Viatical and Life Settlement Case Studies and Examples

Examples of Life Settlements and Viatical Case Studies

Learn from some past viatical and life settlement examples. We have put together a life of viatical and life settlement case studies so you will get an idea of some cash payments and how viatical settlements and life settlements are used. Learn how much your policy is worth as a life settlement or viatical settlement by filling out the form to the right. Please call us at 1-800-973-8258 if you have immediate needs or would like to speak to someone in person.

Call for an appraisal before you attempt to sell your life insurance policy for cash.

Learn More About Viaticals and Life Settlements

- How Preexisting Conditions Affect Life Settlement Offers

- Discovering Hidden Value in Guaranteed Universal Life Policies

- What Happens to Life Insurance Policies in Divorce?

- How Terminal Illness Impacts Life Insurance Options

- Can You Sell a Life Insurance Policy to Pay for Hospice Care?

- Options for Unwanted Life Insurance Policies

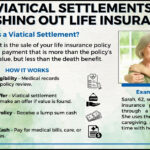

- Viatical Settlements: Cashing Out Life Insurance

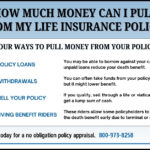

- How Much Money Can I Pull from My Life Insurance Policy?

- Life Settlements: An Alternative to Debt Consolidation

- The Evolution of Viatical Settlements

- Parent Needs Assisted Living but Can’t Afford It

- How Do Life Settlement Investors Determine Life Expectancy?

- Selling a Life Insurance Policy with Waiver of Premium

- Do Interest Rate Changes Affect Life Settlements?

- Paying for Parkinson’s Care

- Redeem Life Insurance While Living

- How Investors Value Your Life Insurance

- Viatical Settlements Can Help Cover Home Care Equipment Costs

- Alternative to Lapsing Life Insurance

- What Happens When Term Insurance Expires?

- How to Get the Best Offer for Your Life Insurance Policy

- Who Buys Life Insurance?

- How Do I Convert My Life Insurance to Cash?

- Financial Relief Through Life Settlements

- Viatical vs Life Settlements

- How to Pay for Cancer Care

- Do I Qualify for a Viatical Settlement?

- The Benefits of Selling Your Life Insurance Policy for Cash

- Financial Assistance for Terminally Ill Patients

- How Long Does a Viatical Settlement Take?

- Take Control of Healthcare Choices with Viatical Settlements

- Impact of Medical Advances on Life Settlements

- Is the Cash Value of Life Insurance Taxable?

- Utilizing Home Equity in Retirement

- Selling Policy to Companies That Buy Life Insurance

- Benefits of Viatical Settlements During Terminal Illness

- Common Misconceptions About Viatical Settlements

- Benefits of Early Life Insurance Payouts

- Advanced Stage Cancer and Viatical Settlements

- Paying for Dementia Care

- How to Borrow Money from Life Insurance

- Rising Cancer Costs

- Medical Conditions Qualifying for Viatical Settlements

- Cash Out a Life Insurance Policy

- Agents and Life Settlements

- Compare Viatical Settlement Offers

- Why Would a Company Buy Your Life Insurance Policy?

- How Much Can You Get for a Viatical Settlement?

- Understanding Lymphoma and Leukemia Treatments and Costs

- Sell Back Your Life Insurance Policy

- Viatical Settlements for Cancer Treatment and Alternative Care

- Companies That Buy Life Insurance Policies Direct

- The Best Company to Sell Your Life Insurance Policy to?

- Sell Your Term Life Insurance Policy for Cash

- Viatical Settlement

- Sell My Life Insurance Policy

- Enhanced Cash Surrender Value Offer

- Life Insurance is Property

- Sell Your Expiring Term Insurance for Cash.

- Life Settlement Taxation

- Cancer Should Be the Worst Thing About Cancer

- Life Settlement Broker Or Life Settlement Provider: The Financial Advisor’s Dilemma

- Florida Life Insurance Law Adds To Life Settlement Regulation

- Sell Your Life Insurance Policy? Why Would You?

- Who Qualifies For A Viatical Settlement

- Financial Assistance And Solutions For Cancer Patients

- Things You Should Know Before Canceling Your Life Insurance Policy

- The Life Settlement Market & Buyers

- Get Cash for Your Life Insurance Policy

- The History of the Viatical Settlement

- Terminal Cancer Diagnosis, What Now?

- Can I Buy Life Insurance Policies from the Secondary Market?

- How do I Invest in Viatical Settlements?

- What are the Costs Associated with Paying for Cancer Treatment?

- What is the Secondary Life Insurance Market?

- The Viatical Settlement Process Explained

- Top 10 Reasons to Get A Viatical Settlement

- Are Viatical Settlement Taxes Ordinary Income?

- What is a Viatical Life Insurance Settlement?

- What Does a Viatical Settlement Provider Do?

A viatical settlement is a financial arrangement in which a person sells their life insurance policy to a third party for a lump sum cash payment. This type of settlement is typically used by individuals who have a terminal illness and need cash to cover medical expenses or other bills.

Here’s an example of a viatical settlement to illustrate how it works:

Sarah, a 65-year-old individual, is diagnosed with a terminal illness and holds a life insurance policy with a face value of $500,000. Facing significant medical expenses and financial strain, Sarah decides to explore a viatical settlement as a way to alleviate her financial burdens.

She contacts a reputable viatical settlement company, which evaluates her policy based on her health condition and life expectancy. After careful assessment, the viatical settlement company offers Sarah a lump sum payment of $300,000, which is 60% of the policy’s face value.

Sarah accepts the offer, and the viatical settlement company becomes the new owner of her policy. They assume the responsibility of paying the remaining premiums until Sarah’s passing. Upon her death, the viatical settlement company receives the death benefit of $500,000.

Life expectancy plays a crucial role in viatical settlements. It refers to the estimated remaining lifespan of the insured. The longer the life expectancy, the longer it may take for the viatical settlement purchaser to receive the death benefit, impacting the potential return on investment.

In general, individuals with a shorter life expectancy are considered ideal candidates for viatical settlements. Individuals facing terminal or chronic illnesses are more likely to qualify for viatical settlements due to their diminished life expectancies, typically of 2-4 years or less.

While life settlements and viatical settlements share similarities, they are not the same.

A life settlement involves the sale of a life insurance policy by a policyholder who no longer needs or can afford the coverage. Typically, life settlements cater to older policyholders without terminal or chronic illnesses. These individuals sell their policies to third-party investors or companies in exchange for a lump sum payment.

On the other hand, a viatical settlement is specifically designed for individuals facing terminal or chronic illnesses with significantly reduced life expectancies. Viatical settlements provide policyholders with the opportunity to sell their life insurance policies to viatical settlement companies or investors for an immediate lump sum payment. This financial transaction helps individuals access funds to cover medical expenses or enhance their quality of life during challenging times.

The key difference between life settlements and viatical settlements lies in the health condition of the policyholder. Life settlements are available to seniors without specific health conditions, while viatical settlements cater to individuals facing terminal or chronic illnesses.