Life insurance policies often serve as essential safety nets, providing financial security for loved ones. However, there are situations where policyholders may no longer need their coverage or find it financially burdensome to maintain. In such cases, exploring options for unwanted life insurance policies can help individuals make informed decisions and potentially recoup some of the value from their policies. Here are several practical solutions for handling unwanted life insurance policies, empowering you to choose the best course of action based on your circumstances.

1. Surrendering the Policy

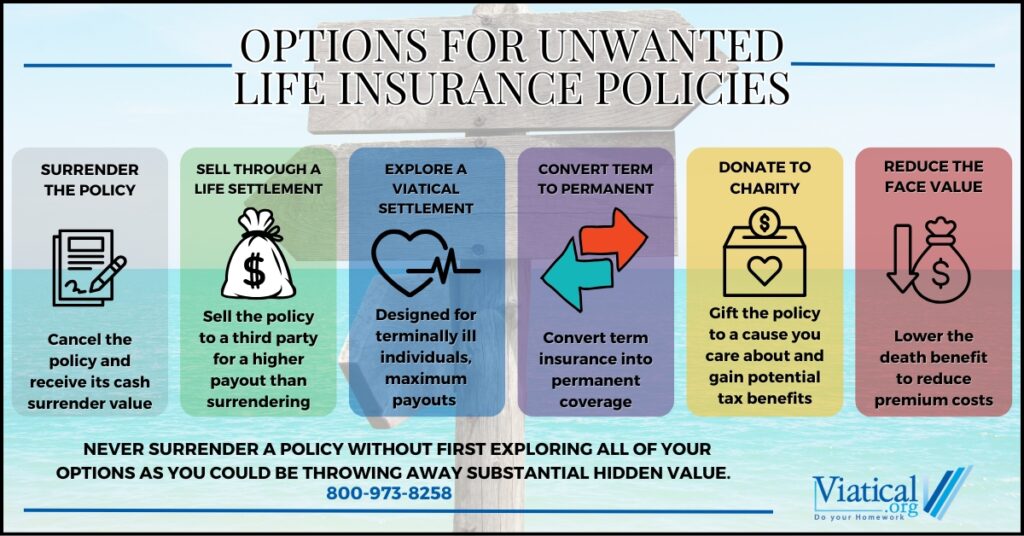

One common option is to surrender the life insurance policy back to the insurance company. This approach involves canceling the policy in exchange for the accumulated cash surrender value, which is typically available for permanent life insurance policies like whole or universal life. While surrendering the policy offers immediate cash, the payout is often significantly less than the total premiums paid and always less than the death benefit amount.

2. Selling the Policy Through a Life Settlement

A life settlement allows policyholders to sell their life insurance policy to a third-party buyer for a cash payout. This option can provide significantly more money than surrendering the policy. In fact, according to a 2023 market survey, the average life settlement payout is 6.2 times more than the cash surrender value. The buyer assumes responsibility for paying future premiums and becomes the beneficiary of the policy.

Life settlements are particularly appealing for seniors or individuals with health conditions that reduce their life expectancy, as buyers are willing to pay more for policies expected to mature sooner.

3. Exploring Viatical Settlements

For individuals diagnosed with a terminal illness, a viatical settlement might be an ideal choice. Similar to life settlements, this option allows you to sell your policy to a third-party buyer. However, viatical settlements are specifically designed for those with a life expectancy of two years or less. These settlements typically offer higher payouts compared to standard life settlements, providing much-needed financial support during a challenging time. Another key benefit of viatical settlements is that the proceeds are typically not subject to tax. Always be sure to consult with your trusted tax professional for advice on your specific situation.

4. Converting Term Life Insurance to Permanent Insurance

Term life insurance policies, which lack cash value, might seem to have no value. However, some term policies include a conversion option that allows policyholders to transition to a permanent life insurance policy without undergoing additional medical underwriting. Once converted, the policy can potentially be sold through a life settlement or viatical settlement if needed. If you are not looking to hold on to your policy, you may consider selling it while it is still a convertible term policy. In most cases, the purchaser will take on the responsibility of converting it.

5. Donating the Policy to Charity

Another creative option for unwanted life insurance policies is donating them to a charity. By transferring ownership of the policy, you provide the charity with a future death benefit or the ability to cash in the policy immediately. Donating to charity not only supports a cause you care about but also may provide you with a tax deduction. Consult with a financial advisor to understand the tax implications of this choice.

6. Reducing the Policy’s Face Value

If maintaining the premiums has become a financial strain but you still want to keep some coverage, consider reducing the policy’s face value. This option lowers the death benefit amount and the associated premium costs, allowing you to retain coverage that aligns better with your current financial situation.

You may also be able to sell a portion of your policy in a life settlement or viatical settlement. If you qualify, this option eliminates your responsibility of paying premiums, but allows you to keep part of the death benefit.

7. Borrowing Against the Policy

Permanent life insurance policies with cash value also allow policyholders to take out a loan against the policy. This option provides immediate access to funds without surrendering or selling the policy. Keep in mind that unpaid loans reduce the death benefit, so it’s important to weigh this option carefully.

There are several options for unwanted life insurance policies, each with unique benefits and drawbacks. Whether you choose to surrender, sell, donate, or repurpose your policy, the key is to evaluate your financial goals and consult with trusted professionals to make the best decision. By understanding the available choices, you can turn an unwanted life insurance policy into an asset that supports your current needs or long-term objectives.

If you are interested in learning more about life settlements or viatical settlements, please give us a call at 800-973-8258. It only takes a 5-10 minute phone call to find out if you are likely to qualify.