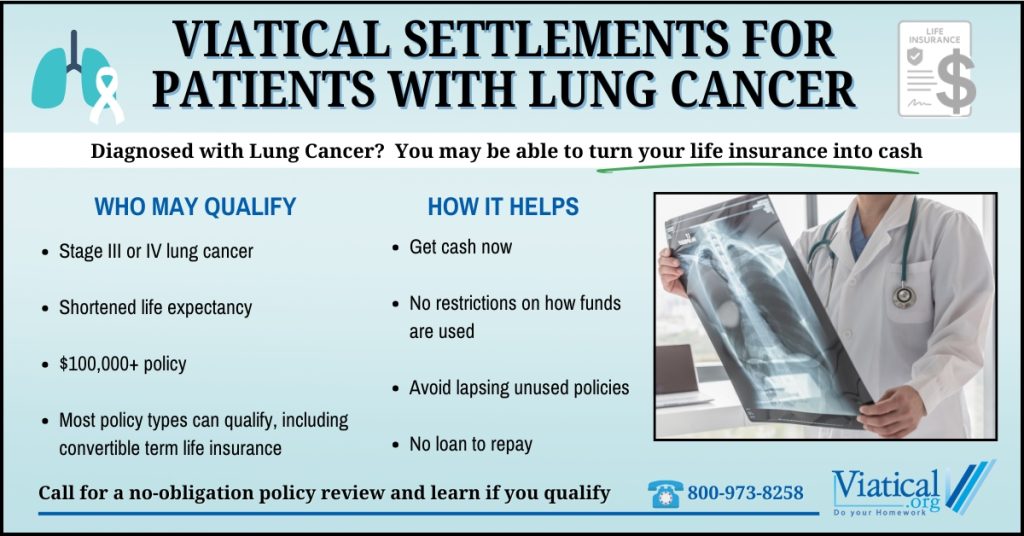

If you or a loved one has been diagnosed with lung cancer and are facing financial challenges, you may want to explore viatical settlements for patients with lung cancer. This option allows qualifying policyholders to sell their life insurance policy to a licensed provider in exchange for a lump sum of cash. These funds can be used immediately for treatment, living expenses, or to ease financial strain during a difficult time.

Lung cancer remains one of the most commonly diagnosed and deadly cancers, especially among adults over 65. Advanced cases, including small cell and non-small cell lung cancer with metastasis, often lead to increased medical bills, reduced income due to inability to work, and long-term care costs. In many cases, individuals qualify for a viatical settlement if they have a shortened life expectancy and a life insurance policy with a face value of $100,000 or more.

Common Lung Cancer Treatments

Treatment for lung cancer varies depending on the stage, cell type, and overall health of the patient. These therapies can be costly, especially when not fully covered by insurance, and may require travel, time off work, or long-term support services. Common lung cancer treatments include:

- Chemotherapy – Often used to kill cancer cells or shrink tumors, especially in small cell lung cancer. Side effects can be significant and may require supportive care.

- Radiation Therapy – Used either alone or in combination with chemotherapy. It may target the primary tumor or areas where the cancer has spread.

- Immunotherapy – Drugs like Keytruda (pembrolizumab) or Opdivo (nivolumab) help the immune system recognize and fight cancer. These are often used for advanced or metastatic cases.

- Targeted Therapy – Medications such as osimertinib (Tagrisso) or alectinib (Alecensa) are used when tumors test positive for specific genetic mutations (such as EGFR, ALK, ROS1).

- Surgery – Early-stage lung cancer may be treated through surgical removal of the tumor, lung lobe (lobectomy), or the entire lung (pneumonectomy).

- Clinical Trials – Many patients consider enrolling in clinical studies to access promising new therapies not yet widely available.

- Palliative Care – Supportive care may be introduced alongside other treatments to manage symptoms like shortness of breath, fatigue, and pain.

These treatments can cost tens or even hundreds of thousands of dollars. A viatical settlement can help patients manage the financial impact and maintain stability during care.

How a Viatical Settlement Works

When patients qualify and accept an offer, a viatical settlement purchaser buys the life insurance policy and becomes the new beneficiary. In return, the policyholder receives a cash payment which is more than the cash surrender value but less than the death benefit. The funds can be used however the seller chooses, with no restrictions. This can be a helpful alternative for individuals who are not using their policy for its original purpose or who need immediate funds to cover:

- Out-of-pocket treatment costs

- Travel expenses to specialized cancer centers

- Home healthcare or hospice services

- Rent or mortgage payments

- Family support and quality-of-life enhancements

Who Qualifies?

Most viatical buyers consider multiple factors when evaluating eligibility, including:

- Diagnosis of lung cancer (especially Stage III or IV)

- Prognosis (typically two years or less life expectancy although those with longer life expectancies can qualify for life settlements)

- Type and status of the life insurance policy

- Policy face value (minimums often start at $100,000)

- Premium costs

If your condition has worsened since the policy was first issued, even if you are still receiving treatment, you may be eligible. Term life insurance policies may also qualify if they are still in force and convertible.

Benefits of Selling Your Policy

A viatical settlement can provide financial peace of mind during a time when you need it most. It allows you to unlock the value of a life insurance policy you may no longer need, giving you flexibility and control over your care and priorities. Many families use the proceeds to remain at home, pursue additional treatment options, or spend more quality time together.

If you’ve been diagnosed with lung cancer and are considering your financial options, call 800-973-8258 to find out if your policy qualifies for a viatical settlement.