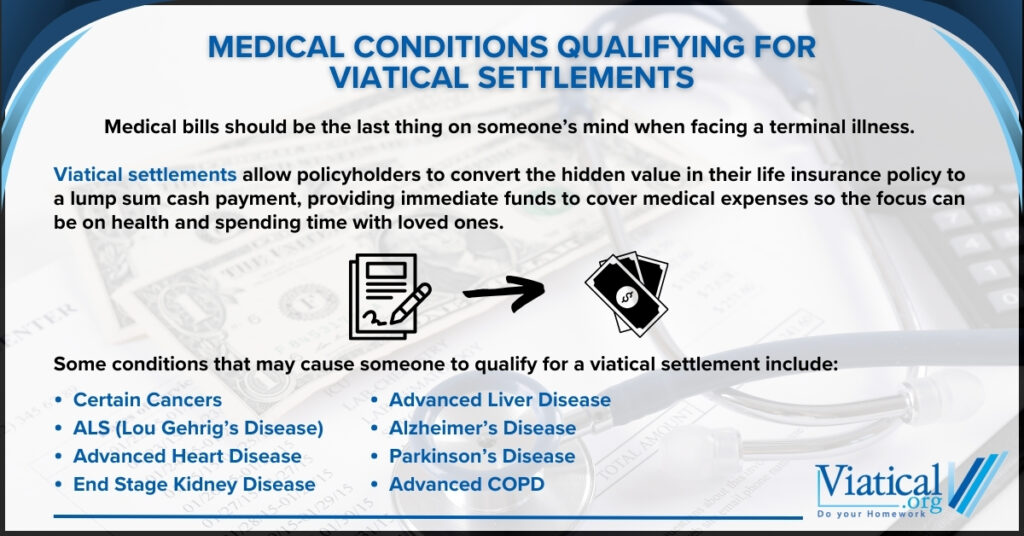

When facing severe health challenges, individuals may seek financial relief through a viatical settlement. This option allows policyholders with specific medical conditions to sell their life insurance policies for a lump sum cash payment, providing immediate funds to cover medical expenses and improve their quality of life. Understanding the medical conditions qualifying for viatical settlements is crucial for those considering this financial option.

Terminal Illnesses

Viatical settlements are primarily designed for individuals diagnosed with terminal illnesses, where the life expectancy is generally less than two years. The following conditions commonly qualify for viatical settlements:

Cancer

When determining how to pay for cancer care, viatical settlements should be considered. Advanced stages of cancer, particularly those with a poor prognosis, typically qualify individuals for viatical settlements. This includes cancers like stage IV lung, breast, colon, and pancreatic cancer, where the expected survival time is significantly limited.

ALS (Amyotrophic Lateral Sclerosis)

ALS, also known as Lou Gehrig’s disease, is a progressive neurodegenerative disease that affects nerve cells in the brain and spinal cord. The rapid progression and severe impact on life expectancy make viatical settlements an option.

Advanced Heart Disease

Conditions such as congestive heart failure, advanced coronary artery disease, and other severe heart conditions that drastically reduce life expectancy are often eligible for viatical settlements. Selling your life insurance with congestive heart failure can allow you to access cash to help pay for treatment.

End-Stage Kidney Disease

Patients with end-stage renal disease, particularly those not responding well to treatment or not candidates for transplantation, can qualify for viatical settlements due to their limited life expectancy.

Advanced Liver Disease

Severe liver conditions, including cirrhosis and liver cancer, particularly in their advanced stages, may also qualify for viatical settlements.

Chronic Illnesses

In addition to terminal illnesses, certain chronic conditions also qualify, especially if they severely impact the individual’s daily living activities and life expectancy:

Alzheimer’s Disease

Advanced stages of Alzheimer’s disease, where the patient requires significant assistance with daily living activities, are often eligible for viatical settlements.

Parkinson’s Disease

Severe stages of Parkinson’s disease, especially when accompanied by dementia or other debilitating complications, typically make patients eligible for viatical settlements. Viatical settlements can provide a lump sum of cash that can be used when paying for Parkinson’s care.

Chronic Obstructive Pulmonary Disease (COPD)

Advanced COPD, particularly when it results in significant breathing difficulties and frequent hospitalizations may be a qualifying factor as well.

Qualifying Criteria

Eligibility for viatical settlements is determined not just by the medical condition but also by the individual’s life expectancy and the specific details of their life insurance policy. Generally, the following criteria are considered:

Life Expectancy

Typically, a life expectancy of two years or less is required for a viatical settlement.

Policy Type and Value

Most life insurance policies qualify, including term life, whole life, and universal life policies. The policy usually needs to have been in force for at least two years and have a minimum face value of at least $100,000.

For those that don’t qualify for viatical settlements, life settlements are often an option. Life settlements still allow a policyowner to receive a lump sum of cash for their policy, but they do not have to have a terminal diagnosis to qualify.

For individuals diagnosed with severe medical conditions, viatical settlements can provide much-needed financial relief. Understanding the medical conditions qualifying for viatical settlements helps patients and their families make informed decisions about accessing funds from life insurance policies to cover essential expenses and improve their quality of life.

If you or a loved one is considering a viatical settlement, it is important to first have your policy appraised for value. Give us a call today to learn if you’re likely to qualify based on your health status and policy details.

800-973-8258