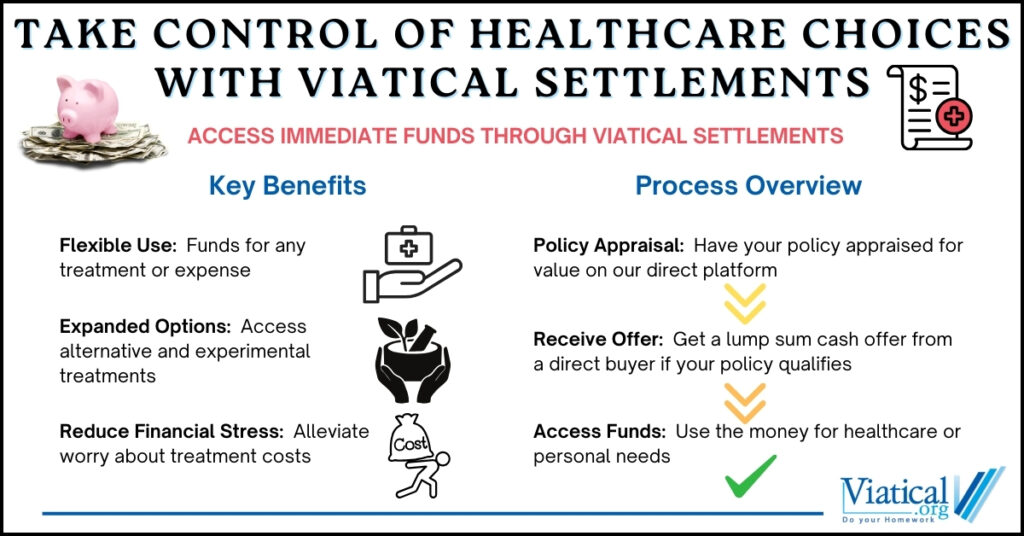

When faced with a terminal illness, patients and their families often encounter difficult decisions regarding treatment options and financial planning. The uncertainty and emotional strain of navigating these choices can be overwhelming. Patients can take control of healthcare choices with viatical settlements by accessing the hidden value in existing life insurance in the form of a lump sum cash payment. This can be particularly beneficial when exploring alternative or experimental treatments that may not be covered by traditional insurance.

The Flexibility of Viatical Settlements

A viatical settlement allows individuals with a terminal illness to sell their life insurance policy for a lump sum payment, which can be used in any way the policyholder sees fit. This financial flexibility is one of the key advantages of viatical settlements, as it allows patients to prioritize their healthcare needs and make informed decisions based on their personal preferences and circumstances.

For instance, some patients may wish to pursue treatments that align with their holistic health beliefs, such as naturopathy, acupuncture, or dietary therapies. Others might be interested in participating in clinical trials for cutting-edge medications or procedures that are still in the experimental phase. By providing the necessary funds upfront, viatical settlements enable patients to access these options without the burden of financial constraints.

Tailoring Treatment Plans to Individual Needs

One of the most significant benefits of viatical settlements is the ability to tailor treatment plans to the individual’s specific needs and goals. Traditional insurance often covers only a narrow range of treatments, leaving patients with limited options. With the funds from a viatical settlement, patients can explore a wider array of healthcare choices that align with their unique circumstances.

For example, a patient with terminal cancer might want to combine conventional treatments like chemotherapy with complementary therapy such as massage, meditation, or nutritional counseling. The flexibility provided by a viatical settlements for cancer treatment and alternative care allows the patient to create a comprehensive care plan that addresses both their physical and emotional well-being.

Reducing Stress and Improving Quality of Life

The financial stress of dealing with a terminal illness can take a toll on both patients and their families. Viatical settlements alleviate this burden by providing a lump sum payment that can be used to cover a wide range of expenses. Whether it’s paying for medical bills, travel expenses for treatment, or simply reducing debt, the financial freedom offered by viatical settlements can significantly improve the quality of life for patients during a challenging time. Viatical settlements can help cover home care equipment costs and other costs associated with home care too.

Having access to immediate funds allows patients to focus on their health and well-being rather than worrying about financial matters. This peace of mind can be invaluable, giving patients the emotional space to concentrate on what truly matters – spending time with loved ones and making the most of each day.

Supporting Family and Caregivers

Viatical settlements not only benefit the patient, but also provide essential support to family members and caregivers. The financial relief offered by a viatical settlement can help cover the costs of caregiving, allowing family members to take time off work or hire professional help if needed. This support ensures that caregivers can provide the best possible care for their loved ones without the added stress of financial worries.

The funds from a viatical settlement can be used to make necessary modifications to the home, such as installing wheelchair ramps, creating a comfortable living space, or purchasing specialized medical equipment. These improvements can enhance the patient’s comfort and independence, further improving their quality of life.

How to Pursue a Viatical Settlement

If you or a loved one is considering a viatical settlement, it’s important to understand the process and how to get started. The first step is to contact a reputable viatical settlement provider who can evaluate your life insurance policy and provide an offer. The offer will be based on several factors, including the policy’s value, the cost of premiums, and the patient’s life expectancy.

Once an offer is made, the policyholder has the option to accept or decline it. If accepted, the ownership of the policy is transferred to the buyer, and the policyholder receives a lump sum payment. This process is straightforward and can typically be completed within a few weeks, allowing patients to access the funds they need quickly.

Viatical settlements offer a powerful tool for patients facing terminal illnesses to take control of their healthcare choices. By providing immediate financial resources, these settlements enable patients to explore a wide range of treatment options, reduce financial stress, and improve their overall quality of life.

For those seeking flexibility and empowerment in their healthcare journey, a viatical settlement can be an invaluable resource. Please give us a call today to learn if you are likely to qualify. 800-973-8258