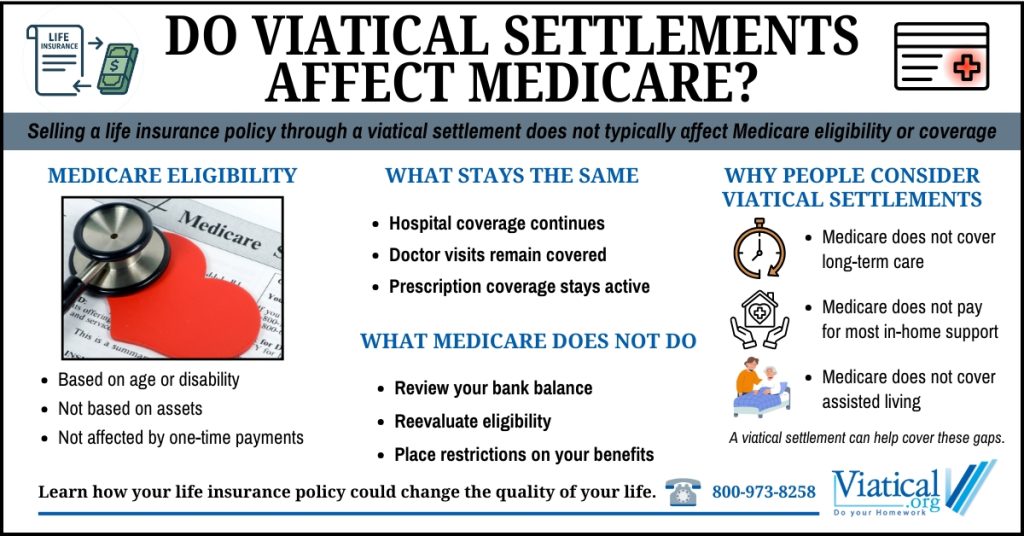

If you are considering selling a life insurance policy after a serious diagnosis, it is natural to ask do viatical settlements affect Medicare benefits. Medicare rules are different from needs-based programs like Medicaid and understanding that distinction can help you evaluate your options without unnecessary concern.

Medicare is not income-based. Eligibility is primarily determined by age or disability status, not by assets or one-time financial transactions. Because of this, receiving funds from a viatical settlement generally does not disqualify someone from Medicare coverage.

Medicare vs. Medicaid: Why the Difference Matters

A common source of confusion is the difference between Medicare and Medicaid.

Medicare:

- Is a federal health insurance program

- Is based on age or disability

- Does not have asset or income limits for eligibility

Medicaid:

- Is a joint federal and state program

- Is means-tested

- Has strict asset and income limits

Since Medicare does not evaluate bank balances or assets to determine eligibility, receiving settlement funds does not affect enrollment or ongoing Medicare coverage in most cases.

Do Viatical Settlements Affect Medicare Premiums?

For most people, Medicare Part A is premium-free. Medicare Part B and Part D premiums can increase if reported income exceeds certain thresholds under the Income-Related Monthly Adjustment Amount (IRMAA).

This is where it is important to distinguish between viatical settlements and life settlements.

Viatical settlements paid to individuals who meet the IRS definition of terminally or chronically ill are generally excluded from taxable income. Because the proceeds are typically not reported as income, they do not trigger income-related Medicare premium adjustments.

By contrast, life settlements may be partially taxable depending on the policy’s cost basis and the amount received. In those situations, higher reported income could temporarily increase Medicare Part B or Part D premiums in a future year. Even then, Medicare eligibility itself is not affected.

How Viatical Settlements Are Typically Treated

A viatical settlement involves selling a life insurance policy due to a serious health condition. The transaction is considered the sale of personal property, not income replacement or a government benefit.

When the insured qualifies under IRS guidelines, the proceeds are generally excluded from gross income. This treatment is one reason viatical settlements are often explored by individuals facing serious illness who rely on Medicare coverage.

Coverage for hospital care, physician services, and prescription drugs continues without interruption.

Can Medicare Claim Viatical Settlement Proceeds?

Medicare does not place liens on viatical settlement proceeds. The funds are not considered reimbursement for medical services paid by Medicare, and there is no requirement to repay Medicare after receiving a settlement.

In addition, Medicare does not restrict how settlement funds are used. Policyholders may use the proceeds for medical expenses, home care, housing costs, travel, or everyday living needs.

Why People on Medicare Consider Viatical Settlements

Medicare has notable coverage gaps. It generally does not pay for:

- Long-term custodial care

- Assisted living

- Ongoing in-home personal care

- Many non-medical support services

A viatical settlement can help cover these costs without interfering with Medicare benefits. This can be especially important for individuals who want flexibility in how and where they receive care.

Situations That May Require Extra Caution

Individuals who receive both Medicare and Medicaid should proceed carefully. While Medicare is not affected, a viatical or life settlement could impact Medicaid eligibility due to asset limits. There are ways to preserve eligibility, like a Medicaid life settlement.

The same applies to Medicare Savings Programs or other needs-based assistance tied to income or resources.

What Medicare Beneficiaries Should Know

For most Medicare recipients, a viatical settlement does not affect eligibility or coverage. Benefits continue as usual, and there is no requirement to spend the funds on specific medical services.

Understanding how Medicare treats viatical settlements, and how that differs from life settlements, allows policyholders to make informed decisions about accessing the value of their life insurance without jeopardizing essential health coverage.

To learn if you or your loved one qualify and to obtain a no-obligation policy appraisal, please give us a call at 800-973-8258.