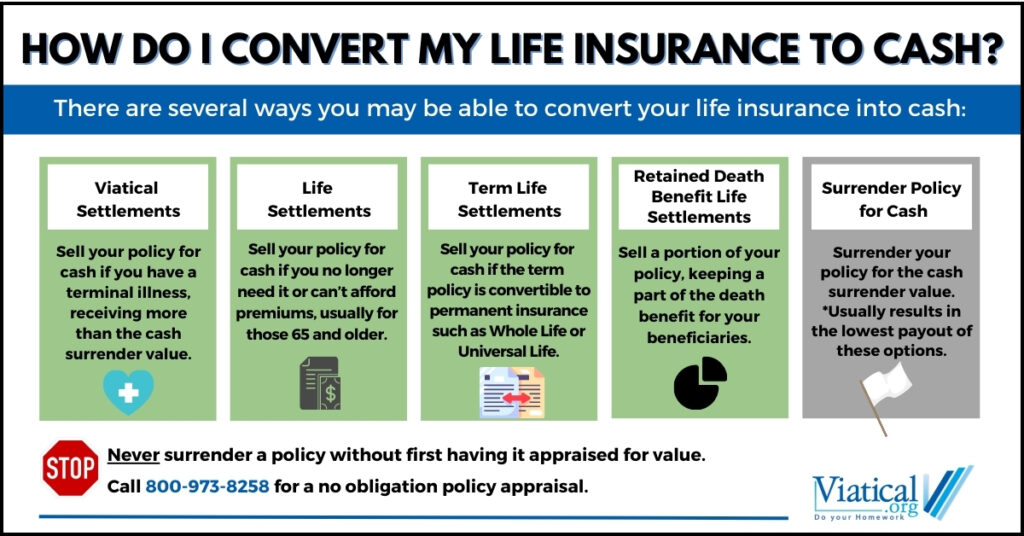

If you’ve ever asked yourself, “How do I convert my life insurance to cash?”, you’re not alone. Many policyholders may face a situation where they need fast access to cash, and life insurance can be an overlooked asset with significant hidden value. There are several ways you can convert your life insurance into cash, each with distinct advantages depending on your needs and circumstances. Whether you are dealing with medical expenses, planning for retirement, or simply need extra income, there are options available. Some of these options include viatical settlements, life settlements, term life settlements, and retained death benefit life settlements.

Viatical Settlements

A viatical settlement is a financial option for individuals diagnosed with a terminal illness who need immediate access to cash. This settlement allows you to sell your life insurance policy to a third-party buyer for a lump sum. The amount you receive is typically greater than the policy’s cash surrender value, but less than the death benefit. In a viatical settlement, the buyer becomes the new owner of the policy and assumes responsibility for paying the premiums. Upon your passing, the buyer receives the death benefit.

Viatical settlements can be especially beneficial for those facing significant medical expenses. Rather than surrendering the policy for its cash value, which is often less than its market value, a viatical settlement can provide you with a larger sum of cash to help manage end-of-life costs, care expenses, or other financial needs. It’s important to note that the amount you receive will depend on factors such as your life expectancy, the type of policy, the size of the death benefit, and other policy provisions and specifics.

Life Settlements

A life settlement is an alternative to lapsing life insurance and is another way to convert your life insurance policy into cash. This option is typically available to seniors who no longer need their life insurance policy or can no longer afford the premiums. In a life settlement, you sell your policy to a third-party buyer, similar to a viatical settlement, but without the requirement of a terminal illness. The buyer takes over the premium payments and becomes the beneficiary, receiving the death benefit when you pass away.

Life settlements are often used by individuals who have outgrown the need for life insurance. Maybe your children are financially independent, or you simply want to stop paying high premiums. Selling your policy through a life settlement can provide a significant amount of cash – more than the cash surrender value – allowing you to put the funds toward more immediate financial goals. While the payout is less than the full death benefit, it can still be a valuable way to access the policy’s value while you’re alive.

Term Life Settlements

Term life settlements are designed for individuals with term life insurance policies. Typically, term life insurance doesn’t accumulate any cash value, making it seem like an asset you can’t convert to cash. However, if your policy is convertible to permanent insurance, you might be eligible to sell your term life insurance policy for cash. In a term life settlement, a third-party buyer takes over the premiums and becomes the beneficiary.

Term life settlements are particularly useful for individuals who no longer need the death benefit or want to cash out on a policy that might otherwise expire without any return. Typically, policies must be convertible in order to qualify, but some non-convertible term policies may qualify for a viatical settlement.

Retained Death Benefit Life Settlements

A retained death benefit life settlement allows you to sell a portion of your life insurance policy while keeping part of the death benefit intact for your beneficiaries. This unique option enables you to access immediate cash without fully sacrificing the policy’s protection for your loved ones.

Retained death benefit life settlements offer a win-win solution for policyholders who need cash now but still want to ensure their family receives some benefit after they pass away. This option provides the flexibility to meet your financial needs today while leaving behind a portion of the death benefit for your beneficiaries.

Surrendering Your Policy for Cash

For some types of life insurance, particularly universal and whole life policies, there is a cash surrender value. This is the amount you can receive if you decide to cancel the policy. While this may seem like an easy and quick option, surrendering your policy for its cash value often results in a lower payout compared to other methods like life or viatical settlements.

The cash surrender value is usually far below the market value of the policy, meaning you could be throwing away hidden value if you opt to surrender it outright. In most cases, a settlement will offer a larger sum of cash, making it a better choice. This is why it’s important to explore all your options before making any final decisions on how to convert your life insurance to cash.

Why Appraisal Matters

Before deciding which route to take, it’s essential to have your life insurance policy appraised. An appraisal will help you understand the true value of your policy, as the market value is often higher than the cash surrender value offered by the insurance company. By getting your policy appraised, you can ensure you’re making the best financial decision and not leaving money on the table. Knowing the approximate appraisal value of your policy allows you to consider whether a settlement or another option would be best for you.

How to Get Started

If you’re looking to convert your life insurance to cash, the best first step is to explore your options and determine which one you might qualify for. At Viatical.org, we help policyholders understand the value of their life insurance and navigate the various methods available to convert policies into cash. Whether you’re considering a viatical settlement, life settlement, or another option, we can help guide you through the process.

Call us today at 800-973-8258 to learn more about the options you may qualify for and how we can help you unlock the value of your life insurance policy. Don’t let your policy’s hidden value go to waste – find out how you can convert it to cash and meet your financial needs today.