A serious diagnosis often brings both emotional strain and financial uncertainty. Most policyholders do not realize that a life insurance policy can offer more than just future protection. It may hold hidden value that could provide financial support when it is needed most, but is selling your life insurance policy an option for you?

Before making any decisions, take time to understand all your options. You may have access to new options that provide immediate funds while still preserving some benefits for your family. Many policy owners are surprised to discover that you may be able to sell your life insurance policy for cash.

For nearly two decades Viatical.org has helped policyholders review their options through a straightforward, direct and consumer focused process with no Broker involvement. Our founder introduced the industry changing, direct-to-consumer platform at the Life Insurance Settlement Association (LISA) conference in 2016 and has continued to champion consumer rights as well as agent protections ever since.

Before You Decide: Why a Policy Review Matters

For individuals with a serious or terminal illness, a no-cost policy valuation can reveal powerful solutions you may not have considered. Knowing your policy’s current value ensures you understand all your options for financial relief.

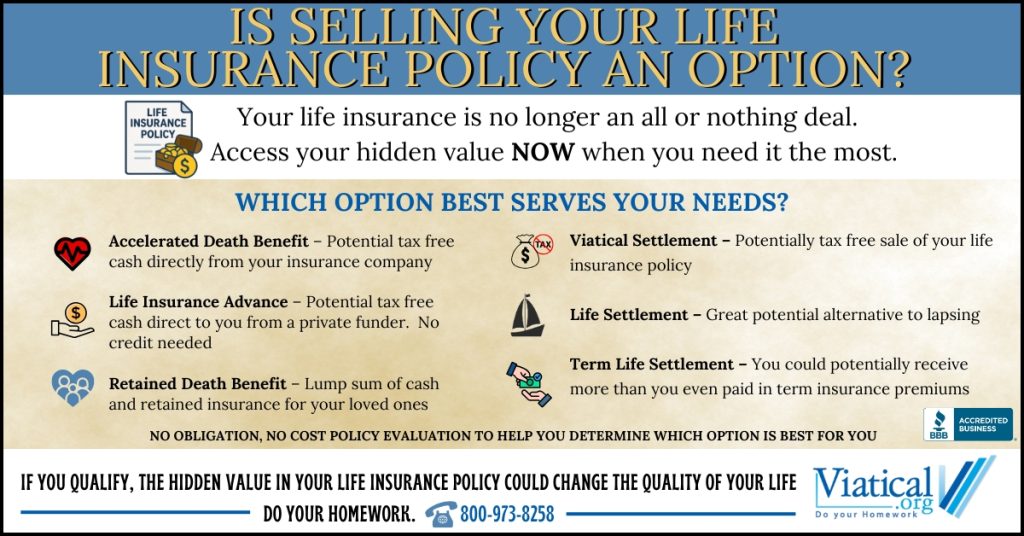

Depending on your age, health, and type of policy, you could qualify for:

- Accelerated Death Benefit – Access a portion of your death benefit directly from your insurer if you have a terminal diagnosis.

- Life Insurance Advance – Receive partial funds now while leaving a reduced benefit for your beneficiaries.

- Retained Death Benefit – Get a lump sum payment and maintain a portion of the death benefit, often with no future premium obligations.

- Viatical Settlement – Sell your policy for a tax-free lump sum if your life expectancy is under 24 months.

- Life Settlement – Typically available to those over 65 or younger with health conditions, and often provides much more than the cash surrender value.

- Term Life Settlement – Many are surprised to learn that a term life insurance policy may have a hidden cash value. Depending on your age and policy, you could qualify for a life settlement for term insurance even if your health is perfect.

Some individuals qualify for multiple options or a combination. A brief phone call can help you explore all of your potential options.

Quick Eligibility Checklist

You may qualify if:

- You have a serious or terminal illness

- You are over 65, or younger with a less serious qualifying health condition

- You own the right Term Policy and are still in good health

- Your policy’s face value is $100,000 or more

- You are the legal owner of the policy

Not sure if you qualify? Call 800-973-8258 for a no-obligation review.

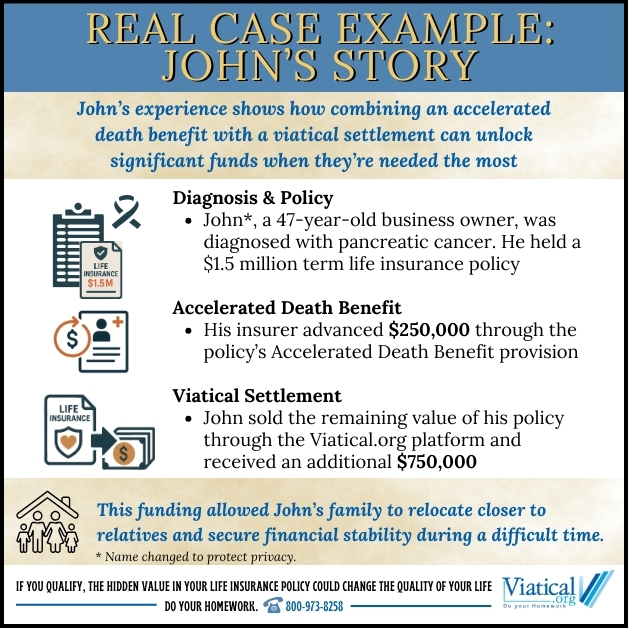

Real Case Example: John’s Story

Here is a real case example, John’s story. John*, a 47-year-old business owner, was diagnosed with pancreatic cancer. One of his policies was a $1.5 million term life insurance policy.

His insurer paid him $250,000 through an Accelerated Death Benefit.

After exploring all his options, John sold the remainder of his policy on the Viatical.org Platform and received an additional $750,000

This funding allowed John’s family to relocate closer to relatives and secure financial stability during a most difficult time.

*Name changed to protect privacy.

What Happens When You Call

Our process is simple, fast, and confidential:

- 5–10 minute call to determine if your policy is likely to qualify

- No cost, no application, no obligation, no pressure

- If eligible, we can arrange a professional, no-obligation and cost free appraisal

- Our direct-to-buyer platform is designed to maximize your payout by avoiding unnecessary broker fees

“My experience was stress-free, I was kept informed throughout the process, and the professionalism was outstanding.”

— E.C.

Frequently Asked Questions

Are viatical settlements legal in every state?

Yes, viatical settlements are legal nationwide, although each state has its own regulations. We’ll help you understand the rules that apply to you.

Will my beneficiaries still receive anything?

Yes, in some cases. Options like the retained death benefit allow you to receive funds now while still preserving some benefits for your family.

Which types of policies qualify?

Term, whole, and universal life policies may all qualify, depending on your age, health, and policy size.

How long does the process take?

The first call takes minutes. Appraisals are typically completed within a day after we request and receive an illustration from your insurance carrier. Some insurance companies can provide what is needed in one day, while others may take up to 10. Once everything is received, transactions can be initiated in a day and are usually finalized with your insurance company within a few weeks.

What do I have to do?

If it looks like you will qualify and you wish to sell a portion of your life insurance, simply sign the digital authorizations. Our platform gathers your medical information, insurance illustrations, policy copy, and verifies the coverage as it prepares the information for institutional buying funds. You sign online, and our platform handles everything else for you.

Discover What Your Policy May Be Worth

If you are managing medical costs, seeking financial relief, or need to improve your quality of life, exploring all your options is the first step. Also, if you are over age 65 you should call us before canceling any unneeded or unaffordable life insurance.

It only takes a 5-10 minute phone call to learn if you may qualify to access the hidden value in your life insurance policy, today. 800-973-8258