When facing financial challenges due to a terminal or chronic illness, many individuals find comfort in exploring viatical settlements: cashing out life insurance to secure much-needed funds. This process enables policyholders to sell their life insurance policies for a lump sum payment, offering a financial lifeline during a critical time. But how does it work, and what should you consider before pursuing this option?

What Is a Viatical Settlement?

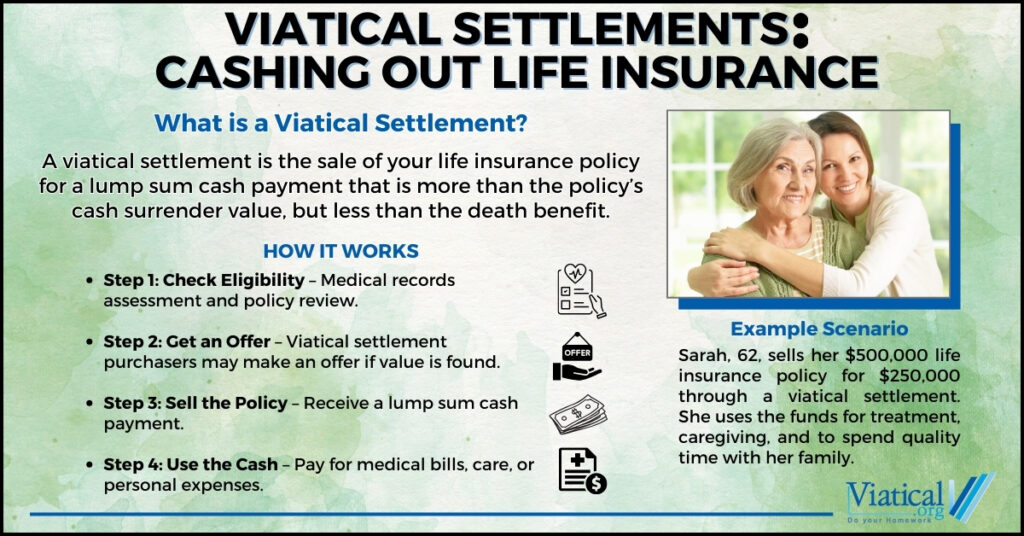

A viatical settlement is the sale of a life insurance policy to a third-party buyer, often an institutional investor. The buyer pays the policyholder an immediate cash sum, which is typically more than the policy’s cash surrender value, but less than its full death benefit. In exchange, the buyer assumes responsibility for the policy’s premiums and receives the death benefit when the insured person passes away.

Who Qualifies for a Viatical Settlement?

To qualify, policyholders typically need a terminal illness with a life expectancy of fewer than two years or a chronic illness that severely impacts daily living. Both term life and permanent life insurance policies may be eligible, though the specifics can vary based on the policy type and provider.

The Benefits of Cashing Out Life Insurance Through a Viatical Settlement

- Immediate Financial Relief: The lump sum payment can be used for medical expenses, living costs, or alternative treatments.

- No Repayment Required: Unlike loans, the funds received from a viatical settlement are not repaid.

- Tax Advantages: In many cases, viatical settlement proceeds are tax-free, providing additional financial relief. Always consult with your trusted tax advisor on your specific situation.

An Example of a Viatical Settlement

Consider Sarah, a 62-year-old woman diagnosed with a terminal illness. Sarah has a $500,000 life insurance policy and is struggling to cover her mounting medical bills and living expenses. Her policy has no cash surrender value, leaving her with few immediate financial options.

After learning about viatical settlements, Sarah decides to explore selling her policy. She is offered $250,000 for her policy—half of the death benefit, but significantly more than she could have accessed otherwise.

With the funds, Sarah pays for experimental treatments, hires a part-time caregiver, and sets aside money to enjoy quality time with her family. By cashing out her life insurance through a viatical settlement, Sarah gains financial freedom and peace of mind during a challenging chapter of her life.

How to Start the Process

If you’re considering a viatical settlement, it’s essential to work with a reputable life settlement company. We have been helping people access the hidden value in life insurance for nearly 20 years and can help guide you through the process, help determine your eligibility, and ensure you receive a direct offer.

Why Choose Viatical Settlements?

For many, cashing out life insurance through a viatical settlement provides the financial resources needed to focus on quality of life during a challenging time. When you redeem life insurance while living, you can relieve financial stress and allocate funds where they’re most needed.

Cashing out life insurance through a viatical settlement can bring significant financial relief at a time when it is needed the most. Whether you’re exploring this option for yourself or a loved one, understanding the process can help you make an informed choice.

Please give us a call at 800-973-8258 to learn if a viatical settlement may be an option for you.