interest and potential reduction in your death benefit?

- Would a viatical settlement or living benefits payout be a better alternative?

If your goal is to maximize financial support without adding long-term debt, exploring options like viatical settlements or accelerated death benefits may provide better relief.

Should I get a life insurance loan for cancer treatment? While it can be a quick source of funds, it’s essential to weigh the drawbacks, including interest accumulation and the risk of policy lapse. If you’re facing high medical expenses, a viatical settlement may provide a larger, more immediate cash payout without the burden of repayment.

If you’d like to explore whether a viatical settlement is an option for you, contact us today at 800-973-8258. You may be able to access the financial support you need without the risks of borrowing against your life insurance.