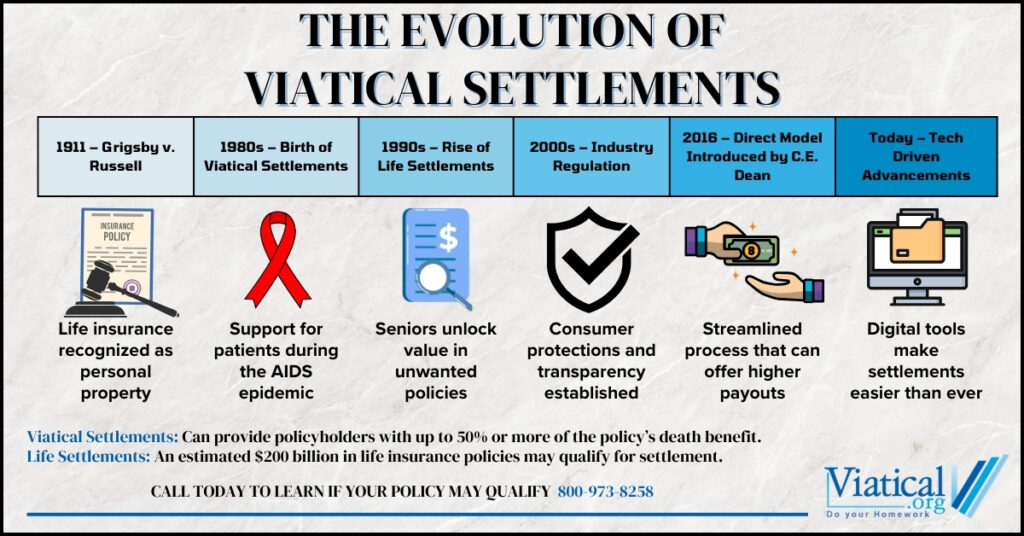

The evolution of viatical settlements has been a remarkable journey, beginning with a landmark legal case over a century ago and transforming into a vital financial option for policyholders today. This journey highlights how life insurance policies, originally created for beneficiaries, became valuable assets that can be sold to address immediate financial needs.

Roots: Grigsby v. Russell

The documented history of viatical and life settlements dates back to 1911 with the U.S. Supreme Court case Grigsby v. Russell. This pivotal case established that a life insurance policy is a form of personal property, giving policyholders the right to sell or transfer their policies. Justice Oliver Wendell Holmes Jr. emphasized that life insurance policies, like other property, could be used to address the policyholder’s financial needs during their lifetime. This legal precedent laid the foundation for today’s secondary market for life insurance.

Birth of Viatical Settlements

The viatical settlement industry emerged in the 1980s during the height of the AIDS epidemic. Terminally ill patients, particularly those with HIV/AIDS, faced mounting medical expenses and turned to selling their life insurance policies for immediate cash. These transactions provided a financial lifeline to cover treatments, housing, and other critical needs.

Viatical settlements were born from necessity and soon gained recognition as a way for individuals with terminal illnesses to gain financial relief. The term “viatical” itself comes from the Latin viaticum, meaning “provisions for a journey,” symbolizing the support offered to patients in their final stages of life.

Expansion into Life Settlements

In the late 1990s and early 2000s, the industry evolved further with the rise of life settlements. Unlike a viatical settlement, life settlements cater to seniors with policies they no longer need or can afford, even if they are not terminally ill. The growth of life expectancy, increasing insurance premiums, and changing financial priorities made life settlements a popular option for older adults seeking to liquidate their policies.

Investors recognized the potential of the secondary market, leading to increased competition and higher payouts for policyholders. As the industry matured, regulatory frameworks were established to protect sellers and ensure transparency.

A Modern Milestone

In 2016, our founder, C.E. Dean, presented the direct model for life and viatical settlements at the annual Life Insurance Settlement Association (LISA) conference. This groundbreaking approach emphasized simplifying the settlement process, ensuring that policyholders could navigate their options with clarity and confidence. By removing unnecessary intermediaries, the direct model provided greater value to sellers while maintaining ethical and regulatory standards.

The Present and Future of Viatical Settlements

Today, viatical settlements continue to serve as a critical resource for individuals with terminal illnesses, offering immediate financial relief. Meanwhile, life settlements have grown into a thriving industry, providing seniors with a way to unlock the hidden value of their policies.

Technological advancements, such as paperless transactions and underwriting, have streamlined the process, making settlements faster and more accessible. Additionally, education and increased consumer awareness has reduced the stigma once associated with selling life insurance policies, positioning settlements as a mainstream financial strategy.

The evolution of viatical settlements reflects society’s ability to adapt and innovate in response to financial challenges. From Grigsby v. Russell to the modern direct model introduced by C.E. Dean, this industry has transformed life insurance policies into powerful tools for financial empowerment. Life insurance is no longer an all or nothing proposition. In many instances, you can benefit from a life insurance policy while living. Whether facing a terminal illness or seeking retirement solutions, policyholders today benefit from a robust and regulated marketplace that puts their needs first.

To find out if you’re likely to qualify to access the hidden value in your life insurance policy, please call us today at 800-973-8258.