When facing unexpected financial challenges or planning for the future, you may wonder, “How much money can I pull from my life insurance policy?” The answer depends on several factors, including the type of policy you own, its cash value, and whether you’re eligible to sell it through a life or viatical settlement. Here, we’ll explore your options for accessing cash from your life insurance policy and how to determine which method works best for your needs.

1. Understanding Cash Value in Life Insurance

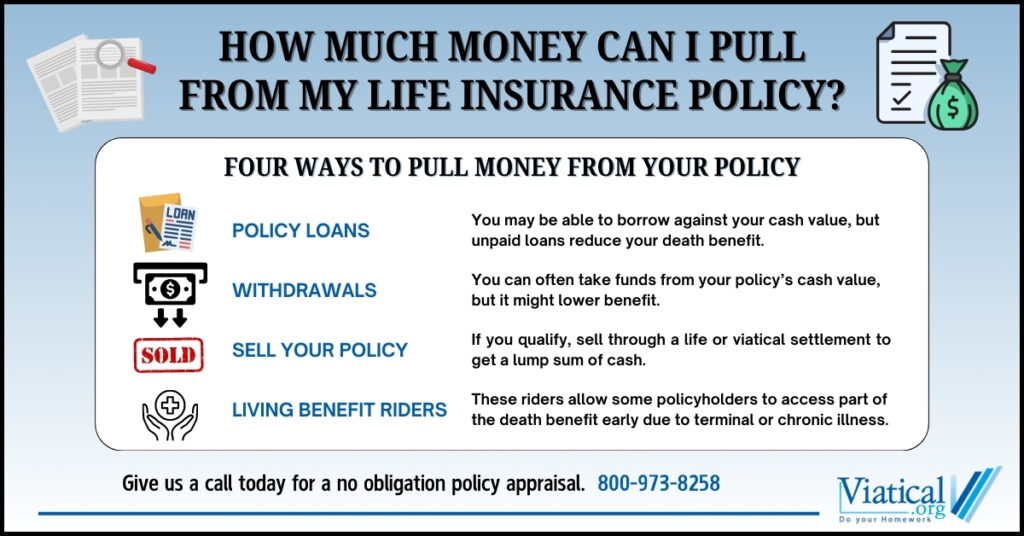

If you own a permanent life insurance policy, such as whole life or universal life insurance, it likely includes a cash value component. This cash value grows over time and can be accessed in the following ways:

- Policy Loans: You can borrow against your policy’s cash value without surrendering it. However, unpaid loans and interest will reduce the death benefit your beneficiaries receive.

- Withdrawals: Some policies allow partial withdrawals from the cash value, but this may lower the policy’s value or benefits.

- Policy Surrender: You can cancel the policy and receive the surrender value, which is the cash value minus any fees or penalties.

2. Selling Your Life Insurance Policy for Cash

Another option is selling your policy through a life settlement or viatical settlement, which allows you to receive a lump sum of cash. This option is particularly valuable for individuals who no longer need their policy or can no longer afford premiums.

- Life Settlement: Ideal for seniors who no longer require life insurance or want to supplement retirement income.

- Viatical Settlement: Viatical settlements are designed for individuals with a terminal or chronic illness, allowing them to access cash to cover medical expenses or improve their quality of life.

The amount you can pull from selling your policy depends on factors like your age, health, the policy type, and its death benefit. On average, policyholders receive 20–30% of the policy’s face value in life settlements, while viatical settlements often yield higher percentages due to the insured’s health condition and shortened life expectancy.

3. Selling Term Life Insurance

If you have a term life insurance policy, it typically doesn’t have cash value. However, some term policies are convertible, meaning they can be converted into a permanent policy. You may be able to sell your term life insurance policy for cash as many life settlement purchasers will buy these types of policies and convert them before or after the sale. Some non-convertible policies can qualify, but usually only if the insured has a terminal condition.

4. Using Riders to Access Funds

Many policies include living benefit riders that allow you to access a portion of your death benefit early if you meet certain criteria, such as being diagnosed with a terminal illness. These accelerated death benefits can provide immediate cash without selling the policy, though the payout will reduce the death benefit available to beneficiaries. Not everyone will qualify for this option.

5. Factors That Influence the Payout

The amount of money you can pull from your life insurance policy depends on:

- The type of policy (term vs. permanent)

- The policy’s cash value (if applicable)

- Your health and age (for life settlements)

- The remaining death benefit

- Market conditions and interest from buyers

To get an accurate estimate, it’s essential to consult with a reputable life settlement company. We can evaluate your policy and provide you with a no-obligation policy appraisal.

6. Next Steps: Explore Your Options

If you’re looking for ways to pull money from your life insurance policy, start by determining what type of policy you have and whether it has cash value. Then, consider your financial goals—whether you need immediate cash for medical expenses, retirement, or other needs. Consulting with an expert can help you decide whether a loan, withdrawal, or the option to sell your life insurance policy for cash is the best choice.

Knowing how much money you can pull from your life insurance policy can empower you to make informed financial decisions. Whether through a cash value withdrawal, a loan, or a life settlement, there are multiple ways to unlock the value of your policy. If you’re considering selling your policy, please give us a call at 800-973-8258 to learn if you’re likely to qualify for a life settlement or viatical settlement.