Patients diagnosed with advanced liver disease may face mounting medical expenses, reduced income, and the emotional toll of a progressive condition. Viatical settlements for patients with liver disease can offer a financial lifeline by allowing those why qualify to sell their life insurance policy for immediate cash. These funds can be used for treatments, living expenses, or anything else you choose.

Understanding Liver Disease and Its Progression

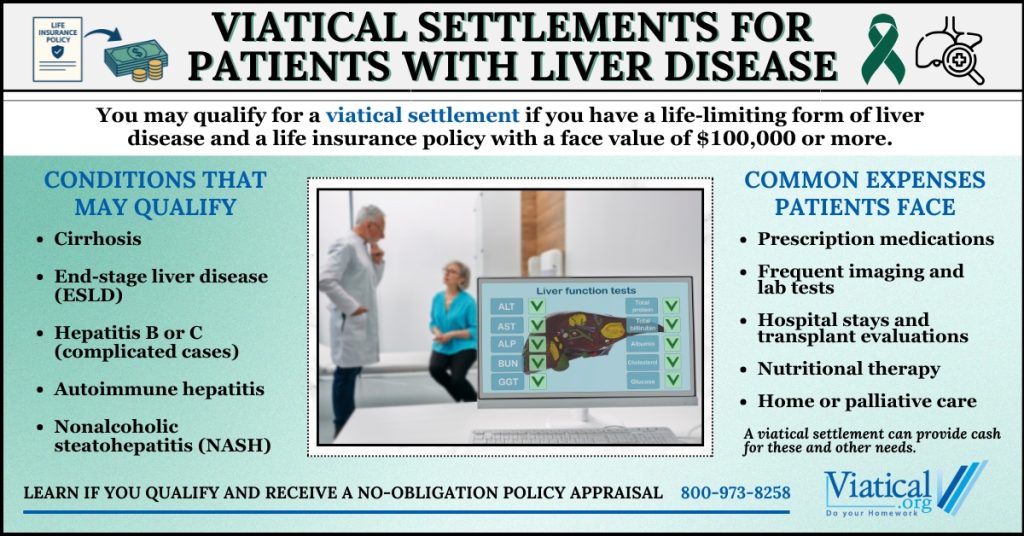

Liver disease encompasses a range of chronic conditions, many of which are progressive and life-limiting. While some forms are manageable in early stages, others may lead to liver failure and a significant reduction in life expectancy. Common types of liver disease that may qualify a patient for a viatical settlement include:

- Cirrhosis from alcohol use, hepatitis C, or nonalcoholic fatty liver disease (NAFLD)

- End-stage liver disease (ESLD)

- Autoimmune hepatitis

- Hepatitis B or C (with complications)

- Nonalcoholic steatohepatitis (NASH)

As liver disease progresses, patients may experience symptoms such as jaundice, abdominal swelling, confusion (hepatic encephalopathy), and severe fatigue. These can impair a person’s ability to work or care for themselves, creating financial strain on top of physical challenges.

Treatment Costs and Financial Burdens

Managing liver disease often involves long-term care and significant out-of-pocket costs. Depending on the severity and underlying cause, patients may require:

- Regular imaging and bloodwork

- Prescription medications (such as antivirals, diuretics, lactulose)

- Hospitalizations for complications like variceal bleeding or fluid buildup

- Nutritional support and specialized diets

- Evaluation for liver transplantation

Even with insurance, co-pays, deductibles, and non-covered services can quickly add up. For patients no longer able to work, the financial pressure can become overwhelming.

How Viatical Settlements Work for Liver Disease

A viatical settlement allows someone with a life-threatening illness to sell their life insurance policy to a viatical settlement buyer in exchange for a lump sum cash payment. In the case of viatical settlements for patients with liver disease, eligibility for a viatical settlement is typically based on life expectancy. Viatical settlements are for those with a life expectancy of around two years or less. Those with longer life expectancies may still qualify for life settlements.

The process involves a review of medical records and policy specifics and life expectancy projections. If a buyer has interest, they will make an offer. If accepted, the seller receives a cash payout and the buyer becomes the policy’s new beneficiary and takes over future premium payments.

Who May Qualify?

Policyholders may be eligible for a viatical settlement if they:

- Have been diagnosed with a serious, life-limiting form of liver disease

- Own a life insurance policy (typically term, whole, or universal) with a death benefit typically over $100,000

- Have experienced a noticeable decline in health since the policy was issued

Eligibility is determined on a case-by-case basis, and there’s no obligation when applying or getting an estimate.

A Flexible Financial Option

The money received from a viatical settlement can be used however the patient sees fit. Common uses include:

- Covering medical bills and treatment costs

- Paying for home care or assisted living

- Funding alternative treatments or clinical trials

- Paying off debts or supporting family members

There are no restrictions on how the funds are spent, which makes viatical settlements a flexible option for individuals facing financial uncertainty.

If you or a loved one is living with advanced liver disease, a viatical settlement may offer financial relief when it’s needed most. To learn if you qualify, please give us a call at 800-973-8258.