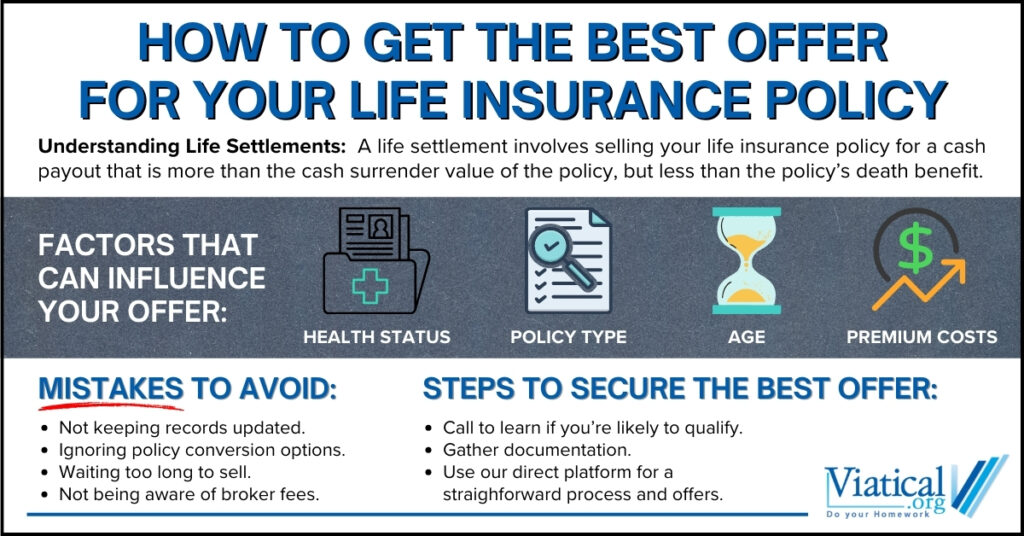

If you’re considering selling your life insurance policy, you may be wondering how to get the best offer for your life insurance policy. Our platform connects you with potential direct buyers, making it easier to secure the best possible offer. To maximize the value, it’s important to understand the factors that influence life settlement offers, such as health status, policy type, and timing.

1. Understand the Life Settlement Process

A life settlement involves selling your life insurance policy for a cash payout. The buyer takes over the premium payments and becomes the policy’s beneficiary, receiving the death benefit when you pass away. This option is suitable for individuals who no longer need the policy, face high premiums, or are seeking a way to generate extra funds. Working with our direct platform ensures that the offer you receive is straightforward, without the need to subtract any fees or commissions from the amount presented to you.

2. Factors That Influence the Offer Amount

Age and Health Condition

Policies owned by older individuals or those with significant health changes often receive higher offers because the policy is more valuable to buyers. If your health has deteriorated since purchasing the policy, it may be worth more in the life settlement market.

Policy Type and Value

Permanent policies like whole or universal life generally yield better offers than term policies. However, if you have a convertible term policy, you may still get a competitive offer by converting it to permanent coverage before the sale. What happens when term insurance expires? If your policy is no longer convertible, it likely won’t qualify for a sale unless you are eligible for a viatical settlement.

Premium Costs

Policies with lower ongoing premiums are more attractive to buyers, as they involve fewer future expenses.

Face Value of the Policy

Larger policies, often with face values of $100,000 or more, tend to attract more buyers due to the larger death benefit payout.

3. Steps to Maximize Your Offer

Maintain Updated Health Records

Providing detailed, up-to-date medical records can help make the policy more appealing to buyers. Clear documentation of health changes may also increase your offer.

Keep the Policy in Good Standing

Avoid any lapses in premium payments, as keeping the policy active makes it more valuable in the life settlement market. If there is a danger of your policy going into grace and you are considering life settlements, it is vital to contact life settlement companies expeditiously so that you don’t risk allowing the policy to lapse.

Review Conversion Options for Term Policies

If you have a term policy, determine whether it can be converted to a permanent policy. Conversion often makes the policy more valuable, as permanent coverage is typically preferred by buyers. Some non-convertible term policies may still be eligible to be sold if the insured has a severe medical diagnosis.

Consider a Viatical Settlement If Eligible

If you have a terminal illness with a life expectancy of fewer than two years, you may qualify for a viatical settlement. Viatical settlements can offer higher payouts compared to standard life settlements. Funds received in this type of settlement can provide financial support for medical and end-of-life expenses.

4. Evaluate Financial Impacts Before Selling

Future Financial Needs

Assess whether selling the policy will affect your long-term financial security or the support for your beneficiaries. If your family relies on the death benefit for future expenses, make sure they have other financial resources available.

Tax Considerations

Viatical settlement proceeds are typically not taxed, but be aware that proceeds from a life settlement could be subject to taxes depending on your policy’s cash value, premiums paid, and the total settlement amount. Consult with a trusted tax professional to understand any tax implications.

Potential Impact on Medicaid Eligibility

If you’re receiving or plan to apply for Medicaid, the proceeds from a life settlement could affect your eligibility. Check your state’s guidelines on how life settlements are treated for Medicaid qualification. A Medicaid life settlement may be available to you if you qualify.

5. Timing Matters: When to Sell

Older Policies and Health Changes

Policies that have been active for longer periods or involve owners with recent health changes often receive higher offers. If your health has worsened since you first purchased the policy, it could be valued more favorably by buyers. All policies must be at least two years old, older in some states, before they may be sold.

Market Conditions

Life settlement offers can vary based on economic conditions and interest rates. When interest rates are low, buyers may be more willing to pay higher prices for life insurance policies. Consider current market trends and investor demand when deciding to sell.

End of Conversion Period for Term Policies

If you have a convertible term policy, it’s often better to sell before the conversion period ends. Once this window closes, the policy may lose its conversion feature, reducing its attractiveness to buyers. It is imperative that you initiate the process at least 60 days before your conversion eligibility ends.

6. Alternatives if the Offer is Below Expectations

Accelerated Death Benefit

Some life insurance policies allow you to access a portion of the death benefit early if you have a qualifying health condition. This can provide needed funds while keeping the policy in place, but not everyone will qualify for this option. Oftentimes, your life expectancy must be 6 months or less in order to be approved.

Policy Loans

If your policy has a cash value component, borrowing against the policy may provide the funds you need without giving up ownership. Keep in mind that a life insurance loan can reduce the death benefit.

Retained Death Benefit Life Settlement

If you don’t want to sell your entire policy, some buyers may offer a partial life settlement. This allows you to sell a portion of the policy while retaining some death benefit coverage for your beneficiaries.

7. Know the Buyer’s Perspective

Low Premium Costs

Lower premium costs mean lower future expenses for the buyer, making the policy more attractive.

Shorter Life Expectancy

Policies held by individuals with shorter life expectancies are considered lower risk, resulting in higher offers.

High Face Value

Larger policies provide higher death benefits, which can yield better returns for the buyer.

8. How to Start the Process

To get the best offer for your life insurance policy, start by reaching out to our direct life settlement platform that can connect you with qualified buyers. Gather your policy details, recent health records, and premium payment history to prepare for the evaluation process. By taking these steps, you can streamline the sale and receive a competitive offer.

Selling your life insurance policy can be a significant decision. By following these steps and understanding the factors that impact life settlement offers, you can get the best offer for your life insurance policy while ensuring the sale aligns with your financial needs.

To learn if you’re likely to qualify, please give us a call at 800-973-8258. We can assist you with a no obligation policy appraisal to help you decide if a life settlement or viatical settlement is right for you.