For individuals facing a terminal illness, medical bills and other costs are a primary concern and many turn to viatical settlements as a way to access funds quickly. A viatical settlement allows policyholders to sell their life insurance policies in exchange for a lump sum payment, which can help cover medical expenses, living costs, or other essential needs. One of the most common questions asked during this process is, “How long does a viatical settlement take?”

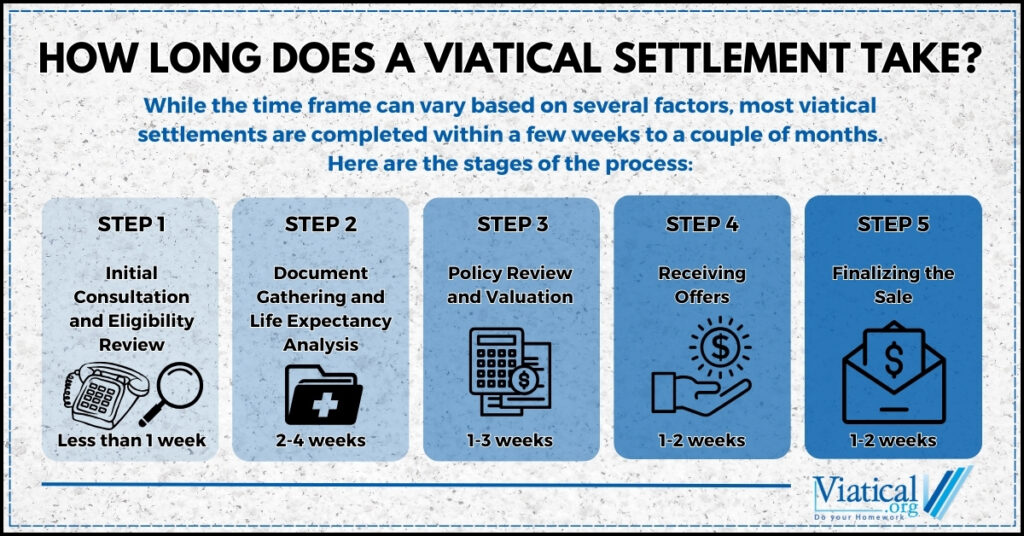

While the time frame can vary based on several factors, most viatical settlements are completed within a few weeks to a couple of months. Let’s take a closer look at the different stages involved and what you can expect throughout the process.

Factors That Affect the Timeline

The length of time it takes to complete a viatical settlement depends on several key factors, each of which can speed up or slow down the process.

The Type of Life Insurance Policy

The type of policy you have can significantly impact the duration of the viatical settlement process. Some life insurance policies, such as universal or whole life policies, are more straightforward for viatical settlement companies to evaluate and purchase. Other policies, such as term life insurance, may require more due diligence, especially if they are convertible policies.

Medical Records and Life Expectancy Evaluation

A critical step in the viatical settlement process is assessing the insured’s medical condition to estimate their life expectancy. Life settlement companies will require access to your medical records in order for buyers to make this assessment. If you are able to secure your own records and provide them quickly, this can help speed up the process. Ultimately, it depends on how quickly your medical provider is willing to provide records either to you directly or to the requesting life settlement company. Delays in gathering medical records can extend the settlement process.

Insurance Company Response Times

Another factor that can affect how long a viatical settlement takes is the responsiveness of the life insurance company. Once a viatical settlement company submits a request for information about your policy, it’s up to the insurance company to provide that data. Some companies are quicker to respond than others, which can either shorten or extend the process. Everything is requested electronically through our direct platform when you choose to work with Viatical.org and this greatly speeds up the process.

Complexity of the Policy

If your life insurance policy has unique provisions or complex terms, such as multiple beneficiaries or a history of loan withdrawals, it could take longer to review and approve. Some viatical settlement buyers may also request clarification from the insurance company, which adds additional time.

The Viatical Settlement Timeline

The time it takes to cash out a life insurance policy can vary. Although each case is unique, here is a general outline of what the viatical settlement timeline might look like:

Step 1: Initial Consultation and Eligibility Review (less than one week)

The first step in the viatical settlement process involves a consultation with a viatical settlement company. During this consultation, you’ll provide basic information about your life insurance policy and your health condition. It usually only takes a 5-10 minute phone call to learn if you are likely to qualify for a viatical settlement or life settlement.

If it looks like you are likely to qualify, you will need to complete initial compliance documents authorizing a life settlement company to gather necessary policy information and medical records. If you have any existing policy information such as a copy of the policy or recent annual statement, submitting these items can help expedite the review of your policy.

Step 2: Document Gathering and Life Expectancy Analysis (2-4 weeks)

After medical records have been gathered and submitted, a third-party life expectancy company will evaluate your life expectancy. This analysis is critical, as it determines how much a buyer will be willing to pay for your policy. The shorter the life expectancy of the insured, the higher the potential payout. This is because life settlement buyers must consider how long they will be paying policy costs when calculating the value of a policy.

This step often takes the longest, as it involves both your healthcare providers and the settlement company working together to gather and interpret your medical history. Some healthcare providers may be quick to release your records, while others could take longer, which will impact the overall timeline. On average, this stage can take 2-4 weeks.

Step 3: Policy Review and Valuation (1-3 weeks)

Once the medical evaluation is complete, buyers of life settlements will review your life insurance policy in detail. They will assess the policy’s value, including factors such as the death benefit, the cost of future premiums, and any existing loans against the policy.

This stage generally moves faster if your policy is straightforward and doesn’t have any complex terms. If your policy has unique features, it may take additional time for the provider to analyze and acquire necessary information from your insurance carrier. Buyers will perform a thorough policy appraisal before presenting an offer for your policy.

Step 4: Receiving Offers (1-2 weeks)

Once your policy has been fully evaluated, you’ll receive one or more offers from potential buyers if value is found and they are interested in purchasing your policy.

Typically, this stage takes about 1-2 weeks, depending on how quickly offers are received and how quickly you compare viatical settlement offers and accept an offer.

Step 5: Finalizing the Sale (1-2 weeks)

After accepting an offer, the final step is completing the paperwork to transfer ownership of the policy to the buyer. You’ll be required to sign legal documents, and the buyer will take over the responsibility of paying the premiums on your policy.

Once the paperwork is complete, you will receive your lump sum cash payment. Depending on the method of payment, you could receive your funds within a few days.

Total Time: 6-10 Weeks

From start to finish, most viatical settlements are completed within 6-10 weeks. However, if there are delays in obtaining medical records or insurance company responses, it could take longer. To speed up the process, it’s a good idea to have your documents organized and ready before beginning the life settlements process.

Can the Process Be Expedited?

While there is no guaranteed way to expedite a viatical settlement, there are a few steps you can take to help ensure the process goes as quickly as possible:

- Gather documents early: Having a copy of your policy ready and completing initial compliance forms quickly can help expedite the policy appraisal process.

- Work with our direct platform: Our secure direct platform utilizes electronic compliance forms and submits all requests for policy documents and medical records electronically, helping to speed up document retrieval.

- Stay in touch: Keep communication lines open to ensure you’re responding to requests quickly and not causing unnecessary delays.

If you’re considering a viatical settlement, understanding how long the process takes is an essential part of planning for your financial future. While the average timeline falls between 6 to 10 weeks, the actual time frame can vary based on your unique situation. By preparing ahead of time and working with an experienced life settlement company, you can help streamline the process and access the funds you need as efficiently as possible.

To learn if you are likely to qualify, please give us a call at 800-973-8258