Guaranteed Universal Life insurance policies are well-known for providing reliable death benefits at relatively low premiums. They are often chosen for their straightforward design and the peace of mind they offer to policyholders. However, what many people don’t realize is that these policies can harbor hidden value, potentially making them eligible for life settlements.

If you’re holding onto a Guaranteed Universal Life (GUL) policy, understanding its features and the market for life insurance settlements could reveal options to sell your life insurance policy for cash when it’s no longer serving its original purpose.

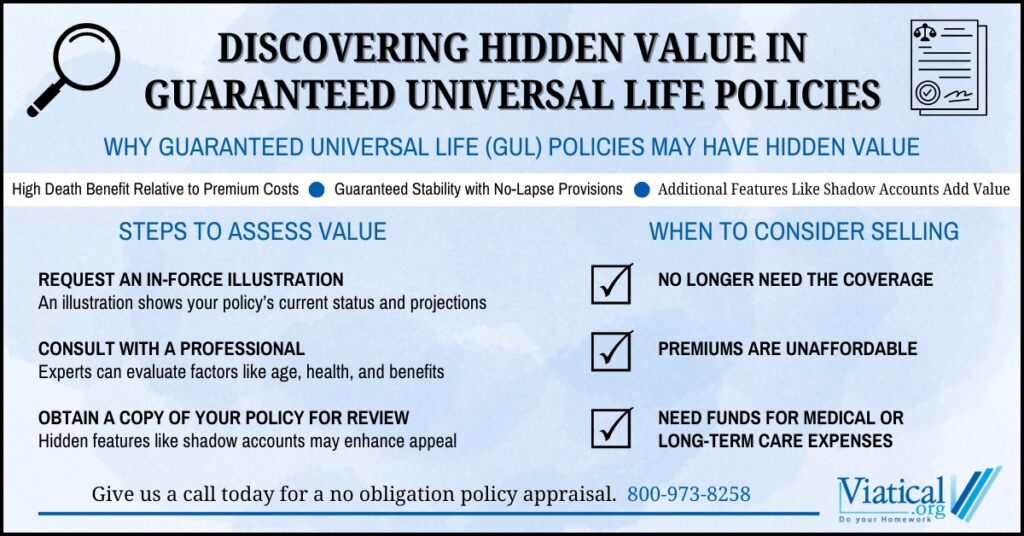

Why Guaranteed Universal Life Policies May Have Hidden Value

Unlike traditional universal life or whole life policies, Guaranteed Universal Life insurance policies are designed with little to no cash value accumulation. Their primary focus is on guaranteeing the death benefit for a set period, provided premiums are paid as required.

While this might seem to limit their potential value, there are key factors that could make GUL policies attractive to buyers in the life settlement market:

- High Death Benefit Relative to Premium Costs:

Guaranteed Universal Life policies often provide a significant death benefit for lower premiums compared to other types of permanent life insurance. This makes them appealing to institutional investors looking for stable, long-term payouts. - Guaranteed Stability:

The no-lapse guarantee associated with Guaranteed Universal Life policies ensures they remain in force even during financial fluctuations, as long as certain premium requirements are met. - Additional Features:

Some GUL policies include provisions—like shadow accounts—that work behind the scenes to protect the policy from lapsing under specific conditions. These hidden mechanisms help reinforce the policy’s guarantees, which can increase its value to buyers.

How to Assess the Potential Value of Your Policy

To uncover the hidden value in your Guaranteed Universal Life policy, consider these steps:

- Request an In-Force Illustration:

An in-force illustration is a detailed snapshot of your policy’s current status and future projections. While it won’t explicitly highlight features like shadow accounts, it can help you understand the overall performance of your policy and its viability in the life settlement market. - Consult with a Professional:

Life settlement specialists have the expertise to evaluate policies for their market value, taking into account factors like the insured’s age, health, and the policy’s death benefit. - Obtain a Copy of Your Policy for Review:

If you’re considering a life settlement, obtaining a copy of your policy is an essential first step. Life settlement purchasers will thoroughly review the specifics of your policy to assess its value. Features like no-lapse guarantees or internal mechanisms, such as shadow accounts, may enhance your policy’s appeal in the settlement market. While these provisions might not be immediately obvious, they play a significant role in determining your policy’s long-term stability and marketability.

When Should You Consider Selling Your Guaranteed Universal Life Policy?

There are many situations where selling your Guaranteed Universal Life policy might make sense, including:

- You no longer need the coverage.

- Premiums have become unaffordable.

- You need funds to cover medical expenses, long-term care, or other significant costs.

In a life settlement, you sell your policy to a third-party investor for a lump sum payment. This amount is often much higher than the policy’s cash surrender value (if any), making it a viable option for many policyholders seeking financial flexibility.

Unlock the Value of Your Policy

Even policies designed to be simple and straightforward, like Guaranteed Universal Life policies, can contain hidden value. Features like shadow accounts, while not always apparent, can play a role in preserving the policy’s guarantees and boosting its appeal to investors. If you’re unsure about whether your policy qualifies for a life settlement, reach out to us for a detailed evaluation. You may find that your GUL policy is worth much more than you initially thought.

At Viatical.org, we specialize in helping policyholders unlock the hidden value in their life insurance policies. Give us a call today at 800-973-8258 to find out if you’re likely to qualify.