Viatical Life Settlement Blog

Viatical.org operates on a direct-to-consumer platform. Institutional investors are able to look at your policy directly with no broker or middleman.

Whether you are healthy and trying to sell your term insurance to get the hidden value in cash or whether you’re sick and trying to utilize the value in your insurance policy as a viatical settlement to pay for alternate care, you should always have your policy appraised before trying to sell it.

It usually only takes a 5-minute phone call to learn if you and your policy qualify for a life settlement or a viatical settlement. Every case is different. Please just give us a call and we’ll try to help you.

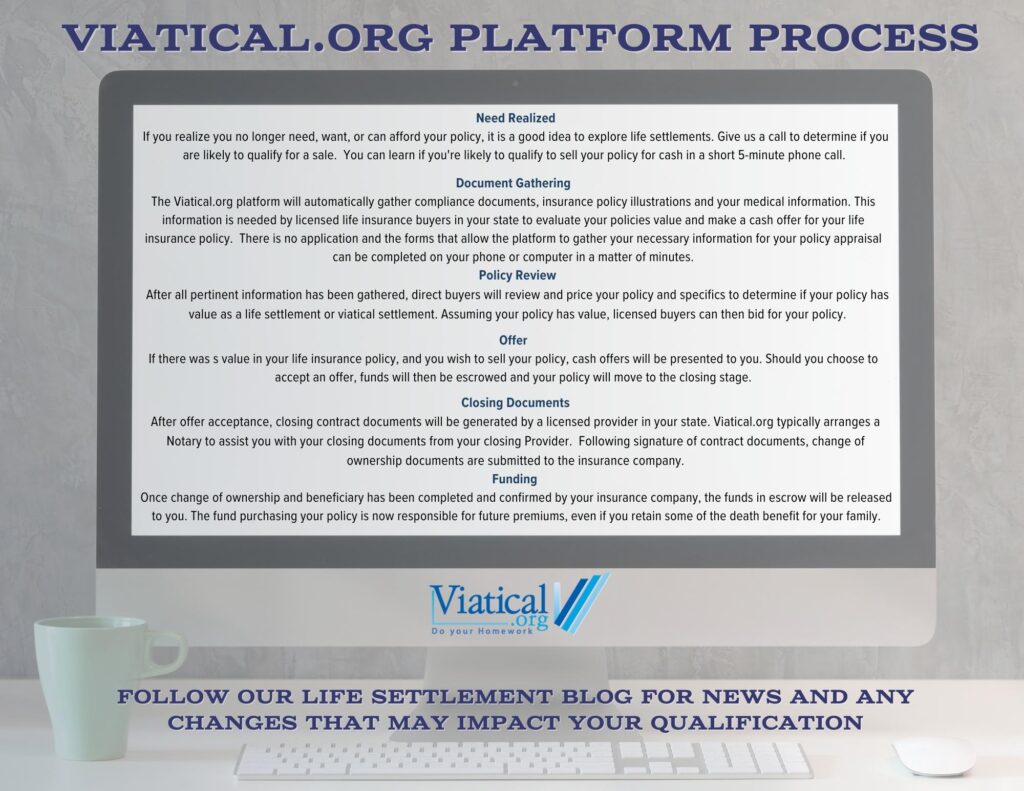

Viatical.org Platform Process

Our direct-to-consumer platform for viatical settlements and life settlements is simple and easy to understand.

Need Realized

If you realize you no longer need, want, or can afford your policy, it is a good idea to explore life settlements. Give us a call to determine if you are likely to qualify for a sale.

You can learn if you’re likely to qualify to sell your policy for cash in a short 5-minute phone call.

Document Gathering

The Viatical.org platform will automatically gather compliance documents, insurance policy illustrations and your medical information. This information is needed by licensed life insurance buyers in your state to evaluate your policies value and make a cash offer for your life insurance policy. There is no application and the forms that allow the platform to gather your necessary information for your policy appraisal can be completed on your phone or computer in a matter of minutes.

Policy Review

After all pertinent information has been gathered, direct buyers will review and price your policy and specifics to determine if your policy has value as a life settlement or viatical settlement. Assuming your policy has value in the secondary market, licensed buyers can then bid for your policy.

Offer

If there was a value in your life insurance policy, and you wish to sell your policy, cash offers will be presented to you. Should you choose to accept an offer, funds will then be escrowed, and your policy will move to the closing stage.

Closing Documents

After offer acceptance, closing contract documents will be generated by a licensed provider in your state. Viatical.org typically arranges a Notary to assist you with your closing documents from your closing Provider.

Following signature of contract documents, change of ownership documents are submitted to the insurance company.

Funding

Once change of ownership and beneficiary has been completed and confirmed by your insurance company, the funds in escrow will be released to you. The institutional fund purchasing your policy is now responsible for all future premiums, even if you retain some of the death benefit for your family.

There is no pressure when selling your life insurance policy direct on the Viatical.org platform. There is no application, fee, or obligation to have your life insurance policy appraised. Viatical.org has been helping consumers for over 15 years and we would be happy to help you.

Follow our Viatical Life Settlement Blog for news and any changes that may impact your qualification.

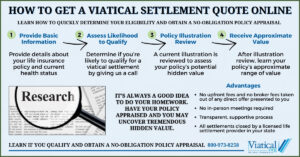

- How to Get a Viatical Settlement Quote Onlineby C.E. DeanIf you’re wondering how to get a viatical settlement quote online, you’re already on the right track to exploring your options. Many people facing a serious illness aren’t aware that life insurance policies can be sold for a lump sum — and even fewer know that you can begin the process entirely online, without leaving your home or meeting anyone in person. What Is a Viatical Settlement Quote? A viatical settlement quote is an estimate of how much money you may receive if you choose to sell your life insurance policy. It’s based on a number of factors, including: The …See More

- Stop Paying for Life Insurance You Don’t Needby C.E. DeanIf you’re still paying monthly or annual premiums for a policy that no longer serves your needs, you’re not alone—and you’re not stuck. It may be time to stop paying for life insurance you don’t need. Whether your original reasons for purchasing the policy have changed or your financial priorities have shifted, there are smarter ways to handle an unneeded policy than simply letting it lapse. Why You Might No Longer Need Your Policy Life insurance is a valuable tool, but it’s meant to serve a purpose. If that purpose has passed, the policy may no longer be worth keeping. …See More

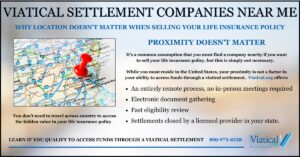

- Viatical Settlement Companies Near Meby C.E. DeanIf you’ve recently searched for viatical settlement companies near me, you’re not alone. Many people dealing with a serious illness or helping a loved one through one are looking for ways to access the value of a life insurance policy. While it’s natural to assume that working with a nearby company is necessary, the truth is that location doesn’t matter. With today’s technology — and our platform in particular — the entire process can be handled electronically and remotely, without ever needing to leave your home. Why “Near Me” Doesn’t Matter Anymore Traditionally, people may have looked for a local …See More

- Why Your Insurance Company Might Not Tell You About Life Settlementsby C.E. DeanIf you’ve ever wondered why your insurance company didn’t mention the option to sell your life insurance policy, you’re not alone. Why your insurance company might not tell you about life settlements comes down to one simple fact: it’s not in their financial interest to do so. Life settlements offer policyholders a way to receive more than the policy’s surrender value—but that means the insurance company may ultimately have to pay out a death benefit they were hoping to avoid. What Is a Life Settlement? A life settlement is the sale of an existing life insurance policy to a third-party …See More

- How Fast Can I Get Money from a Viatical Settlement?by C.E. DeanIf you’re facing mounting medical bills, caregiving expenses, or other urgent financial needs, a viatical settlement could provide immediate relief. But you’re probably wondering “How fast can I get money from a viatical settlement?” The answer depends on several factors, including policy details, required paperwork, and the efficiency of the insurance carrier. In this post, we’ll break down the fastest and slowest timelines for viatical settlements, common delays, and how to help ensure you get paid as quickly as possible. How Quickly Can You Get Paid? The viatical settlement process can typically take as little as a few weeks, but …See More

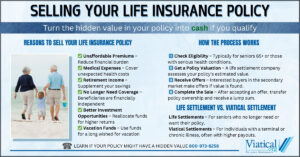

- Selling Your Life Insurance Policyby C.E. DeanMany policyholders find themselves wondering whether selling their life insurance policy is a viable financial option. Whether due to changing financial needs, an inability to keep up with premium payments, or a desire to access cash for immediate expenses, selling your life insurance policy can provide much needed funds. This process, known as a life settlement or viatical settlement, allows policyholders to receive a lump sum payment in exchange for their coverage. Why Consider Selling Your Life Insurance Policy? There are several reasons why someone might choose to sell their life insurance policy. Some common scenarios include: In addition to …See More

- Selling a Premium Financed Life Insurance Policy for Cashby C.E. DeanMany individuals and businesses use premium financing to fund large life insurance policies. While this strategy can provide financial flexibility, it may also lead to challenges if the policyholder can no longer afford loan payments or the policy is no longer needed. In such cases, a premium finance rescue, selling a premium financed policy for cash, may offer a way out—allowing policyholders to sell their policy, pay off the outstanding loan, and potentially walk away with cash in hand. What Is Premium Financing for Life Insurance? Premium financing is a method used to pay for life insurance premiums using borrowed …See More

- Should I Get a Life Insurance Loan for Cancer Treatment?by C.E. DeanA cancer diagnosis often brings not only emotional stress but also financial strain. As medical bills pile up, many individuals consider different options to cover the cost of treatment. One option some policyholders explore is borrowing against their life insurance policy. But should I get a life insurance loan for cancer treatment? While this may seem like an accessible solution, there are important factors to consider before making a decision. How a Life Insurance Loan Works A life insurance loan allows policyholders to borrow against the cash value of their permanent life insurance policy. Unlike traditional loans, this option does …See More

- How Do I Sell My Client’s Life Insurance Policy?by C.E. DeanIf you’re wondering, “How do I sell my client’s life insurance policy?” you’re not alone. Financial advisors, attorneys, trustees, and even life insurance agents often find themselves in situations where a client no longer needs or can no longer afford their life insurance policy. In such cases, a life settlement can provide a valuable alternative to surrendering the policy or allowing it to lapse. By selling a life insurance policy on the secondary market, your client may receive significantly more than the cash surrender value offered by the insurance company. Understanding Life Settlements A life settlement involves selling an existing …See More

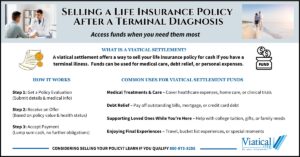

- Selling a Life Insurance Policy After a Terminal Diagnosisby C.E. DeanReceiving a terminal diagnosis can bring not only emotional challenges but also significant financial burdens. Selling a life insurance policy after a terminal diagnosis can be a practical solution for individuals seeking financial relief to cover medical expenses, improve their quality of life, or secure their family’s future. A viatical settlement allows policyholders to convert the hidden value in their life insurance into a cash payout, providing immediate funds during a difficult time. What Is a Viatical Settlement? A viatical settlement is the process of selling a life insurance policy to a third-party buyer for a lump sum payment. The …See More

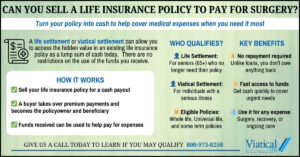

- Can You Sell a Life Insurance Policy to Pay for Surgery?by C.E. DeanIf you’re facing the high cost of surgery, you may be wondering: Can you sell a life insurance policy to pay for surgery? The answer is yes, you may be able to sell a policy for cash—many policyholders can sell their life insurance policy through a life settlement or viatical settlement, depending on their health status and policy type. This option can provide a much-needed financial lifeline for those struggling with medical expenses. The Origin of Life Settlements: Grigsby v. Russell The right to sell a life insurance policy was established over a century ago in the landmark 1911 U.S. …See More

- How to Find the Best Offer When Selling Your Life Insuranceby C.E. DeanIf you’re looking to sell your life insurance policy, your goal is simple: get the highest payout possible while working with a reputable, licensed buyer. But the life settlement market can be confusing, and not all buyers offer the same price. Some brokers take hefty commissions and knowing how to find the best offer when selling your life insurance is essential, as the offers you receive can vary widely based on factors like your policy type, health status, and market demand. So, how do you ensure that you’re getting the best deal? Let’s walk through the process, key considerations, and …See More

- Paying for Cancer Treatment Without Health Insuranceby C.E. DeanFacing a cancer diagnosis is challenging enough on its own, but navigating the costs of treatment without insurance can feel overwhelming. However, there are numerous avenues for financial assistance, creative payment solutions, and support resources available to help you get the care you need. Here’s how to go about paying for cancer treatment without health insurance: 1. Financial Assistance Programs and Charitable Organizations Several nonprofit organizations and charitable foundations provide financial assistance specifically for cancer patients without insurance. These organizations can help cover the costs of medical bills, prescription medications, travel expenses, and other related costs. Key Resources: To maximize …See More

- How to Get Cash from Life Insurance If You’re Sickby C.E. DeanIf you’re sick and need cash, your life insurance policy could be a valuable resource. Knowing how to get cash from life insurance if you’re sick can help ease financial stress and provide much-needed funds for medical expenses, daily living costs, or other financial needs. In this article, we’ll explore the options available to you and how to make the most of your life insurance policy if you’re dealing with a serious health condition. Understanding Your Options There are several ways to get cash from your life insurance policy if you’re sick, including: How to Qualify for a Viatical Settlement …See More

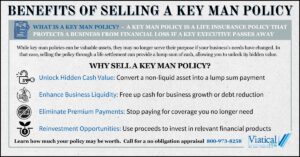

- Benefits of Selling a Key Man Policyby C.E. DeanIf your business no longer needs its key man life insurance policy, you might be wondering about the benefits of selling a key man policy for cash. Many business owners and financial professionals are unaware that key man policies can be converted into a lump sum payment through a life settlement. This strategic financial move can provide your company with immediate liquidity and unlock the hidden value of an otherwise dormant asset. What is a Key Man Policy? A key man policy is a life insurance policy purchased by a business to provide financial protection if a key executive, owner, …See More

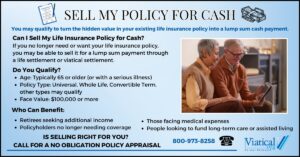

- Sell My Policy for Cashby C.E. DeanIf you’re wondering how to sell my policy for cash, you’re not alone. Many policyholders discover that they no longer need or can no longer afford their life insurance and want to unlock its value. Selling your life insurance policy through a life or viatical settlement can provide you with a lump sum of cash, often far more than surrendering the policy back to the insurance company. Can I Sell My Life Insurance Policy for Cash? Yes, in many cases, you can sell your life insurance policy for cash. This process is known as a life settlement or viatical settlement, …See More

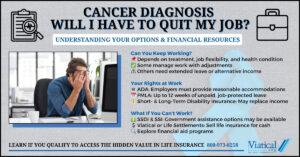

- Cancer Diagnosis Will I Have to Quit My Job?by C.E. DeanCancer Diagnosis Will I Have to Quit My Job? This question weighs heavily on many individuals after receiving life-changing news. The decision to continue working depends on factors such as your treatment plan, job flexibility, and financial situation. While some people manage to balance work with treatment, others may need extended leave or alternative income sources. In this article, we’ll explore your rights as an employee, workplace accommodations, and financial options—such as a viatical settlement or life settlements—if you can no longer work. Can You Keep Working After a Cancer Diagnosis? Many people with cancer continue working during treatment, while …See More

- Paying Off Bills with a Life Settlementby C.E. DeanIf you’re struggling with financial obligations, paying off bills with a life settlement can provide much-needed relief. A life settlement allows you to sell your life insurance policy for a lump sum of cash, which can be used to eliminate debt, cover medical expenses, or simply ease financial stress. One key advantage of selling a policy is that you are no longer responsible for premium payments—a significant financial burden that many policyholders struggle with as they age. While life insurance is a necessity for many, in some cases, a policy is no longer needed, and it just doesn’t make sense …See More

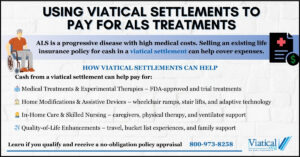

- Using Viatical Settlements to Pay for ALS Treatmentsby C.E. DeanAmyotrophic lateral sclerosis (ALS), also known as Lou Gehrig’s disease, is a progressive neurodegenerative disorder that affects nerve cells in the brain and spinal cord. As the disease advances, individuals with ALS often face significant medical expenses, including specialized care, assistive devices, and experimental treatments that may not be covered by insurance. Using viatical settlements to pay for ALS treatments can provide a financial solution that allows patients to access a lump sum of cash to help cover these costs. What Is a Viatical Settlement? A viatical settlement involves selling a life insurance policy to a third-party buyer in exchange …See More

- Selling Your Life Insurance with Congestive Heart Failureby C.E. DeanCan You Sell Your Life Insurance Policy If You Have CHF? Congestive Heart Failure (CHF) is a progressive condition that can lead to increasing medical costs and financial strain. If you or a loved one has been diagnosed with end-stage CHF, selling your life insurance with congestive heart failure can allow you to access an immediate cash payment through a viatical settlement. If your life expectancy is longer than two years, you may still be eligible for a life settlement, which offers similar benefits but typically provides a lower payout than a viatical settlement. Understanding CHF and Its Impact on …See More

- Viatical Settlements May Help You Access the Latest Treatmentsby C.E. DeanFor individuals facing serious illnesses, accessing cutting-edge treatments can be both life-changing and financially overwhelming. Viatical settlements may help you access the latest treatments by providing immediate funds from the sale of a life insurance policy. Whether you are managing advanced Parkinson’s disease, cancer, or another severe medical condition, a viatical settlement can offer financial relief to help cover the cost of new therapies, home care, and other medical expenses. New Treatment Advances and the Rising Cost of Care Medical breakthroughs are constantly expanding treatment options for serious illnesses. However, these treatments often come with high out-of-pocket costs, even for …See More

- The Role of AI in Life Settlement Valuationsby C.E. DeanThe role of AI in life settlement valuations is transforming how policies are assessed, priced, and transacted within the viatical and life settlements markets. Traditionally, underwriting and policy valuation relied on manual assessments, actuarial tables, and extensive human-driven analysis. Today, artificial intelligence (AI) and machine learning are streamlining these processes, leading to faster, more accurate, and data-driven decision-making. How AI is Revolutionizing Life Settlement Valuations Machine Learning and Predictive Analytics in Underwriting The Future of AI in the Life Settlement Industry Life settlement companies are already using AI to improve life expectancy predictions, enhance policy valuation accuracy, and streamline underwriting processes. …See More

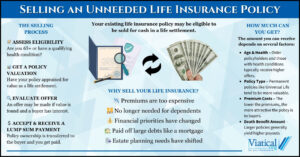

- Selling an Unneeded Life Insurance Policyby C.E. DeanMany policyholders find themselves in a situation where they no longer need or can no longer afford their life insurance coverage. Selling an unneeded life insurance policy can provide a financial solution by turning the policy into a lump sum of cash. Instead of surrendering it for a fraction of its value or letting it lapse, a life settlement or viatical settlement may allow you to receive significantly more. Why Sell a Life Insurance Policy? There are several reasons why a policyholder may no longer need their life insurance policy: Case Study: A Retired Couple Turns a Policy into Retirement …See More

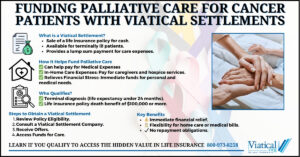

- Funding Palliative Care for Cancer Patients with Viatical Settlementsby C.E. DeanFor many individuals facing a cancer diagnosis, ensuring comfort and quality of life through palliative care is a top priority. Funding palliative care for cancer patients with viatical settlements offers a financial solution for those in need of immediate resources to cover medical and living expenses. By selling their life insurance policy, patients can access a lump sum payment to support their care journey without waiting for a death benefit. What Are Viatical Settlements? A viatical settlement is the sale of a life insurance policy to a third-party buyer for a cash payout. This option is available to individuals with …See More

- Is Selling Your Life Insurance Legal?by C.E. DeanIs selling your life insurance legal? Yes, selling a life insurance policy is entirely legal and has been upheld by U.S. courts for over a century. The right to sell your policy for cash, known as a life settlement or viatical settlement, originates from a landmark legal decision that established life insurance as personal property, giving policyholders the right to sell or transfer ownership as they see fit. This practice allows policyholders to sell their life insurance policies to third-party buyers for a lump sum cash payment, often when the policyholder no longer needs the coverage or requires financial assistance …See More

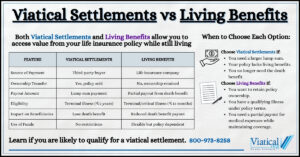

- Viatical Settlements vs Living Benefitsby C.E. DeanWhen comparing viatical settlements vs living benefits, both options provide a way to access funds from a life insurance policy while still alive, but they differ significantly in how they work, eligibility requirements, and financial implications. Understanding the differences can help policyholders make informed decisions about which option best fits their financial needs during challenging times. What Are Viatical Settlements? A viatical settlement involves selling a life insurance policy to a third-party buyer for a lump sum cash payment. The buyer takes over premium payments and receives the death benefit when the insured passes away. Viatical settlements are often used …See More

- How to Sell a Life Policy Quicklyby C.E. DeanIf you’re wondering how to sell a life policy quickly, Viatical.org offers a streamlined, direct-to-consumer platform that can help you turn your life insurance into cash faster than traditional methods. By removing brokers and middlemen, our process connects you directly with institutional buyers, significantly reducing delays and ensuring a smoother transaction. Step 1: Determine If Your Policy Qualifies Selling a life policy quickly starts with determining if your policy is eligible for a life settlement or viatical settlement. This can often be determined in a brief 5-minute phone call. Whether you are in good health and considering selling your term …See More

- Get Cash for a Life Insurance Policy with a Loanby C.E. DeanIf you’re wondering whether it’s possible to get cash for a life insurance policy with a loan, the answer is yes, you may be able to sell a policy with a loan in a life settlement or viatical settlement. While having a loan against your policy can impact its value, you may still be eligible to sell it. Understanding how life settlements work, even for policies with outstanding loans, can help you make an informed decision and unlock the cash value tied to your policy. How Does a Policy Loan Affect Your Settlement Options? When you take a loan against …See More

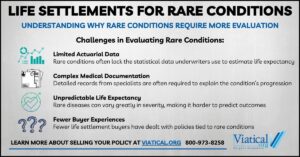

- Life Settlements for Rare Conditionsby C.E. DeanLife settlements for rare conditions can provide financial relief for individuals facing unique and challenging medical circumstances. While most people associate life settlements with common terminal illnesses like cancer or heart disease, those living with rare conditions may also qualify for this option. Understanding the criteria for eligibility and how rare conditions are evaluated in the life settlement process can help policyholders to make informed decisions about selling their life insurance policies. What Qualifies as a Rare Condition? In the context of life settlements, rare conditions refer to medical diagnoses that affect a small percentage of the population. These conditions …See More

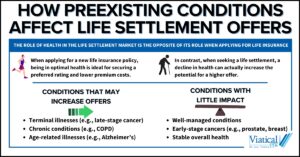

- How Preexisting Conditions Affect Life Settlement Offersby C.E. DeanWhen considering selling your life insurance policy, it’s important to understand how preexisting conditions affect life settlement offers. These conditions can significantly influence the value of your policy and the offers you receive from potential buyers. Interestingly, the role of health in the life settlement market is the opposite of its role when applying for life insurance. When applying for a new life insurance policy, being in optimal health is ideal for securing a super-preferred rating and lower premium costs. In contrast, when seeking a life settlement, a decline in health can actually increase the potential for a higher offer. …See More

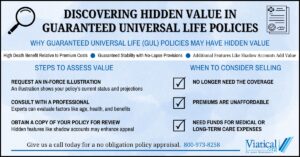

- Discovering Hidden Value in Guaranteed Universal Life Policiesby C.E. DeanGuaranteed Universal Life insurance policies are well-known for providing reliable death benefits at relatively low premiums. They are often chosen for their straightforward design and the peace of mind they offer to policyholders. However, what many people don’t realize is that these policies can harbor hidden value, potentially making them eligible for life settlements. If you’re holding onto a Guaranteed Universal Life (GUL) policy, understanding its features and the market for life insurance settlements could reveal options to sell your life insurance policy for cash when it’s no longer serving its original purpose. Why Guaranteed Universal Life Policies May Have …See More

- What Happens to Life Insurance Policies in Divorce?by C.E. DeanDivorce often comes with significant financial and emotional adjustments, and life insurance policies are frequently overlooked in the process. While many people focus on dividing tangible assets like homes, retirement accounts, and vehicles, life insurance policies can be an important, though often misunderstood, aspect of post-divorce planning. So, what happens to life insurance policies in divorce? The answer depends on the ownership, purpose, and ongoing need for the policy. If you own a life insurance policy on your ex-spouse, you maintain full ownership rights, even after the divorce. This means you can choose to keep the policy in force, let …See More

- How Terminal Illness Impacts Life Insurance Optionsby C.E. DeanFacing a terminal illness is an incredibly challenging time, and understanding how terminal illness impacts life insurance options can provide valuable financial relief and peace of mind. If you or a loved one has a life insurance policy, it’s important to know that certain options, like viatical settlements or an accelerated death benefit, may be available to help cover expenses during this difficult period. Exploring Viatical Settlements One option for those with a terminal illness is a viatical settlement. This allows policyholders to sell their life insurance policy to a third party for a lump sum payment, which is higher …See More

- Can You Sell a Life Insurance Policy to Pay for Hospice Care?by C.E. DeanIf you or a loved one are considering hospice care, you are likely wondering how to pay for this valuable, but often expensive care. Can you sell a life insurance policy to pay for hospice care? The answer is yes you may be able to sell a policy for cash and this option can provide much-needed financial relief during a challenging time. Selling a life insurance policy, often through a viatical settlement, allows policyholders to access a portion of their policy’s value while they are still alive, helping to cover medical bills, living expenses, and end-of-life care. How Does Selling …See More

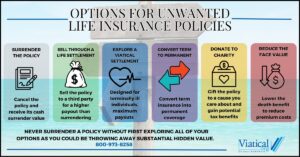

- Options for Unwanted Life Insurance Policiesby C.E. DeanLife insurance policies often serve as essential safety nets, providing financial security for loved ones. However, there are situations where policyholders may no longer need their coverage or find it financially burdensome to maintain. In such cases, exploring options for unwanted life insurance policies can help individuals make informed decisions and potentially recoup some of the value from their policies. Here are several practical solutions for handling unwanted life insurance policies, empowering you to choose the best course of action based on your circumstances. 1. Surrendering the Policy One common option is to surrender the life insurance policy back to …See More

- Viatical Settlements: Cashing Out Life Insuranceby C.E. DeanWhen facing financial challenges due to a terminal or chronic illness, many individuals find comfort in exploring viatical settlements: cashing out life insurance to secure much-needed funds. This process enables policyholders to sell their life insurance policies for a lump sum payment, offering a financial lifeline during a critical time. But how does it work, and what should you consider before pursuing this option? What Is a Viatical Settlement? A viatical settlement is the sale of a life insurance policy to a third-party buyer, often an institutional investor. The buyer pays the policyholder an immediate cash sum, which is typically …See More

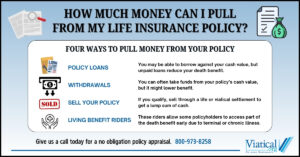

- How Much Money Can I Pull from My Life Insurance Policy?by C.E. DeanWhen facing unexpected financial challenges or planning for the future, you may wonder, “How much money can I pull from my life insurance policy?” The answer depends on several factors, including the type of policy you own, its cash value, and whether you’re eligible to sell it through a life or viatical settlement. Here, we’ll explore your options for accessing cash from your life insurance policy and how to determine which method works best for your needs. 1. Understanding Cash Value in Life Insurance If you own a permanent life insurance policy, such as whole life or universal life insurance, …See More

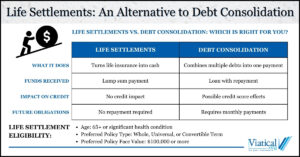

- Life Settlements: An Alternative to Debt Consolidationby C.E. DeanDebt consolidation is a common financial strategy for those juggling multiple debts. While it can simplify payments and reduce interest rates, it’s not always the best solution for everyone. If you’re struggling with debt and own a life insurance policy, you might want to consider life settlements an alternative to debt consolidation. A life settlement allows policyholders to sell their life insurance policy for a lump sum of cash. This option could provide you with the funds you need to pay off debts without taking on additional loans or restructuring your existing obligations. Here’s how life settlements can be a viable alternative …See More

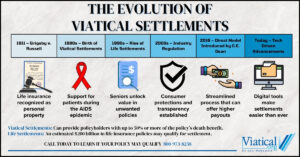

- The Evolution of Viatical Settlementsby C.E. DeanThe evolution of viatical settlements has been a remarkable journey, beginning with a landmark legal case over a century ago and transforming into a vital financial option for policyholders today. This journey highlights how life insurance policies, originally created for beneficiaries, became valuable assets that can be sold to address immediate financial needs. Roots: Grigsby v. Russell The documented history of viatical and life settlements dates back to 1911 with the U.S. Supreme Court case Grigsby v. Russell. This pivotal case established that a life insurance policy is a form of personal property, giving policyholders the right to sell or transfer …See More

- Parent Needs Assisted Living but Can’t Afford Itby C.E. DeanWhen a parent needs assisted living but can’t afford it, the financial and emotional strain on families can feel overwhelming. Assisted living costs can quickly add up, averaging thousands of dollars per month. Fortunately, there are ways to alleviate this burden, including exploring a life settlement or viatical settlement as a potential source of funds. These options allow qualifying policyholders to sell their life insurance policies for cash, which can be used to cover assisted living expenses or other urgent financial needs. The Rising Cost of Assisted Living The cost of assisted living varies depending on location and level of …See More

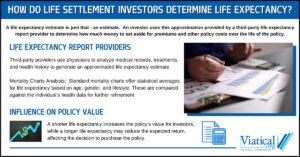

- How Do Life Settlement Investors Determine Life Expectancy?by C.E. DeanWhen considering the purchase of a life insurance policy through life settlements or viatical settlements, one critical factor that shapes investment decisions is life expectancy. How do life settlement investors determine life expectancy? In these transactions, life expectancy is estimated by third-party life expectancy report providers who employ physicians that evaluate existing medical records. This analysis helps investors estimate how long the policyholder is expected to live, which in turn affects the value and potential profitability of purchasing the policy. The Role of Life Expectancy Reports To ensure accurate predictions, life expectancy report providers rely on experienced physicians who conduct …See More

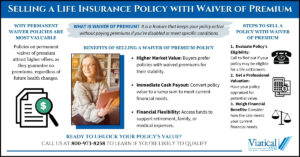

- Selling a Life Insurance Policy with Waiver of Premiumby C.E. DeanFor those holding a life insurance policy on waiver of premium, the idea of selling a life insurance policy with waiver of premium for cash may not be top of mind. However, this unique status could make the policy highly appealing in the secondary market, offering you an opportunity to access substantial cash that could support your current needs. Here’s how selling a life insurance policy with waiver of premium works and why it may be the perfect time to consider this option. Understanding the Waiver of Premium Benefit A waiver of premium feature in a life insurance policy generally …See More

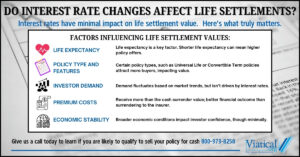

- Do Interest Rate Changes Affect Life Settlements?by C.E. DeanOne question we often hear is: do interest rate changes affect life settlements? The reality is that interest rate fluctuations have minimal direct impact on life settlement values. Unlike other financial products, life settlements are largely influenced by factors directly tied to the policy itself and the insured’s health, rather than external economic variables like interest rates. Below, we’ll explore why life settlement values remain relatively stable despite interest rate changes and what factors do play a significant role in determining their value. Key Factors Influencing Life Settlement Values For those considering a life settlement, understanding what truly drives value …See More

- Paying for Parkinson’s Careby C.E. DeanWhen it comes to paying for Parkinson’s care, many families face a daunting financial challenge. The cost of managing this progressive neurological disorder can be substantial, with expenses often covering a range of needs from daily care assistance to medications and specialized therapies. For some, the financial burden can become overwhelming. Fortunately, options like viatical settlements and life settlements allow individuals with life insurance policies to access cash from their policy to help cover these costs. The Cost of Parkinson’s Care Parkinson’s disease care costs vary based on the severity of the condition, location, and level of care required. According …See More

- Redeem Life Insurance While Livingby C.E. DeanWhen most people purchase a life insurance policy, they intend it to provide financial protection for their loved ones after they’re gone. But what if you need access to funds sooner? Can you redeem life insurance while living? The answer is yes; it may be possible to access your policy’s value during your lifetime through options like a life settlement or a viatical settlement. Here’s how these options work, who qualifies, and the potential benefits they offer. Can You Redeem a Life Insurance Policy While You’re Still Alive? Yes, it can be possible to redeem your life insurance policy while …See More

- How Investors Value Your Life Insuranceby C.E. DeanIf you’re considering selling a life insurance policy, understanding how investors value your life insurance can help you navigate the process and potentially secure a higher payout. Life insurance policies are valued based on factors that indicate the potential profitability for investors, who typically aim to balance risk with return. From life expectancy and policy premiums to health factors and market demand, investors use a detailed approach to assess each policy before making an offer. Key Factors in Life Insurance Valuation Additional Influences on Policy Valuation Geographic and Legal Factors The regulatory environment in the policyholder’s state can significantly impact …See More

- Viatical Settlements Can Help Cover Home Care Equipment Costsby C.E. DeanFor families managing the costs of serious illness at home, covering essential expenses can become overwhelming. Medical equipment like hospital beds, oxygen systems, and mobility aids are critical for maintaining quality of life, but these items are often costly, with expenses adding up quickly. This is where viatical settlements can help cover home care equipment costs. By selling a life insurance policy, a policyholder facing a terminal illness can receive an immediate cash payout. This option provides flexibility and financial relief, allowing families to purchase necessary equipment and secure ongoing in-home care services. The Expanding U.S. Home Healthcare Market The …See More

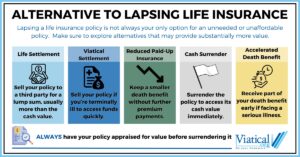

- Alternative to Lapsing Life Insuranceby C.E. DeanIf you are considering letting your life insurance policy lapse, you should explore an alternative to lapsing life insurance that could provide you with more financial value. Many policyholders face rising premium costs or simply feel they no longer need the coverage they once had. However, letting a policy lapse can mean losing out on years of premiums with no return. There are alternatives that allow you to recover some of the value from your policy instead of letting it go to waste. What Happens When a Life Insurance Policy Lapses? A life insurance policy lapses when the policyholder stops …See More

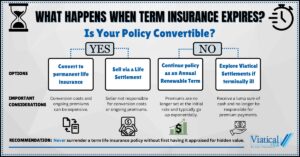

- What Happens When Term Insurance Expires?by C.E. DeanTerm life insurance is a popular choice because it offers affordable, straightforward financial protection for a set period—typically 10, 20, or 30 years. But what happens when that period ends? If you’re approaching the end of your term, it’s essential to understand your options. In this post, we’ll explain what happens when term insurance expires and explore how you might still benefit from your policy, including the potential to sell it through a life or viatical settlement. What to Expect When Your Term Life Insurance Ends When a term life insurance policy reaches its expiration, coverage stops, and the policyholder …See More

- How to Get the Best Offer for Your Life Insurance Policyby C.E. DeanIf you’re considering selling your life insurance policy, you may be wondering how to get the best offer for your life insurance policy. Our platform connects you with potential direct buyers, making it easier to secure the best possible offer. To maximize the value, it’s important to understand the factors that influence life settlement offers, such as health status, policy type, and timing. 1. Understand the Life Settlement Process A life settlement involves selling your life insurance policy for a cash payout. The buyer takes over the premium payments and becomes the policy’s beneficiary, receiving the death benefit when you …See More

- Who Buys Life Insurance?by C.E. DeanWhen people think about life insurance, they often view it as a way to provide financial protection for loved ones. However, there is also a market where existing life insurance policies can be bought and sold. But who buys life insurance policies once they are in place? Life settlement buyers and viatical settlement purchasers purchase policies in the secondary market. These buyers acquire existing policies from those who no longer need or want the coverage, offering a lump sum cash payment in exchange. Understanding who buys life insurance and the roles of various market players is key for anyone considering …See More

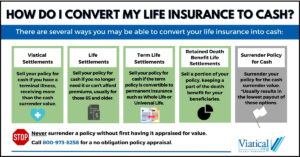

- How Do I Convert My Life Insurance to Cash?by C.E. DeanIf you’ve ever asked yourself, “How do I convert my life insurance to cash?”, you’re not alone. Many policyholders may face a situation where they need fast access to cash, and life insurance can be an overlooked asset with significant hidden value. There are several ways you can convert your life insurance into cash, each with distinct advantages depending on your needs and circumstances. Whether you are dealing with medical expenses, planning for retirement, or simply need extra income, there are options available. Some of these options include viatical settlements, life settlements, term life settlements, and retained death benefit life …See More

- Financial Relief Through Life Settlementsby C.E. DeanFor many individuals, particularly seniors or those facing unexpected financial challenges, life insurance policies may no longer serve their original purpose. However, instead of allowing a policy to lapse or surrendering it for minimal value, there is a beneficial alternative—finding financial relief through life settlements. This option enables policyholders to sell their life insurance policy for a lump sum of cash, offering immediate financial support when it’s needed the most. Understanding Life Settlements A life settlement is a financial transaction in which the owner of a life insurance policy sells it to a third-party investor. The investor then takes over …See More

- Viatical vs Life Settlementsby C.E. DeanWhen exploring financial options related to life insurance, two terms often come up: viatical settlements and life settlements. While both offer a way to access the value of a life insurance policy before death, they serve very different purposes and apply to different situations. Understanding “Viatical vs Life Settlements” is essential for making an informed decision about which option may be right for you or a loved one. Let’s explore the differences between viatical settlements and life settlements. What is a Viatical Settlement? A viatical settlement involves selling a life insurance policy to a third party for a lump sum …See More

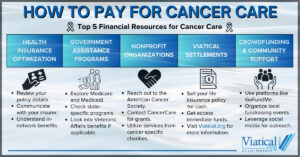

- How to Pay for Cancer Careby C.E. DeanWhat happens when you get diagnosed with cancer? Facing a cancer diagnosis is an overwhelming experience that brings numerous challenges, not least of which is the financial burden that leaves many wondering “how do you get treatment if you can’t afford it?” One of the most pressing concerns for patients and their families is how to pay for cancer care. With the cost of treatments escalating and a notable rise in cancer cases globally, understanding the financial avenues available is more crucial than ever. Health Insurance: Maximizing Your Benefits Reviewing Your Policy Thoroughly Begin by meticulously reviewing your health insurance …See More

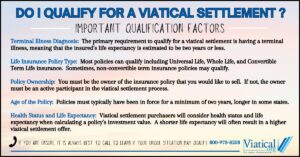

- Do I Qualify for a Viatical Settlement?by C.E. DeanA diagnosis of a terminal illness can be overwhelming, especially when financial burdens add to the stress. If you’re considering selling your life insurance policy for cash, you might be asking yourself, “Do I qualify for a viatical settlement?” Understanding the eligibility criteria and factors that determine qualification is essential in making an informed decision. What is a Viatical Settlement? A viatical settlement is a financial transaction that allows individuals with terminal illnesses to sell their life insurance policies to a third party for a lump sum cash payment. This cash can be a crucial lifeline, helping to cover medical …See More

- The Benefits of Selling Your Life Insurance Policy for Cashby C.E. DeanLife insurance policies are often seen as a safety net for loved ones in the event of unexpected circumstances. However, there are times when the policyholder might find themselves in need of immediate cash. In such cases, the benefits of selling your life insurance policy for cash can be significant. This post will explore the advantages of selling your life insurance policy and why it might be a viable option for you. Financial Flexibility One of the most compelling reasons to sell your life insurance policy for cash is financial flexibility. Life can be unpredictable, and there may come a …See More

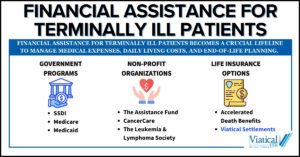

- Financial Assistance for Terminally Ill Patientsby C.E. DeanFacing a terminal illness is an overwhelming experience that affects not only your health but also your financial well-being. Financial assistance for terminally ill patients becomes a crucial lifeline to manage medical expenses, daily living costs, and end-of-life planning. This article explores various financial support options available. Understanding the Financial Burden Medical treatments, medications, and hospital stays can quickly deplete savings and strain finances. Additionally, the inability to work may reduce income, making it challenging to cover everyday expenses like mortgage payments, utilities, and groceries. Seeking financial assistance can alleviate stress and allow patients to focus on their health and …See More

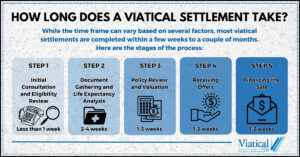

- How Long Does a Viatical Settlement Take?by C.E. DeanFor individuals facing a terminal illness, medical bills and other costs are a primary concern and many turn to viatical settlements as a way to access funds quickly. A viatical settlement allows policyholders to sell their life insurance policies in exchange for a lump sum payment, which can help cover medical expenses, living costs, or other essential needs. One of the most common questions asked during this process is, “How long does a viatical settlement take?” While the time frame can vary based on several factors, most viatical settlements are completed within a few weeks to a couple of months. …See More

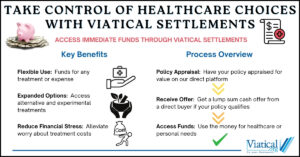

- Take Control of Healthcare Choices with Viatical Settlementsby C.E. DeanWhen faced with a terminal illness, patients and their families often encounter difficult decisions regarding treatment options and financial planning. The uncertainty and emotional strain of navigating these choices can be overwhelming. Patients can take control of healthcare choices with viatical settlements by accessing the hidden value in existing life insurance in the form of a lump sum cash payment. This can be particularly beneficial when exploring alternative or experimental treatments that may not be covered by traditional insurance. The Flexibility of Viatical Settlements A viatical settlement allows individuals with a terminal illness to sell their life insurance policy for …See More

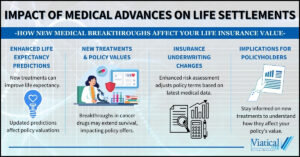

- Impact of Medical Advances on Life Settlementsby C.E. DeanMedical advances are continuously reshaping various aspects of our lives and the impact of medical advances on life settlements is no exception. As new technologies and treatments emerge, they influence life expectancy predictions, policy valuations, and the overall dynamics of the life settlement market. Here’s a closer look at how recent medical breakthroughs are affecting viatical settlements and life settlements and what policyholders should consider. Enhanced Life Expectancy Predictions Advancements in medical technology, such as improved diagnostic tools and treatments, have led to more accurate predictions of life expectancy. For instance, recent breakthroughs in cancer treatment are impacting the life …See More

- Is the Cash Value of Life Insurance Taxable?by C.E. DeanWhen considering life insurance policies, a question that frequently arises is, “Is the cash value of life insurance taxable?” Life insurance policies often have a cash value component that grows over time, but understanding how it is taxed—or if it is taxed—can be complex. In this blog post, we’ll discuss the potential tax implications of the cash value of life insurance policies, as well as the tax treatment of proceeds from life settlements and viatical settlements. It’s important to note, however, that every financial situation is unique, and it’s crucial to consult a trusted tax professional to ensure you’re navigating …See More

- Utilizing Home Equity in Retirementby C.E. DeanAs people approach their retirement years, they often begin thinking about how to make the most of the resources they’ve spent decades accumulating. One of the most significant assets retirees often possess is their home. Utilizing home equity in retirement is a popular strategy to provide financial security and maintain a comfortable lifestyle. However, while many retirees consider taking out a second mortgage or a home equity line of credit (HELOC), there’s another, lesser-known option that could offer a more favorable solution: life settlements. The Challenge of Tapping into Home Equity For most retirees, their home is their biggest financial …See More

- Selling Policy to Companies That Buy Life Insuranceby C.E. DeanWhen considering the sale of your life insurance policy, the process of selling policy to companies that buy life insurance may seem complex. However, with a clear understanding of the options available and the right guidance, this financial transaction can provide significant benefits, especially when traditional options, such as borrowing against the policy or surrendering it, don’t meet your needs. In this article, we will walk you through the essentials of selling your life insurance policy, explaining the steps, benefits, and potential risks, as well as providing tips for navigating the process smoothly. What Does It Mean to Sell Your …See More

- Benefits of Viatical Settlements During Terminal Illnessby C.E. DeanDealing with a terminal illness is one of life’s most difficult challenges, but the benefits of viatical settlements during terminal illness can provide both financial security and emotional relief. A viatical settlement allows individuals facing a terminal diagnosis to sell their life insurance policy for a lump sum of cash, offering immediate financial support. In this article, we’ll explore both the emotional and financial advantages of viatical settlements and how they can help ease the burden on patients and their families. Understanding Viatical Settlements Before diving into the specific benefits, it’s important to understand what a viatical settlement is. A …See More

- Common Misconceptions About Viatical Settlementsby C.E. DeanWhen considering a viatical settlement, it’s important to understand what this financial option truly entails. Unfortunately, there are many myths that can cloud the decision-making process. In this article, we will explain why the top 5 common misconceptions about viatical settlements simply aren’t accurate, clarifying what’s fact and what’s fiction. This way, you’ll have a clearer understanding of how viatical settlements work and whether they may be the right choice for you or a loved one. 1. Misconception: Viatical Settlements Are Only for Terminally Ill People One of the most widespread myths about viatical settlements is that they are exclusively …See More

- Benefits of Early Life Insurance Payoutsby C.E. DeanLife insurance is often viewed as a safety net for loved ones after a policyholder’s passing, but it can also serve as a valuable financial resource during the policyholder’s lifetime. Early life insurance payouts, often obtained through viatical settlements or accelerated death benefits, provide policyholders with immediate access to cash, which can be a crucial lifeline in times of need. This post explores the various benefits of early life insurance payouts and how they can significantly impact a person’s financial well-being. Financial Relief During Critical Illness One of the most significant benefits of early life insurance payouts is the financial …See More

- Advanced Stage Cancer and Viatical Settlementsby C.E. DeanA viatical settlement can be a lifeline for individuals facing the dual challenges of a terminal illness and financial hardship. This financial option allows a person with a life insurance policy to sell it for a lump sum of money, which is often much needed for medical expenses, caregiving costs, or simply to improve quality of life during a difficult time. When discussing advanced stage cancer and viatical settlements, it’s important to note that advanced-stage cancer, particularly stage IV cancer, is one of the most common conditions that may qualify an individual for this type of settlement. Advanced-stage cancer can …See More

- Paying for Dementia Careby C.E. DeanPaying for dementia care is a growing concern as the prevalence of dementia increases globally. Someone in the world develops dementia every three seconds, and in 2020, there were over 55 million people living with this condition. This number is projected to nearly double every 20 years, reaching 78 million in 2030 and 139 million in 2050. Given the rising costs of care, it’s crucial for families to explore financial strategies such a viatical settlement or life settlements by working with life settlement companies. Dementia Medications and Treatments Dementia treatments and their associated costs vary widely depending on the type …See More

- How to Borrow Money from Life Insuranceby C.E. DeanWhen unexpected financial challenges arise, knowing how to borrow money from life insurance can provide crucial financial relief. This process involves taking a loan against the cash value of your life insurance policy, allowing you to access funds without needing a credit check or income verification. This option is particularly useful for those with permanent life insurance policies, such as whole or universal life, which accumulate cash value over time. Viatical Settlements: A Flexible Alternative For policyholders with terminal illnesses, viatical settlements offer another option. This involves selling the life insurance policy to a third-party investor in exchange for a lump sum …See More

- Rising Cancer Costsby C.E. DeanThe Financial Challenge of Cancer Care A comprehensive study led by researchers at the American Cancer Society (ACS) and The University of Texas MD Anderson Cancer Center reveals rising cancer costs. The study, published in the Journal of the National Cancer Institute (JNCI), highlights the increasing financial burden on privately insured patients under 65. Out-of-pocket costs for breast, colorectal, and lung cancer patients rose by more than 15% to over $6,000, and to $4,500 for prostate cancer patients in 2016. Study Findings The study examined trends in total and out-of-pocket costs for breast, colorectal, lung, and prostate cancer patients diagnosed …See More

- Medical Conditions Qualifying for Viatical Settlementsby C.E. DeanWhen facing severe health challenges, individuals may seek financial relief through a viatical settlement. This option allows policyholders with specific medical conditions to sell their life insurance policies for a lump sum cash payment, providing immediate funds to cover medical expenses and improve their quality of life. Understanding the medical conditions qualifying for viatical settlements is crucial for those considering this financial option. Chronic Illnesses In addition to terminal illnesses, certain chronic conditions also qualify, especially if they severely impact the individual’s daily living activities and life expectancy: Alzheimer’s Disease Advanced stages of Alzheimer’s disease, where the patient requires significant …See More

- Cash Out a Life Insurance Policyby C.E. DeanLife insurance is designed to provide financial security to your loved ones in the event of your passing. However, there may be times when you need to access the value of your policy while you’re still alive. There are several ways you may be able to cash out a life insurance policy. Understanding the Cash Value of Life Insurance Before delving into the methods of cashing out, it’s essential to understand that not all life insurance policies accumulate cash value. Permanent life insurance policies, such as whole life, universal life, and variable life insurance, build cash value over time. In …See More

- Agents and Life Settlementsby C.E. DeanWhy Your Insurance Agent Might Not Tell You About Life Settlements When it comes to managing life insurance, many policyholders trust their insurance agents to provide comprehensive advice on all available options. However, agents and life settlements don’t always mix. The reason? Some insurance carriers prohibit their agents from discussing or even mentioning life settlements. This post aims to shed light on this often-overlooked option and explain how our platform can assist you in exploring life settlements, offering a referral fee to anyone who helps connect us with interested policyholders. What is a Life Settlement? A viatical settlement or life …See More

- Compare Viatical Settlement Offersby C.E. DeanWhen it comes to managing financial needs during a challenging time, a viatical settlement can provide much-needed relief. However, not all viatical settlement offers are created equal. As you compare viatical settlement offers, it’s crucial to be aware of broker fees that can significantly impact the amount of money you receive. Fortunately, you can avoid these fees by using our direct viatical settlement platform in an effort to get the maximum value directly from licensed buyers in your state. The Role of Brokers in Viatical Settlements Brokers act as intermediaries between the policyholder and potential buyers and maintain a fiduciary …See More

- Why Would a Company Buy Your Life Insurance Policy?by C.E. Dean“Why would a company buy your life insurance policy?” is often one of the first questions we’re asked. Unlike traditional investments tied to the stock market or interest rates, the value of a life settlement is largely independent of market fluctuations. Instead, it hinges on factors such as the insured individual’s life expectancy, the type of policy, and the associated costs of maintaining that policy. Companies view life settlements as predictable investments because they can estimate the return, typically a target of 10-18%, based on actuarial data. This non-correlation with market volatility makes life settlements an attractive option for diversifying …See More

- How Much Can You Get for a Viatical Settlement?by C.E. DeanViatical settlements are a valuable financial solution for those with life insurance policies who are facing terminal illnesses. If you’re wondering “how much can you get for a viatical settlement,” the answer depends on several factors, including the policy’s value, the insured’s life expectancy, and the current market conditions. This option allows policyholders to sell their life insurance policies to a third party in exchange for a lump sum payment, which is always more than the cash surrender value but less than the death benefit. What is a Viatical Settlement? A viatical settlement is a financial transaction in which a …See More

- Understanding Lymphoma and Leukemia Treatments and Costsby C.E. DeanLymphoma and leukemia are two types of cancer that affect the blood and lymphatic system and understanding lymphoma and leukemia treatments and costs is of the utmost importance. These diseases can be daunting for patients and their families, not only due to their medical complexity but also because of the financial burden associated with treatment. Here, we will delve into the most popular treatments for lymphoma and leukemia. Additionally, we’ll explore how viatical settlements or life settlements can offer financial assistance to individuals facing these challenges. Understanding Lymphoma and Leukemia Lymphoma and leukemia are both cancers of the blood and …See More

- Sell Back Your Life Insurance Policyby C.E. DeanIf you are trying to sell back your life insurance policy, you will find that your insurance company may not make the highest offer to you. Insurance companies are limited to the amount of cash that they can offer you for your insurance policy. Can I Sell Back My Life Insurance Policy? Essentially, your cash surrender value is an offer from your insurance company to give you that much money to surrender or cancel your policy. Because Life Insurance is private property, you have the right to check the market for life settlements and secure an offer to purchase your …See More

- Viatical Settlements for Cancer Treatment and Alternative Careby C.E. DeanWhen facing a cancer diagnosis, the journey ahead can feel overwhelming, both emotionally and financially. From understanding treatment options to managing everyday expenses, individuals and families impacted by cancer often find themselves in need of additional support. In such challenging times, exploring financial options becomes crucial. Among the array of resources available, viatical settlements for cancer treatment and alternative care stand out as a potential lifeline, offering immediate financial relief to those in need. Understanding Viatical Settlements A viatical settlement is a financial transaction in which a person with a life-threatening illness, such as cancer, sells their life insurance policy …See More

- Companies That Buy Life Insurance Policies Directby C.E. DeanCompanies that buy life insurance policies direct have changed the entire life settlement industry. Until 2016, when we introduced the direct model at the LISA (Life Insurance Settlement Association) conference, anyone looking to sell their life insurance policy essentially had to go through a life settlement broker. Viatical.org Direct Platform In 2016, the Viatical.org direct platform was introduced as a way for consumers to get their policies in front of companies that buy life insurance policies direct from the consumer. Some brokers work hard to sell your life insurance policy and it can be involved and expensive, but others essentially just …See More

- The Best Company to Sell Your Life Insurance Policy to?by C.E. DeanThe best company to sell your life insurance policy to is the one that will net you the most money for your life insurance policy, provided they are licensed. Non-licensed entities and individuals are permitted to purchase 1 or 2 policies per year in most states, and there are groups that actively solicit to that end. It is always best to deal with a licensed buyer. Who is licensed to buy life insurance policies? Life Settlement Providers are licensed to purchase life insurance policies, but most of them purchase policies to sell to institutional buyers or buy policies on various …See More

- Sell Your Term Life Insurance Policy for Cashby C.E. DeanYou may be able to cash out your term life insurance policy and actually sell your term life insurance policy for cash. This comes as a shock to many policy owners who mistakenly assume that when the term on your life insurance policy is up, your insurance and all the premiums you have paid over the years are simply gone. If your health has slipped since you purchased your term life insurance policy, you may now have a hidden value in your term life insurance policy, value that you can access NOW as a cash payment for your policy. Types …See More

- Viatical Settlementby C.E. DeanA viatical settlement could be a potential solution to financial distress which is all too often correlated to a terminal or chronic illness. A viatical settlement is when the terminally ill sell their life insurance policy to a third-party buyer of life insurance policies, for a cash settlement which is less than the death benefit. You do not have to be terminally ill to sell your life insurance policy, but your age and the status of your health are the primary drivers of value in life insurance sold in the secondary market. It stands to reason that someone who is …See More

- Sell My Life Insurance Policyby C.E. DeanYou can’t just say “Sell my life insurance policy” to someone and expect to get the most cash for your insurance policy. If someone tells you it is fast and easy to sell your life insurance policy, there is a good chance you are not going to get the most money for the sale of your insurance. Look at it as if you are selling a home. Life insurance is also property. There are some Real Estate investors that will offer to buy your home in a day, but they rarely pay anywhere near the true market price. It’s often …See More

- Enhanced Cash Surrender Value Offerby C.E. DeanGuaranteed Universal Life (GUL) Guaranteed Universal Life contracts are the policies that life insurance companies are trying to get off the streets. The reason is that they are guaranteed to pay a death benefit to you, provided you pay the premiums that were stipulated when you bought your life insurance policy. It does not matter if you have a cash value on a GUL, provided you pay your premiums, your life insurance company will ultimately have to pay the claim when you die. Though estimates vary, it is safe to say that somewhere around 90% of all life insurance policies …See More

- Life Insurance is Propertyby C.E. DeanWhen asked ‘Who is your Insurance Agent?’ People often answer us with their P&C agent or simply say they do not have one. An agent is only mentioned if they are trusted. This circumstance creates a tremendous opportunity for a trusted Property and Casualty Agent to both benefit their client and qualify for the Million Dollar Round Table (MDRT) with life insurance commissions as they augment their income. Qualifications for the MDRT in 2023 are $69,000 in commissions or $138,000 in premiums. If your concentration is property insurance, you likely have literally sat across the table from MDRT qualification and …See More

- Sell Your Expiring Term Insurance for Cash.by C.E. DeanSell your expiring term insurance for cash, if you qualify. Most people still have no idea that if you qualify, you might be able to sell your expiring term insurance for cash, today. It usually only takes a 5-minute call to learn if you’re likely to qualify or not. Even healthy people, if they have the right policy and are the right age, could qualify to sell an unneeded term insurance policy and possibly even get the equivalent of all the money they paid for the insurance coverage over the years. Insurance companies rely on an astronomical lapse rate when …See More

- Life Settlement Taxationby viaticalWhat is the tax basis of a Life settlement and how does this affect life settlement taxation? Changes from the TCJA Act 2017 You should always have your life insurance policy appraised, and yes it is often possible to qualify to sell your life insurance for cash to pay for healthcare or any other needs you may have. Your life insurance could be the emergency fund you need, but there are life settlement taxation considerations. A lump sum of cash from the sale of your life insurance can indeed help you take back control of your healthcare decisions, but you absolutely need to …See More

- Cancer Should Be the Worst Thing About Cancerby viaticalIt is devastating enough to watch a loved one’s health decline or to be faced with the fact that you may be taken away from your family by a disease. But the added stress of paying for cancer treatment while being unable to work is also counter to healing. Focus should be on providing (or seeking) what you feel is the best care possible – not on paying for cancer treatment. Unfortunately, that care is absolutely limited by your financial resources and health insurance. Finding what you feel is the best cancer care for you or your loved ones may …See More

- Life Settlement Broker Or Life Settlement Provider: The Financial Advisor’s Dilemmaby viaticalMost Advisors rely on a life settlement broker to assist them in the sale of a life insurance policy, but some Advisors work directly with life insurance providers. Unlike with precious metals, stocks or bonds, there is no centralized exchange for Life Settlements. Every situation is unique because life insurance policies have different provisions, costs of insurance and premium schedules, and this has to be contrasted against the unique health of the underlying insured. Life Settlement Broker The secondary market for life insurance is more akin to Real Estate, where the asset is unique. Life Settlement Brokerages work to gather …See More

- Florida Life Insurance Law Adds To Life Settlement Regulationby viaticalLife Insurance Companies in Florida can no longer suppress valuable information from Life Insurance policy owners. The Prohibited Insurance Acts Bill, or HB 1007, now forces Life Insurance companies to allow the disclosure of alternative options available to life insurance policy owners who are considering lapsing, surrendering, or canceling their Life Insurance policy. The Florida Life Insurance Law requires Florida Insurance Companies to create designated Anti-Fraud Departments and hire an employee who is solely focused on anti-fraud oversight. The passage of HB 1007 is a major win for Consumer Advocates in the Life Insurance industry. Darwin M. Bayston, …See More

- Sell Your Life Insurance Policy? Why Would You?by viaticalWhy would you sell your life insurance policy? Well, some studies state that more than 80 percent of life insurance policies never pay out a death benefit, others say as many as 80 percent of life insurance policies never pay out a death benefit. Either way, it’s safe to say that only around 20 percent of beneficiaries are seeing proceeds from the insured’s life insurance policy. By selling your life insurance policy in the secondary market, you may receive an amount equivalent to, or even more than, the premiums that were paid over the years. Sure, some policies come with a cash …See More

- Who Qualifies For A Viatical Settlementby viaticalHow do know who qualifies for a viatical settlement? And what is a viatical settlement? Viatical Settlement: Definition A viatical settlement by definition is “a financial transaction whereby a person with a terminal illness sells their life insurance policy to a third party for less than the face amount of the policy but more than the cash value in the policy.” How do you know how much value is in your policy? Above all else – how do you qualify? No two policies are the same when you consider the premiums that have been paid over the years, the age …See More

- Financial Assistance And Solutions For Cancer Patientsby viaticalPatients who receive terminal diagnoses often look for financial assistance and solutions to deal with unexpected, serious financial pressure. Travel, treatment, medications, and keeping up with household expenses can be a daunting task. In this article we will discuss financial assistance and solutions for cancer patients. You’re seated in a blue, soft, upholstered chair in your doctor’s office. Your family is seated in identical chairs right beside you. You look at each other, nervously awaiting the test results, knowing your world may soon change. In these last few moments, before your doctor arrives to deliver the news that will change your …See More

- Things You Should Know Before Canceling Your Life Insurance Policyby viaticalIf you are canceling a life insurance policy with a cash value, it is likely that you know what that value is. You pay into your life insurance policy over the years and there’s a cash value element and a cash surrender value element on some policies. In essence that’s the amount of money the insurance company is willing to pay you for your life insurance policy. If you have a term life insurance policy you know how much cash you’re getting back from the policy when you decide you no longer need it. And the amount you’ll get with a …See More

- The Life Settlement Market & Buyersby viaticalNavigating the Life Settlement Market The life settlement market is simply a marketplace of life settlement buyers. Life settlement buyers are looking for life insurance policy owners that may benefit from the possibility of getting cash immediately. If you are a qualified candidate, you may find that selling your life insurance policy to a life settlement buyer may unlock a hidden value in your policy. In order to sell your policy, life settlement brokers often compile and review your medical history and the costs of keeping your policy in force. Upon reviewing this information, and once life settlement brokers contact …See More

- Get Cash for Your Life Insurance Policyby viaticalDid you know that you can get cash for your life insurance policy? Or have you ever wondered, “Can I cash-in life insurance while I am still alive?” Good news – the answer is yes, and there are several ways to get cash for your life insurance policy. If you suffer from a chronic illness, you may be able to borrow against your life insurance policy to assist with medical bills, living expenses, additional care or alternative therapies. This option is called a Life Insurance Advance. A Life Insurance Advance is a loan, and allows you to keep ownership and …See More

- The History of the Viatical Settlementby viaticalThe viatical settlement industry developed in the 1980’s when people around the world started dying from AIDS. The history of viatical settlements can be traced back to a 1911 Supreme Court decision in Grigsby v. Russell that established that a life insurance policy is an asset.

- Terminal Cancer Diagnosis, What Now?by viaticalBeing diagnosed with terminal cancer is enough to make anyone cry. Once you have had time to come to terms with the reality of the situation, you will face the prospects of expensive treatment and care. If you own a life insurance policy, you may be able to sell it for a lump sum of cash in the secondary market for insurance, and use the money to relieve the financial burden of cancer.