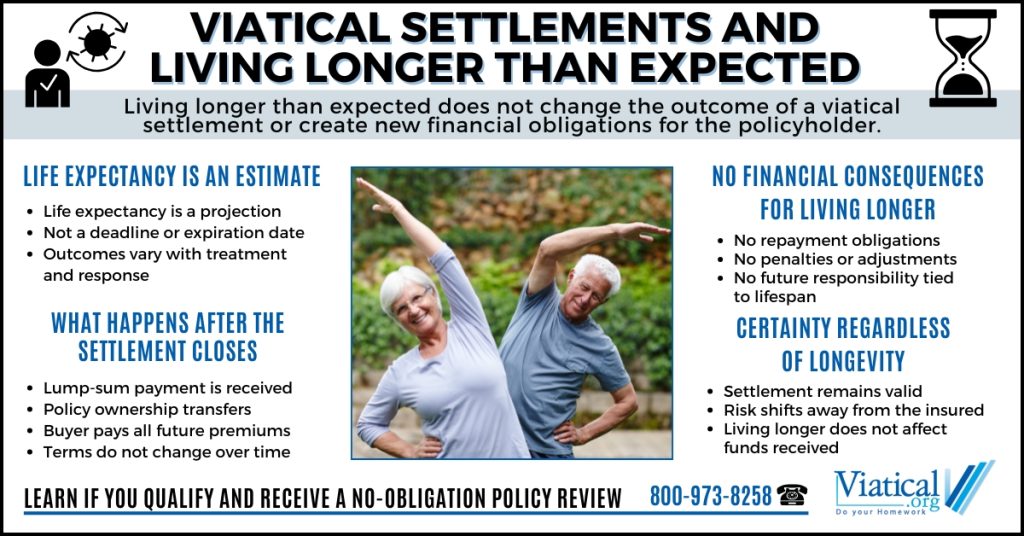

One common question people have when considering a viatical settlement is what happens if medical projections change and they live longer than expected. Viatical settlements and living longer than expected are not at odds with each other. This situation is anticipated within the settlement structure and does not create complications for the policyholder or their family.

Life Expectancy Estimates Are Not Deadlines

Life expectancy estimates are used during the evaluation process to help determine a policy’s value. These estimates are based on medical records, diagnosis, treatment history, and actuarial data. They are projections, not fixed timelines. No estimate is intended to predict exactly how long someone will live.

Medical outcomes can vary widely. New treatments, better responses to care, and individual health factors can all lead to longer survival than initially projected. Viatical settlements are designed with this uncertainty in mind.

What Changes After a Viatical Settlement Closes

Once a viatical settlement is completed, ownership of the life insurance policy transfers to the buyer. At that point:

- The policyholder receives a lump sum cash payment.

- The buyer becomes responsible for all future premium payments.

- The policyholder no longer has any financial obligation related to the policy.

- The death benefit is paid to the buyer when the insured passes away, whenever that occurs.

If the insured lives longer than expected, the transaction does not change. The settlement is not reversed, renegotiated, or adjusted based on longevity.

There Are No Penalties for Living Longer

A common misconception is that living longer than projected creates financial consequences for the policyholder. That is not how viatical settlements work.

The policyholder is never required to repay funds received from a viatical settlement. There are no repayment obligations or conditions tied to how long someone lives after the sale. The buyer assumes all longevity risk as part of the transaction.

Living longer than expected does not reduce the payout already received and does not create future liability.

Who Pays Premiums If You Outlive Projections

After the settlement closes, the buyer is responsible for paying all premiums required to keep the policy in force. This responsibility does not change if the insured lives longer than expected.

The policyholder is not asked to resume payments or contribute later. Even if premiums increase over time, those costs remain with the buyer, not the insured. This feature is one reason viatical settlements differ from options like policy loans, which can continue to accrue interest and affect finances long after funds are accessed.

How This Differs from Other Life Insurance Options

Some life insurance alternatives can become more complicated if someone lives longer than anticipated:

- Policy loans continue to accrue interest and reduce the death benefit.

- Letting a policy lapse results in no financial benefit at all.

Viatical settlements provide finality. Once completed, the terms do not change based on future health outcomes.

Why Living Longer Does Not Change the Outcome

A viatical settlement is structured to account for uncertainty in medical projections from the outset. Once the transaction is complete, the policyholder has already received the agreed-upon cash payment and has no ongoing responsibility tied to how long they live. If health outcomes improve or treatment is effective, the settlement remains valid and unchanged. This certainty is a key reason viatical settlements are considered a stable option for accessing the value of life insurance. The outcome does not depend on whether life expectancy estimates prove accurate, and living longer than anticipated does not create financial consequences for the insured or their family.

To learn if you or your loved one are likely to qualify to access your policy’s hidden value today, please give us a call at 800-973-8258.