When a parent needs assisted living but can’t afford it, the financial and emotional strain on families can feel overwhelming. Assisted living costs can quickly add up, averaging thousands of dollars per month. Fortunately, there are ways to alleviate this burden, including exploring a life settlement or viatical settlement as a potential source of funds. These options allow qualifying policyholders to sell their life insurance policies for cash, which can be used to cover assisted living expenses or other urgent financial needs.

The Rising Cost of Assisted Living

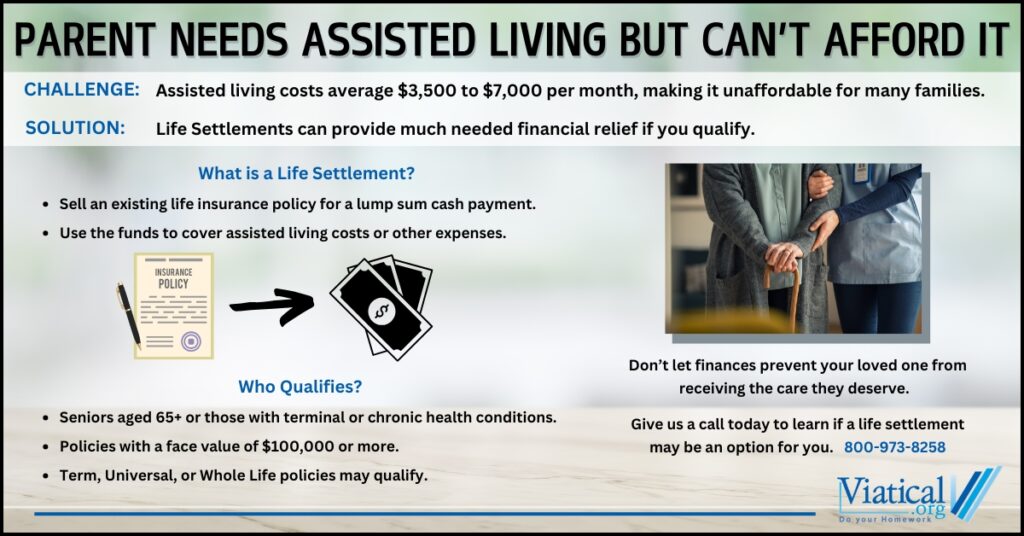

The cost of assisted living varies depending on location and level of care but often ranges between $3,500 and $7,000 per month. For many families, this expense is out of reach, especially if savings or retirement accounts have been depleted. Medicaid and long-term care insurance may provide some relief, but they don’t cover everyone or everything. This is where alternative funding options, like life settlements, can provide a lifeline.

What Is a Life Settlement?

A life settlement involves selling an existing life insurance policy to a third party for a lump sum payment. This payment is higher than the policy’s cash surrender value, but less than the death benefit. The funds can be used for any purpose, including paying for assisted living. Policyholders over 65 with policies of $100,000 or more may be eligible.

For those facing a terminal illness, a viatical settlement may be an even better option. This type of settlement provides immediate cash to individuals with a shortened life expectancy, regardless of age, and offers a way to secure financial resources when they are needed most.

How Life Settlements Help Families

If your parent needs assisted living but can’t afford it, the option to sell your life insurance policy for cash to pay for assisted living can offer several benefits:

- Immediate Funds: The proceeds from a life settlement can be used immediately to cover assisted living costs or other pressing expenses.

- Avoiding Debt: By using the cash from a settlement, families can avoid taking on loans or other forms of debt.

- Preserving Dignity: A life settlement allows seniors to afford the care they deserve without burdening their loved ones financially.

Eligibility for Life and Viatical Settlements

Not all policies or policyholders qualify for a life settlement, but there are general guidelines:

- Policy Type: Term, universal, or whole life insurance policies may qualify, though term policies often need to be convertible.

- Policy Value: Typically, the policy should have a face value of $100,000 or more.

- Age and Health: Seniors aged 65 and older, or individuals with significant health impairments, are more likely to qualify.

A viatical settlement has additional requirements, such as a documented terminal illness. However, for those who meet the criteria, the payout is often substantial and tax-free.

Steps to Explore Life Settlement Options

- Assess the Policy: Determine if the policy meets eligibility requirements. If you aren’t sure, please give us a call. We would be happy to help you understand whether or not your policy may qualify.

- Consult with Experts: Work with life settlement professionals who can evaluate the policy and provide a market value estimate.

- Use the Funds Wisely: Apply the proceeds toward assisted living or other essential expenses.

When a parent needs assisted living but can’t afford it, the situation can seem dire. However, a life settlement or viatical settlement can provide a viable solution for families struggling to cover care costs. By unlocking the value of an existing life insurance policy, you can help ensure your loved one receives the support and dignity they deserve in their golden years.

To learn more about how life settlements work and whether they’re right for your family’s situation, please give us a call at 800-973-8258.

We have been helping people access the hidden value in life insurance for nearly 20 years.