Divorce often comes with significant financial and emotional adjustments, and life insurance policies are frequently overlooked in the process. While many people focus on dividing tangible assets like homes, retirement accounts, and vehicles, life insurance policies can be an important, though often misunderstood, aspect of post-divorce planning. So, what happens to life insurance policies in divorce? The answer depends on the ownership, purpose, and ongoing need for the policy.

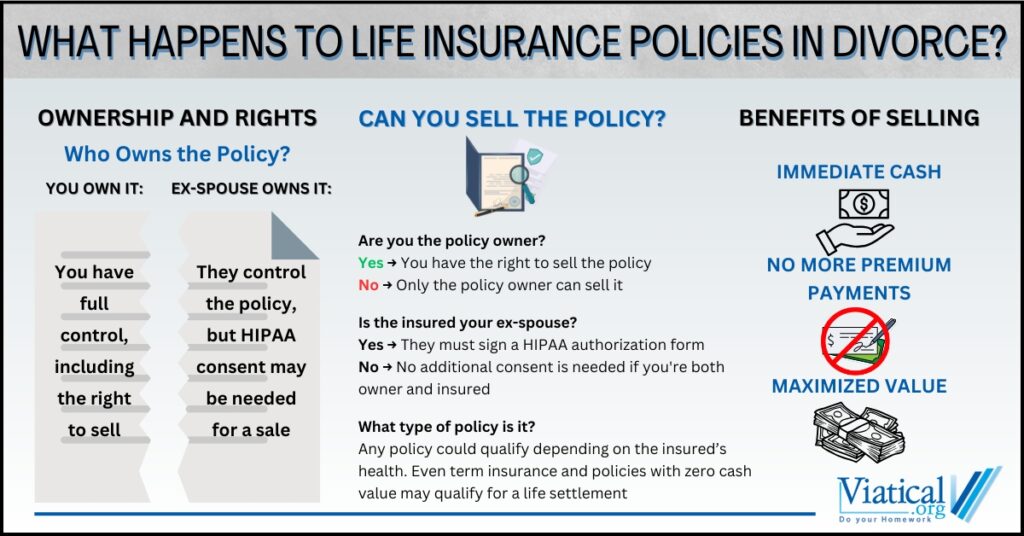

If you own a life insurance policy on your ex-spouse, you maintain full ownership rights, even after the divorce. This means you can choose to keep the policy in force, let it lapse, or sell it in a life settlement. Selling the policy can be a smart financial move if you no longer need the coverage or wish to stop paying premiums. However, if you choose to sell, your ex-spouse must sign a HIPAA authorization form. This form allows access to their medical records, which are necessary for determining the value of the policy in the life settlements process. While this requirement might seem like a hurdle, it’s a standard part of the transaction and ensures compliance with medical privacy laws.

Ownership and Control After Divorce

The owner of a life insurance policy has full control over it, regardless of who the insured person is. This means that if you’re the policy owner, you’re entitled to make decisions about whether to continue, cancel, or sell the policy—even if it insures your ex-spouse. Ownership, not the insured party, determines these rights. This is an important distinction, as many people mistakenly believe the insured person has some control over the policy’s fate.

In some divorce agreements, courts may mandate that a life insurance policy be maintained to provide financial support, such as alimony or child support. In these cases, the policy is typically structured to benefit a former spouse or dependents. However, when no such obligations exist, many policy owners find that the policy becomes unnecessary and increasingly expensive to maintain, especially if premiums rise annually. Selling the policy in a life settlement allows you to recapture some of its value and repurpose the funds for other priorities.

How Life Settlements Work in Divorce

A life settlement is the sale of a life insurance policy to a third party for a lump sum cash payment. The payment is typically higher than the policy’s cash surrender value but less than its death benefit. This option is particularly attractive for divorcees who no longer need the policy or want to free themselves from paying premiums.

If your policy is term life insurance, you might think it has no value. However, convertible term policies are often eligible for a life settlement. Even policies nearing expiration may have significant value in the secondary market. This makes life settlements a viable option for many divorced individuals looking to offload a policy tied to a previous relationship.

One essential step in the process is the HIPAA authorization form. Since the insured’s medical history impacts the policy’s market value, your ex-spouse will need to provide consent for their records to be accessed. While this might seem like a sensitive issue, it’s a necessary part of ensuring the sale is handled legally and transparently. A qualified life settlement company can help facilitate this process smoothly.

Why Consider Selling a Policy After Divorce?

Life insurance policies serve a specific purpose, such as income replacement or financial security for loved ones. After a divorce, these needs often change. You may no longer need to maintain coverage on your ex-spouse, especially if they are not financially dependent on you. Meanwhile, premiums can become a burden, particularly as term policies transition to more expensive renewable coverage.

Selling a policy in a life settlement can provide:

- Immediate Cash: Use the proceeds to cover divorce-related expenses, pay off debt, or invest in your future.

- Relief from Premium Payments: Eliminate the ongoing financial obligation of maintaining a policy you no longer need.

- Maximized Value: Unlock more value than you would by simply surrendering the policy or letting it lapse.

Additional Considerations

In order to qualify for a life settlement, the insured person (in this case, your ex-spouse) must generally be age 65 or older or have had a significant slippage in health since the policy was issued. Those with more serious health concerns may qualify for a viatical settlement.

If you’re the insured party, your ex-spouse may still own a policy on you. In this case, they retain the right to sell the policy, provided they meet the legal requirements, including obtaining your HIPAA consent.

For those navigating divorce, it’s important to consider life insurance policies as part of your overall financial picture. Whether you’re the policy owner or the insured, these policies represent a potential asset that can be used to support your post-divorce financial goals.

Divorce is a time of transition, and life insurance policies are often left behind as priorities shift. Whether you’re looking to simplify your finances or leverage the value of an unused asset, selling your life insurance policy in a life settlement can provide a path forward. If you own a policy on your ex-spouse, remember that while they must sign a HIPAA form, the decision to sell rests entirely with you.

If you’d like to learn more about selling a life insurance policy after divorce, contact us at 800-973-8258. We can help you learn if the policy you own is likely to qualify and assist you with obtaining a no obligation policy appraisal.