Viatical Life Settlement Blog

Viatical.org operates on a direct-to-consumer platform. Institutional investors are able to look at your policy directly with no broker or middleman.

Whether you are healthy and trying to sell your term insurance to get the hidden value in cash or whether you’re sick and trying to utilize the value in your insurance policy as a viatical settlement to pay for alternate care, you should always have your policy appraised before trying to sell it.

It usually only takes a 5-minute phone call to learn if you and your policy qualify for a life settlement or a viatical settlement. Every case is different. Please just give us a call and we’ll try to help you.

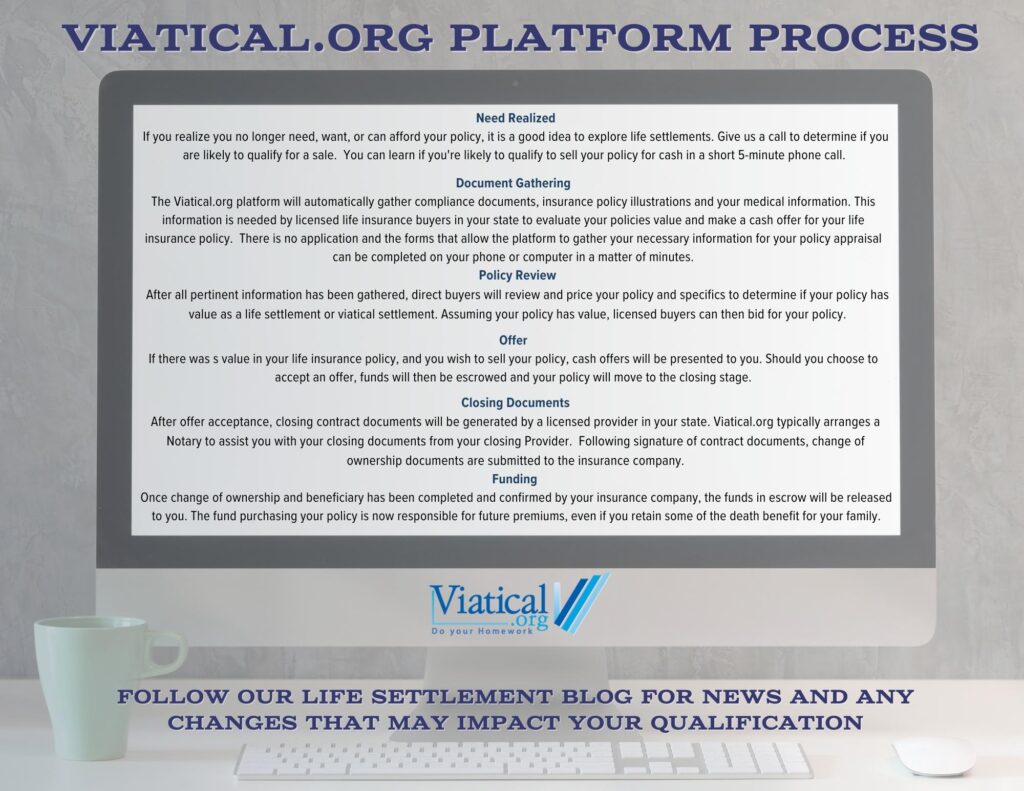

Viatical.org Platform Process

Our direct-to-consumer platform for viatical settlements and life settlements is simple and easy to understand.

Need Realized

If you realize you no longer need, want, or can afford your policy, it is a good idea to explore life settlements. Give us a call to determine if you are likely to qualify for a sale.

You can learn if you’re likely to qualify to sell your policy for cash in a short 5-minute phone call.

Document Gathering

The Viatical.org platform will automatically gather compliance documents, insurance policy illustrations and your medical information. This information is needed by licensed life insurance buyers in your state to evaluate your policies value and make a cash offer for your life insurance policy. There is no application and the forms that allow the platform to gather your necessary information for your policy appraisal can be completed on your phone or computer in a matter of minutes.

Policy Review

After all pertinent information has been gathered, direct buyers will review and price your policy and specifics to determine if your policy has value as a life settlement or viatical settlement. Assuming your policy has value in the secondary market, licensed buyers can then bid for your policy.

Offer

If there was a value in your life insurance policy, and you wish to sell your policy, cash offers will be presented to you. Should you choose to accept an offer, funds will then be escrowed, and your policy will move to the closing stage.

Closing Documents

After offer acceptance, closing contract documents will be generated by a licensed provider in your state. Viatical.org typically arranges a Notary to assist you with your closing documents from your closing Provider.

Following signature of contract documents, change of ownership documents are submitted to the insurance company.

Funding

Once change of ownership and beneficiary has been completed and confirmed by your insurance company, the funds in escrow will be released to you. The institutional fund purchasing your policy is now responsible for all future premiums, even if you retain some of the death benefit for your family.

There is no pressure when selling your life insurance policy direct on the Viatical.org platform. There is no application, fee, or obligation to have your life insurance policy appraised. Viatical.org has been helping consumers for over 15 years and we would be happy to help you.

Follow our Viatical Life Settlement Blog for news and any changes that may impact your qualification.

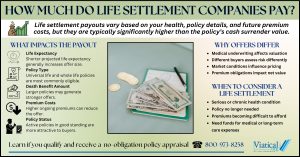

- How Much Do Life Settlement Companies Payby C.E. DeanIf you are wondering how much do life settlement companies pay, the answer depends on several key factors including your age, health condition, policy type, and the size of your death benefit. In general, a life settlement pays more than the cash surrender value but less than the full death benefit. For many policyholders facing serious illness or financial strain, it can provide access to funds that would otherwise remain unavailable. What Determines the Payout Amount Life settlement companies evaluate policies based on risk and projected return. The most important factors include: Life ExpectancyBuyers review medical records to estimate life …See More

- What Documents Are Needed for a Viatical Settlement?by C.E. DeanIf you are considering a viatical settlement, one of the first things you will want to know is what documents are needed for a viatical settlement and how long it will take to gather them. The good news is that most of the paperwork is straightforward, and in many cases, you already have some of it. The goal is to verify the life insurance policy details, confirm who has the legal right to sell it, and provide medical information that supports eligibility. Basic Policy Documents These documents confirm what the policy is, who owns it, and what the current status …See More

- Can You Sell a Term Life Insurance Policy Without Converting It First?by C.E. DeanCan you sell a term life insurance policy without converting it first? Yes, you may be able to sell a term life insurance policy without converting it first, but most buyers require that the policy still has an active conversion privilege. In many cases, the conversion option is what makes a term policy eligible for purchase, even if the policy is not converted before the sale. However, there are limited situations where a non-convertible term policy may still qualify, particularly when the insured meets viatical settlement criteria. Why Conversion Privilege Usually Matters Most term life insurance policies do not simply …See More

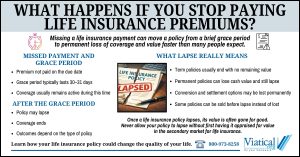

- What Happens If You Stop Paying Life Insurance Premiums?by C.E. DeanIf you are wondering what happens if you stop paying life insurance premiums, the outcome depends on the type of policy you own, how long premiums have gone unpaid, and whether any options are exercised before the policy lapses. Many policyholders stop paying premiums during illness, retirement, or financial stress without realizing that doing so can permanently eliminate valuable rights. Understanding the timeline and consequences can help you avoid losing coverage or policy value unnecessarily. The Grace Period After a Missed Payment Most life insurance policies include a grace period, typically 30 or 31 days. During this time, coverage usually …See More

- Viatical Settlements and Living Longer Than Expectedby C.E. DeanOne common question people have when considering a viatical settlement is what happens if medical projections change and they live longer than expected. Viatical settlements and living longer than expected are not at odds with each other. This situation is anticipated within the settlement structure and does not create complications for the policyholder or their family. Life Expectancy Estimates Are Not Deadlines Life expectancy estimates are used during the evaluation process to help determine a policy’s value. These estimates are based on medical records, diagnosis, treatment history, and actuarial data. They are projections, not fixed timelines. No estimate is intended …See More

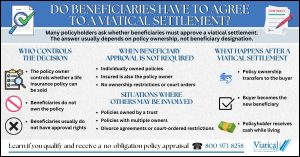

- Do Beneficiaries Have to Agree to a Viatical Settlement?by C.E. DeanDo beneficiaries have to agree to a viatical settlement? This is one of the most common questions policyholders ask when they are considering selling their life insurance policy for cash. Many people worry that moving forward with a viatical settlement requires permission from family members or that beneficiaries can block the sale. The answer is usually more straightforward than expected, but there are important details to understand before making a decision. Who Has the Legal Right to Sell a Life Insurance Policy In most cases, the person or entity that owns the life insurance policy controls what happens to it. …See More

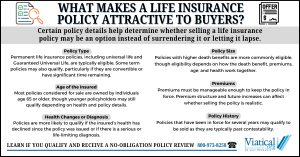

- What Makes a Life Insurance Policy Attractive to Buyers?by C.E. DeanWhat makes a life insurance policy attractive to buyers? This is one of the most common questions policyholders ask when they are considering whether selling their life insurance policy is an option. Not all policies qualify, and not all qualifying policies are valued the same way. Buyers evaluate several specific factors to determine whether a policy has market value and how much they may be willing to pay for it. Understanding these factors can help you decide whether it makes sense to explore selling your policy rather than letting it lapse or surrendering it back to the insurance company. Policy …See More

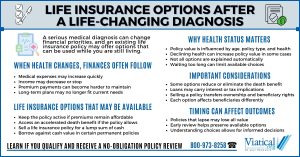

- Life Insurance Options After a Life-Changing Diagnosisby C.E. DeanFacing a serious medical diagnosis often brings immediate financial questions, especially when income drops and medical expenses rise. Life insurance options after a life-changing diagnosis are not always explained by doctors or insurance companies, yet they can provide financial flexibility during a difficult time. Many people assume their life insurance policy is something that only helps others in the future, but in some cases, it may offer options that can be used while the policyholder is still living. A life-changing diagnosis may involve advanced cancer, progressive neurological conditions, heart disease, organ failure, or other illnesses that significantly affect daily functioning …See More

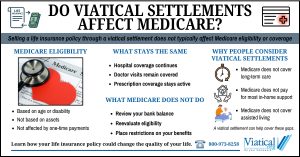

- Do Viatical Settlements Affect Medicare?by C.E. DeanIf you are considering selling a life insurance policy after a serious diagnosis, it is natural to ask do viatical settlements affect Medicare benefits. Medicare rules are different from needs-based programs like Medicaid and understanding that distinction can help you evaluate your options without unnecessary concern. Medicare is not income-based. Eligibility is primarily determined by age or disability status, not by assets or one-time financial transactions. Because of this, receiving funds from a viatical settlement generally does not disqualify someone from Medicare coverage. Medicare vs. Medicaid: Why the Difference Matters A common source of confusion is the difference between Medicare …See More

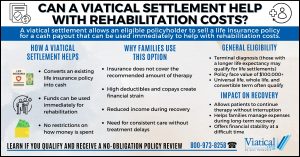

- Can a Viatical Settlement Help with Rehabilitation Costs?by C.E. DeanPeople facing long recovery periods often struggle with rising medical bills, reduced income, and ongoing therapy. Many want to know what financial options are available and ask an important question: Can a viatical settlement help with rehabilitation costs? For individuals with a qualifying terminal diagnosis, selling a life insurance policy may provide fast access to cash that can be used to cover rehabilitation expenses when health insurance or savings fall short. What a Viatical Settlement Covers A viatical settlement allows a policyholder with a terminal illness to sell their life insurance for a percentage of the death benefit. The funds …See More

- Check Your Term Policy’s Conversion Options Before It Expiresby C.E. DeanWhen a term life policy is nearing the end of its level premium period, many people assume their coverage is about to become worthless. In reality, it is important to check your term policy’s conversion options before it expires, because buyers in the life settlement and viatical settlement market often require a policy to be convertible. Knowing whether that feature exists can determine if your policy is worth evaluating for a potential sale. Why Conversion Options Matter to Buyers Most term policies technically offer two ways to continue coverage after the initial term ends: Annual renewable term keeps coverage in …See More

- Can a Life Settlement Help Pay for Skilled Nursing Care?by C.E. DeanFamilies often reach a point where the cost of a skilled nursing facility becomes overwhelming, which leads many to ask a direct question: can a life settlement help pay for skilled nursing care? For people with serious or life limiting health conditions, the value inside an existing life insurance policy can provide meaningful financial relief. What Skilled Nursing Care Includes Skilled nursing facilities provide a higher level of medical support than assisted living or home care. Services often include wound care, IV therapy, rehabilitation, respiratory care, and full-time supervision. These services are essential for people recovering from major surgery, stroke, …See More

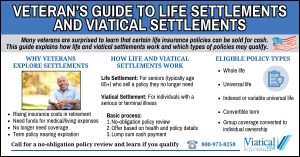

- Veteran’s Guide to Life Settlements and Viatical Settlementsby C.E. DeanMany former service members are unaware that they may be able to turn an existing life insurance policy into immediate cash. This veteran’s guide to life settlements and viatical settlements explains how these options work, who qualifies, and how veterans can benefit especially those holding convertible term life insurance policies that are nearing expiration. What Are Life Settlements and Viatical Settlements? Life settlements allow a policyholder to sell a life insurance policy they no longer need in exchange for a lump-sum cash payment that exceeds the surrender value.A viatical settlement is similar but applies when the insured has a serious …See More

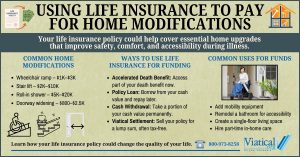

- Using Life Insurance to Pay for Home Modificationsby C.E. DeanFor many people facing a serious or terminal illness, home becomes both a place of comfort and a source of new challenges. Moving around safely, sleeping comfortably, or managing daily routines can suddenly require expensive upgrades. Using life insurance to pay for home modifications helps make your living space safer and more accessible without adding financial strain at a difficult time. Why Home Modifications Matter Serious health conditions often limit mobility or increase fall risk. Installing ramps, stair lifts, widened doorways, and accessible bathrooms or purchasing mobility devices can greatly improve independence and quality of life. But these upgrades can …See More

- A Life Settlement Could Help Pay for an Elderly Parent’s Careby C.E. DeanCaring for an aging parent is one of the most compassionate and challenging responsibilities a family can face. Between rising costs for assisted living, in-home nursing, and medical treatments, many families find themselves searching for new ways to manage expenses without sacrificing quality of care. For those whose parents still hold a life insurance policy, a life settlement could help pay for an elderly parent’s care by converting that policy into immediate cash, often far more than the surrender value offered by the insurance company. Understanding How a Life Settlement Works Life settlements are the sale of an existing life …See More

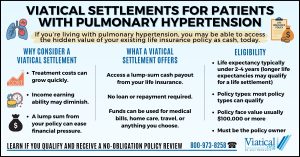

- Viatical Settlements for Patients with Pulmonary Hypertensionby C.E. DeanViatical settlements for patients with pulmonary hypertension can provide an important financial lifeline for those facing the high costs of managing this serious and progressive condition. Pulmonary hypertension occurs when the blood pressure in the arteries of the lungs becomes dangerously high, forcing the heart to work harder to pump blood. While treatments have advanced, the ongoing costs of care can create a major financial burden for patients and their families. Understanding Pulmonary Hypertension Pulmonary hypertension is not the same as general high blood pressure. It specifically affects the arteries in the lungs and the right side of the heart. …See More

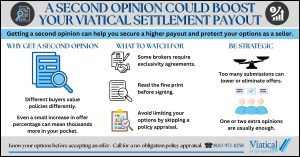

- A Second Opinion Could Boost Your Viatical Settlement Payoutby C.E. DeanIf you’ve already received an offer for your life insurance policy, a second opinion could boost your viatical settlement payout in ways you might not expect. Many policyholders assume their first offer is the best they can get. In reality, life settlement and viatical settlement offers can vary significantly depending on the buyer, underwriting approach, and market conditions. Another factor is whether or not you must deduct broker commissions from your offer. Taking the time to explore a second opinion can lead to a higher payout, sometimes by thousands of dollars. Why a Second Opinion Matters Viatical and life settlement …See More

- Do Life Settlements Affect Social Security?by C.E. DeanMany retirees ask, “Do life settlements affect Social Security?” It’s a smart question. Social Security provides a steady income for millions of older Americans, but it often isn’t enough to cover the rising costs of living, medical bills, and long-term care. For those who own a life insurance policy, selling it through a life settlement can be a way to unlock additional funds. But understanding how a life settlement may (or may not) impact Social Security benefits is essential before moving forward. How Social Security Benefits Work Social Security (SSA) benefits are typically not affected by most types of personal …See More

- Can You Sell Part of Your Life Insurance Policy?by C.E. DeanIf you’re wondering, can you sell part of your life insurance policy?, the answer is yes, it is possible, through a viatical or life settlement with a retained death benefit. This lets you receive cash now while keeping a portion of the death benefit in place for your beneficiaries, so part of the coverage remains even after selling part of the policy. What “Selling Part of a Policy” Really Means When people ask to sell a portion of a policy, they are usually talking about a retained death benefit within a settlement. Retained Death Benefit (RDB) In a retained death …See More

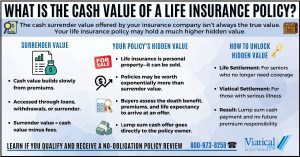

- What Is the Cash Value of a Life Insurance Policy?by C.E. DeanPeople are often surprised to learn that the cash value shown by their insurance company doesn’t reflect what their policy may actually be worth. What is the cash value of a life insurance policy? It’s the amount your insurer lists as available if you surrender or borrow against your policy. But that figure represents only what the insurance company is willing to pay, not its potential market value. In many cases, a life insurance policy can be worth significantly more when sold through a life settlement or viatical settlement in the secondary market. How Insurers Define Cash Value Cash value …See More

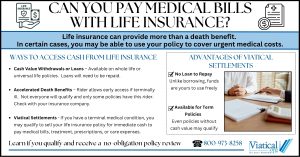

- Can You Pay Medical Bills with Life Insurance?by C.E. DeanMedical costs in the United States can create financial stress for families facing serious illness. From hospital stays to ongoing treatments, expenses can add up quickly and overwhelm even the most prepared households. If you’re wondering, “Can you pay medical bills with life insurance?” you may be able to, depending on the type of policy you own and your health situation. Common Ways to Use Life Insurance for Medical Expenses Life insurance is not only a benefit that pays out after death. Depending on the structure of your policy, there may be ways to access value while you are still …See More

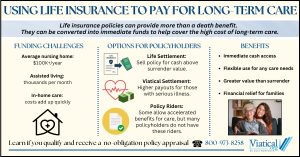

- Using Life Insurance to Pay for Long-Term Careby C.E. DeanFor many seniors and their families, the rising cost of extended medical support can be overwhelming. Nursing homes, assisted living facilities, and in-home caregivers often come with monthly bills that quickly drain savings. Fortunately, there are alternatives to simply spending down retirement accounts. One option is using life insurance to pay for long-term care, which allows policyholders to convert an existing life insurance policy into funds that can be applied toward these expenses. Why Long-Term Care Costs Are a Concern Long-term care is not covered by Medicare in most situations, and private health insurance rarely offers comprehensive coverage for extended …See More

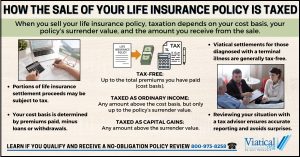

- How the Sale of Your Life Insurance Policy Is Taxedby C.E. DeanHow the sale of your life insurance policy is taxed is an important question to answer before considering a life settlement. Selling a policy can provide access to funds for healthcare, living expenses, or other financial needs, but the money you receive may be subject to tax. The Tax Cuts and Jobs Act of 2017 (TCJA) clarified the rules, making it easier for policyholders to understand how their settlement will be treated. Since that update, there have been no further finalized changes to how policyowners are taxed when selling a life insurance policy. Understanding the Basics When the IRS looks …See More

- Get a Viatical Settlement in Your Stateby C.E. DeanIf you are facing a serious illness and need financial relief, you may be wondering how to get a viatical settlement in your state. Viatical settlements allow you to sell your life insurance policy for a lump sum of cash while you are still alive. Instead of letting your policy lapse or surrendering it for a small amount, a viatical settlement can unlock the hidden value of your coverage and provide funds when you need them most. Understanding Viatical Settlements A viatical settlement is a financial option available to people who have been diagnosed with a terminal or chronic illness. …See More

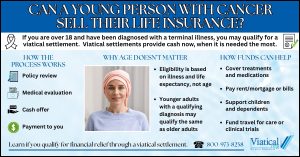

- Can a Young Person with Cancer Sell Their Life Insurance?by C.E. DeanIf you’re facing a cancer diagnosis, you may be wondering, “Can a young person with cancer sell their life insurance?” The answer is yes. As long as you’re over 18 and have a terminal or life-limiting illness, you may qualify for a viatical settlement, which allows you to sell your life insurance policy for immediate cash. This option can help relieve financial strain and provide money when you need it most. What Is a Viatical Settlement? A viatical settlement is the sale of a life insurance policy to a licensed buyer. Instead of waiting for the death benefit to be …See More

- Selling Your Insurance Policy When You Have Cancerby C.E. DeanSelling your insurance policy when you have cancer lets you access value that is otherwise locked in the policy. The proceeds can support treatment, travel for care, help at home, or other needs. This option is often considered when premiums become unaffordable, when care costs are rising, or when a policy is no longer needed for family protection. Instead of letting the policy lapse or accepting a small surrender value, you may be able to receive a much higher cash payout by selling the policy to a licensed buyer. Offers are based on your health and policy specifics such as …See More

- How to Find Life Insurance Policy Buyersby C.E. DeanIf you are trying to figure out how to find life insurance policy buyers, the first thing to know is that you don’t have to settle for surrendering your policy or letting it lapse. In today’s secondary market, life insurance policies can be sold for cash through either a life settlement or a viatical settlement, depending on your circumstances. This option has helped thousands of people turn something they once saw only as a death benefit into an immediate financial resource. Why People Sell Their Policies Life insurance is often purchased with good intentions, to protect loved ones or secure …See More

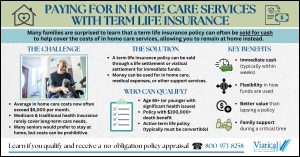

- Paying for In Home Care Services with Term Life Insuranceby C.E. DeanFamilies across the country face the challenge of covering the high costs of in home care services and other types of senior care services. One option often overlooked is paying for in home care services with term life insurance. While term coverage is usually seen as a way to leave a death benefit, under the right circumstances, it can also be converted into a valuable source of immediate funds to help pay for essential care. The Rising Cost of In-Home Care The demand for in home senior care continues to grow as many older adults prefer to remain at home …See More

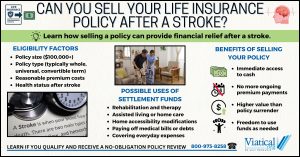

- Can You Sell Your Life Insurance Policy After a Stroke?by C.E. DeanCan you sell your life insurance policy after a stroke? Yes, you can if you qualify. A stroke diagnosis can make you eligible to sell your policy through a viatical settlement or life settlement. This option allows you to turn an existing policy into immediate cash that can be used for medical care, rehabilitation, long-term care, or household expenses. Why a Stroke May Qualify You to Sell Your Life Insurance Policy Strokes can have lasting effects on mobility, speech, and independence. Survivors often face long hospital stays, rehabilitation, therapy, and follow-up appointments that create financial strain. Some patients may need …See More

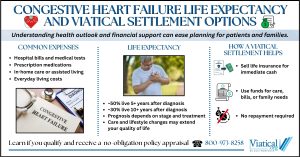

- Congestive Heart Failure Life Expectancy and Viatical Settlement Optionsby C.E. DeanWhen considering congestive heart failure life expectancy and viatical settlement options, it is important to look at both the medical and financial realities that come with this diagnosis. For many patients, understanding the expected progression of the disease is the first step in planning for the future. At the same time, exploring ways to access financial support through a viatical settlement can make it possible to focus on comfort and care rather than the burden of medical bills. Understanding Congestive Heart Failure Congestive heart failure (CHF) is a chronic, progressive condition where the heart cannot pump blood efficiently enough to …See More

- Chemotherapy Costs and How a Viatical Settlement Can Helpby C.E. DeanChemotherapy is one of the most common treatments for cancer, but it can also be one of the most expensive. Between hospital visits, infusion fees, prescription medications, and supportive care, patients often face overwhelming bills. Many families quickly realize that even with insurance, out-of-pocket costs can drain savings and create long-term financial strain. That’s why it’s important to talk about chemotherapy costs and how a viatical settlement can help, since a settlement can provide a financial lifeline by turning an existing life insurance policy into immediate cash when it is needed most. The Rising Costs of Chemotherapy The cost of …See More

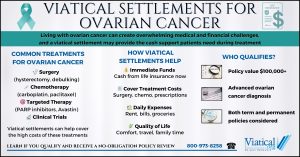

- Viatical Settlements for Ovarian Cancerby C.E. DeanOvarian cancer creates both emotional and financial challenges for patients and their families. Treatment costs, hospital visits, and the impact on daily income can quickly overwhelm even the most prepared households. Viatical settlements for ovarian cancer allow patients to sell an existing life insurance policy for immediate cash. Instead of waiting for a death benefit, this option provides funds during treatment, when they are most needed for medical bills, household expenses, or quality of life improvements. What Is a Viatical Settlement? A viatical settlement is the sale of a life insurance policy to a viatical settlement buyer in exchange for …See More

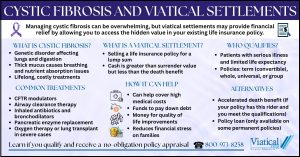

- Cystic Fibrosis and Viatical Settlementsby C.E. DeanThere are many challenges associated with cystic fibrosis and viatical settlements can help lessen some of the financial burden. Cystic fibrosis (CF) is a genetic disease that primarily affects the lungs and digestive system. While medical advances have significantly improved life expectancy, the condition still requires ongoing treatment, frequent hospitalizations, and daily management. These demands can lead to overwhelming financial stress. For patients who own life insurance, a viatical settlement may provide a way to convert a policy into immediate funds to cover care costs, reduce debt, or improve quality of life. Understanding Cystic Fibrosis Cystic fibrosis is caused by …See More

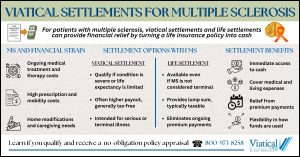

- Viatical Settlements for Multiple Sclerosisby C.E. DeanLiving with multiple sclerosis (MS) can bring physical, emotional, and financial challenges. For those holding a life insurance policy, exploring viatical settlements for multiple sclerosis may provide a much-needed source of funds. Some patients may qualify for a viatical settlement if their health condition is considered severe or life expectancy is significantly limited. However, many people with MS will instead qualify for a life settlement, which still allows policyholders to sell their life insurance for a lump sum that is typically greater than the cash surrender value but less than the death benefit. Understanding Multiple Sclerosis and Financial Needs Multiple …See More

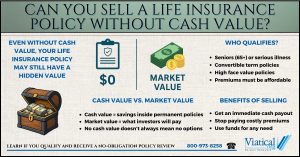

- Can You Sell a Life Insurance Policy Without Cash Value?by C.E. DeanMany policyholders wonder: can you sell a life insurance policy without cash value? The short answer is yes, in many cases you can. While traditional wisdom suggests that only permanent life insurance with an accumulated cash value can be sold, the secondary market offers solutions for certain term policies and other policies that have little or no cash value at all. Understanding how this works can help you determine whether selling your policy is a viable option for accessing funds when you need them most. Understanding Cash Value vs. Market Value Cash value is the savings component of certain permanent …See More

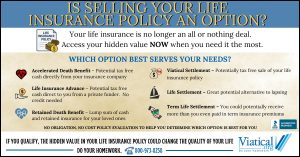

- Is Selling Your Life Insurance Policy an Option?by C.E. DeanA serious diagnosis often brings both emotional strain and financial uncertainty. Most policyholders do not realize that a life insurance policy can offer more than just future protection. It may hold hidden value that could provide financial support when it is needed most, but is selling your life insurance policy an option for you? Before making any decisions, take time to understand all your options. You may have access to new options that provide immediate funds while still preserving some benefits for your family. Many policy owners are surprised to discover that you may be able to sell your life insurance policy for cash. For …See More

- How to Get the Best Viatical Settlementby C.E. DeanWhen facing a serious or terminal illness, financial stress can add to an already overwhelming situation. Many people in this position don’t realize that an existing life insurance policy can be sold for a lump sum. Understanding how to get the best viatical settlement is the key to receiving a high payout in the shortest amount of time. By working directly through our secure platform, you can avoid unnecessary middlemen and keep the process moving so you can get funds when you need them. Understand How a Viatical Settlement Works A viatical settlement allows a qualifying policyholder to sell their …See More

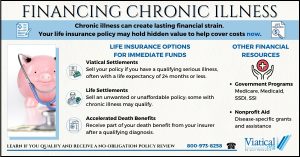

- Financing Chronic Illnessby C.E. DeanManaging a long-term health condition often brings ongoing costs that can feel overwhelming. Financing chronic illness involves more than simply paying medical bills, it’s about creating a sustainable plan to cover treatments, medications, supportive care, and everyday living expenses while maintaining as much stability and quality of life as possible. Understanding the available financial tools can help patients and their families make informed decisions. Understanding the Costs Chronic illnesses such as heart disease, COPD, diabetes, autoimmune diseases, and progressive neurological disorders often require: These expenses can persist for years, making careful financial planning essential. Health Insurance Coverage and Gaps Health insurance …See More

- Financial Options for Bile Duct Cancer Patients with Life Insuranceby C.E. DeanA diagnosis of bile duct cancer can bring emotional, physical, and financial stress, but there may be untapped resources that can help. One of the most overlooked financial options for bile duct cancer patients with life insurance is the ability to access the value of an existing life insurance policy through a viatical settlement or other living benefits. Understanding Bile Duct Cancer and Treatment Costs Bile duct cancer, also known as cholangiocarcinoma, is a rare and aggressive cancer that forms in the bile ducts connecting the liver and small intestine. It’s typically classified into three types based on location: intrahepatic …See More

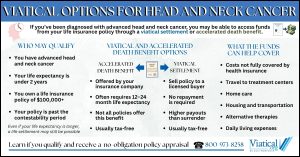

- Viatical Options for Head and Neck Cancerby C.E. DeanPatients facing advanced-stage head and neck cancer often experience not only physical and emotional challenges but also significant financial strain. Fortunately, there are viatical options for head and neck cancer that can help ease the burden. Two key options include accelerated death benefits and viatical settlements, both of which allow eligible patients to access funds from their existing life insurance policies. Understanding Head and Neck Cancers Head and neck cancers refer to a group of cancers that usually begin in the squamous cells lining the head and neck region. These include: Some cases of head and neck cancer are linked …See More

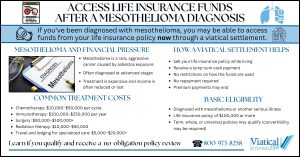

- Access Life Insurance Funds After a Mesothelioma Diagnosisby C.E. DeanA mesothelioma diagnosis often brings overwhelming medical costs, lost income, and urgent financial decisions. Many policyholders don’t realize that life insurance may offer immediate financial help. You may be able to access life insurance funds after a mesothelioma diagnosis through a viatical settlement, allowing you to sell your policy for a lump sum while you’re still living. What Is Mesothelioma? Mesothelioma is a rare and aggressive cancer usually caused by exposure to asbestos. Most cases affect the lungs (pleural mesothelioma), but it can also impact the abdomen or heart. Because symptoms often appear decades after exposure, many people are diagnosed …See More

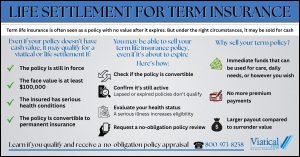

- Life Settlement for Term Insuranceby C.E. DeanA life settlement for term insurance can provide an unexpected source of financial relief. While many people assume that term life insurance policies expire without any value, some can be sold for cash, even if they are nearing the end of their term. If you have a term policy you no longer need or can’t afford, a life settlement may be an option worth exploring. What Is a Life Settlement? A life settlement is the sale of an existing life insurance policy to a third party. In exchange for a lump-sum cash payment, the buyer takes over premium payments and becomes the …See More

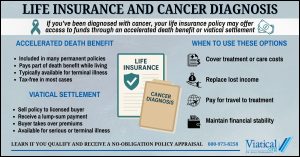

- Life Insurance and Cancer Diagnosisby C.E. DeanA cancer diagnosis can bring not only emotional and physical challenges but also financial uncertainty. When it comes to life insurance and cancer diagnosis, many people don’t realize that an existing policy may offer living benefits through options like an accelerated death benefit or viatical settlement. Accessing Your Policy While Still Living Most people think of life insurance as something that only benefits loved ones after death. However, if you’ve been diagnosed with cancer, particularly advanced or terminal cancer, you may be able to access the value of your policy while you’re still alive. Two primary options include: 1. Accelerated …See More

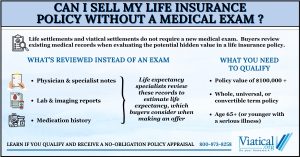

- Can I Sell My Life Insurance Policy Without a Medical Exam?by C.E. DeanMany policyholders want to know, can I sell my life insurance policy without a medical exam? The answer is yes. When you sell a policy through a life settlement or viatical settlement, potential buyers review your existing medical records instead of requiring a new exam. These records provide enough information for buyers to evaluate your health history and determine your policy’s potential value, without any additional testing or appointments. How Medical Records Are Used Instead of Exams When you sell a life insurance policy, the buyer needs to assess the risk and potential payout. To do this, life settlement purchasers …See More

- Viatical Settlements for Autoimmune Disease Patientsby C.E. DeanLiving with an autoimmune disease can be both physically and financially overwhelming, particularly when the condition is life-limiting or severely impacts quality of life. Viatical settlements for autoimmune disease patients offer a way to access the hidden value of a life insurance policy, providing a financial lifeline during a difficult time. By selling an existing life insurance policy to a direct buyer, patients may receive a lump-sum cash payout that can be used for medical expenses, ongoing care, or other pressing needs. Understanding Autoimmune Diseases Autoimmune diseases occur when the body’s immune system mistakenly attacks healthy tissues, leading to chronic …See More

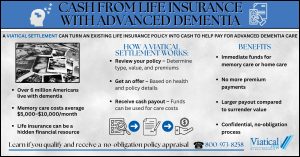

- Cash from Life Insurance with Advanced Dementiaby C.E. DeanFamilies caring for someone with advanced dementia face overwhelming challenges – emotionally, physically, and financially. Accessing cash from life insurance with advanced dementia is one option that can help relieve some of the financial burden. Through a viatical settlement, policyholders can sell an existing life insurance policy in exchange for a lump-sum cash payment. This payout can be used for critical needs, such as memory care, medications, or in-home support, at a time when expenses are often at their peak. The High Costs of Advanced Dementia Care The care needs of someone with advanced dementia can be extensive. As the …See More

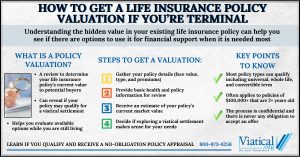

- How to Get a Life Insurance Policy Valuation If You’re Terminalby C.E. DeanIf you or a loved one has been diagnosed with a terminal illness, it is important to understand every financial option available. One of the most overlooked resources is your life insurance policy. You may be wondering how to get a life insurance policy valuation if you’re terminal. This process can help you discover whether your policy has immediate value that you can access now, when it is most needed. What Is a Life Insurance Policy Valuation? A life insurance policy valuation determines how much your policy is worth on the secondary market. This is not the same as your …See More

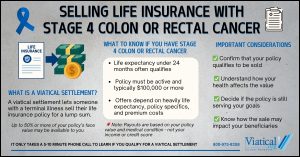

- Selling Life Insurance with Stage 4 Colon or Rectal Cancerby C.E. DeanFor patients facing a serious diagnosis, financial stress can quickly become overwhelming. Selling life insurance with stage 4 colon or rectal cancer may provide a way to access money from your policy while you’re still living. Through a viatical settlement, you can sell your life insurance policy to a licensed buyer in exchange for a lump-sum cash payment. This option is designed for individuals with a terminal illness who need funds for medical care, family support, or other urgent expenses. It allows you to receive money from your life insurance now, when it can make a real difference. What Is …See More

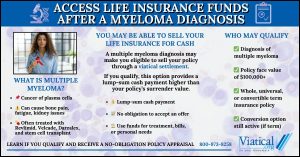

- Access Life Insurance Funds After a Myeloma Diagnosisby C.E. DeanA multiple myeloma diagnosis can bring financial strain along with the emotional and physical toll of treatment. Many people are surprised to learn that they may be able to access life insurance funds after a myeloma diagnosis without taking on new debt or depleting savings. If you have been diagnosed with myeloma, you may qualify to sell your life insurance policy through a viatical settlement. This option allows eligible policyholders to receive a lump-sum cash payment, often much higher than the policy’s cash surrender value. These funds can provide flexibility during a time of uncertainty and support important decisions for …See More

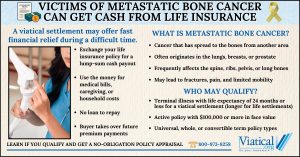

- Victims of Metastatic Bone Cancer Can Get Cash from Life Insuranceby C.E. DeanVictims of metastatic bone cancer can get cash from life insurance through a viatical settlement, offering much-needed financial relief at a time when expenses and care needs often increase rapidly. When cancer spreads to the bones, commonly from the lungs, breasts, or prostate, patients may experience severe pain, limited mobility, and rising out-of-pocket medical costs. Selling your life insurance policy can provide immediate funds without incurring debt or using home equity. What is Metastatic Bone Cancer? Metastatic bone cancer happens when cancer cells spread from another part of the body to the bones. This is different from primary bone cancer, …See More

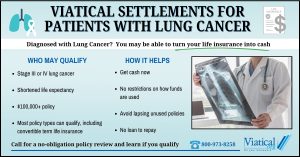

- Viatical Settlements for Patients with Lung Cancerby C.E. DeanIf you or a loved one has been diagnosed with lung cancer and are facing financial challenges, you may want to explore viatical settlements for patients with lung cancer. This option allows qualifying policyholders to sell their life insurance policy to a licensed provider in exchange for a lump sum of cash. These funds can be used immediately for treatment, living expenses, or to ease financial strain during a difficult time. Lung cancer remains one of the most commonly diagnosed and deadly cancers, especially among adults over 65. Advanced cases, including small cell and non-small cell lung cancer with metastasis, …See More

- Viatical Settlements for Patients with Liver Diseaseby C.E. DeanPatients diagnosed with advanced liver disease may face mounting medical expenses, reduced income, and the emotional toll of a progressive condition. Viatical settlements for patients with liver disease can offer a financial lifeline by allowing those why qualify to sell their life insurance policy for immediate cash. These funds can be used for treatments, living expenses, or anything else you choose. Understanding Liver Disease and Its Progression Liver disease encompasses a range of chronic conditions, many of which are progressive and life-limiting. While some forms are manageable in early stages, others may lead to liver failure and a significant reduction …See More

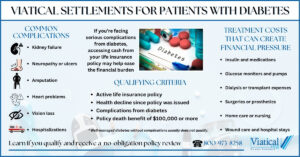

- Viatical Settlements for Patients with Diabetesby C.E. DeanIf you’re living with diabetes and facing financial strain, you may be wondering whether you qualify to sell your life insurance policy. Viatical settlements for patients with diabetes are possible in certain cases, particularly when the disease has led to severe complications that limit life expectancy. While well managed diabetes alone usually does not qualify, many people develop progressive or life-threatening complications that could make them eligible. When Does Diabetes Qualify for a Viatical Settlement? In general, life insurance buyers are looking for cases in which a policyholder has experienced a significant decline in health. For patients with diabetes, this …See More

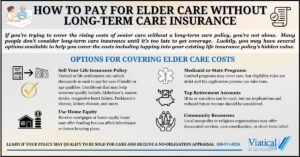

- How to Pay for Elder Care Without Long-Term Care Insuranceby C.E. DeanFor families facing the rising costs of senior care, understanding how to pay for elder care without long-term care insurance is essential. Many older adults do not carry long-term care coverage, yet need help paying for assisted living, home care, or nursing services. One often overlooked option is selling an existing life insurance policy through a viatical or life settlement. Use a Viatical or Life Settlement to Fund Care If the policy insured has experienced a serious health decline, a viatical settlement may be an option. This allows individuals to sell their life insurance policy to a third-party buyer in …See More

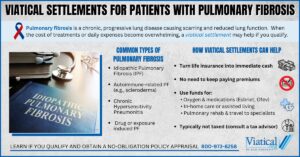

- Viatical Settlements for Patients with Pulmonary Fibrosisby C.E. DeanPulmonary fibrosis is a progressive, life-limiting condition that causes scarring of the lungs, making it increasingly difficult to breathe. For those facing the emotional and financial toll of this diagnosis, exploring viatical settlements may offer relief. Viatical settlements for patients with pulmonary fibrosis allow eligible policyowners to sell their life insurance policy for a lump sum of cash that is often far more than the policy’s surrender value. This money can then be used to pay for care, treatments, home modifications, or to relieve financial stress during an already difficult time. What Is Pulmonary Fibrosis? Pulmonary fibrosis is a type …See More

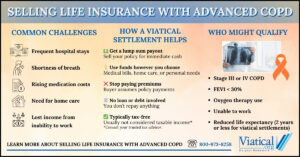

- Selling Life Insurance with Advanced COPDby C.E. DeanFor individuals living with chronic obstructive pulmonary disease (COPD), managing the progression of the illness can bring growing physical limitations, emotional strain, and financial pressure. Selling life insurance with advanced COPD may offer a valuable financial solution by allowing qualifying policyholders to access a portion of their policy’s value now rather than waiting for the death benefit to be paid out later. A viatical settlement can help cover medical expenses, caregiving, and daily living costs during a difficult time. What Is Advanced COPD? COPD is a progressive and irreversible lung disease that includes conditions such as chronic bronchitis and emphysema. …See More

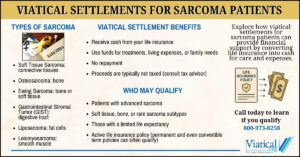

- Viatical Settlements for Sarcoma Patientsby C.E. DeanReceiving a sarcoma diagnosis often brings emotional, physical, and financial challenges. For those facing advanced stages of this rare cancer, viatical settlements for sarcoma patients can offer a way to access financial resources by selling an existing life insurance policy. This option allows patients to unlock immediate funds to help cover medical treatments, daily living expenses, and other financial needs while focusing on care and quality of life. Understanding Sarcoma Sarcoma is a rare form of cancer that develops in the bones or soft tissues, such as muscles, fat, blood vessels, nerves, tendons, and ligaments. There are many subtypes of …See More

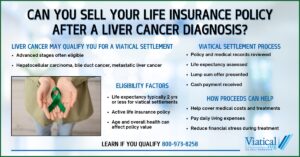

- Can You Sell Your Life Insurance Policy After a Liver Cancer Diagnosis?by C.E. DeanA liver cancer diagnosis can change many aspects of your life, including your financial situation. Health insurance doesn’t always cover all costs especially those associated with alternative therapies or daily living expenses. You may be wondering: Can you sell your life insurance policy after a liver cancer diagnosis? In many cases, the answer is yes and doing so through a viatical settlement may provide much needed financial relief during treatment. Understanding Viatical Settlements for Liver Cancer Viatical settlements allow policyholders with serious illnesses to sell their life insurance policies to a third party for a lump sum cash payment. The …See More

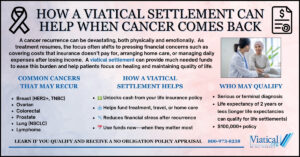

- How a Viatical Settlement Can Help When Cancer Comes Backby C.E. DeanWhen cancer comes back, the emotional and financial toll can be overwhelming. For many patients, the return of a previous cancer, known as a recurrence or relapse, means more aggressive treatment, extended time away from work, and higher out-of-pocket costs. Learning how a viatical settlement can help when cancer comes back can open the door to financial relief during one of life’s most challenging moments, allowing patients to focus on care instead of costs. A viatical settlement allows someone with a serious or terminal diagnosis to sell their life insurance policy to a third party for a lump sum of …See More

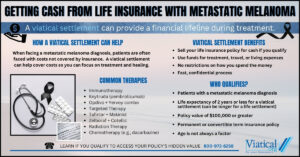

- Getting Cash from Life Insurance with Metastatic Melanomaby C.E. DeanReceiving a diagnosis of metastatic melanoma can be overwhelming—emotionally, physically, and financially. For individuals facing advanced skin cancer, getting cash from life insurance with metastatic melanoma may offer an unexpected financial lifeline. Through a viatical settlement, policyholders living with late-stage illness can often sell their life insurance policy for a lump sum payment, which can be used to help cover treatment costs, living expenses, or personal goals during this challenging time. Understanding Metastatic Melanoma Melanoma is a serious form of skin cancer that becomes far more dangerous once it spreads beyond the skin to other organs, such as the lungs, …See More

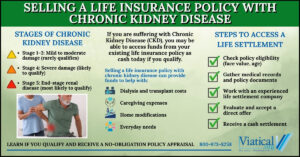

- Selling a Life Insurance Policy with Chronic Kidney Diseaseby C.E. DeanIf you have chronic kidney disease and are considering selling a life insurance policy with chronic kidney disease, you’re not alone. Many individuals facing serious health conditions explore life settlements as a way to unlock the value of their policies to cover medical expenses, caregiving costs, or other financial needs. What Is Chronic Kidney Disease? Chronic Kidney Disease (CKD) is a progressive condition where the kidneys gradually lose function over time. It’s typically divided into five stages, with Stage 5, also called end-stage renal disease (ESRD), being the most severe. At this stage, the kidneys can no longer filter waste …See More

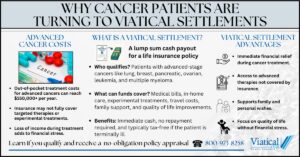

- Why Cancer Patients Are Turning to Viatical Settlementsby C.E. DeanWhy cancer patients are turning to viatical settlements has a lot to do with the overwhelming financial strain that comes with a cancer diagnosis. Cancer treatment is often expensive, and patients may face mounting medical bills, loss of income, and other financial challenges. A viatical settlement provides an option for cancer patients to sell their life insurance policy for a lump sum cash payment, offering much-needed financial relief during a difficult and uncertain time. Understanding Viatical Settlements for Cancer Patients A viatical settlement is a financial arrangement where an individual with a terminal or severe chronic illness, such as advanced …See More

- Viatical Settlements for End of Life Careby C.E. DeanFacing a terminal illness is one of the most challenging experiences a person and their family can endure. Amidst the emotional and physical toll, the financial burdens of end-of-life car such as medical bills, hospice services, and living expense can add tremendous stress. In these difficult times, you may be able to use funds from viatical settlements for end of life care to help ease some of this financial strain, providing much-needed support and peace of mind. What Are Viatical Settlements? A viatical settlement is a financial option available to individuals diagnosed with a terminal illness, typically with a life …See More

- Viatical Settlements for Patients with Pancreatic Cancerby C.E. DeanViatical settlements for patients with pancreatic cancer can offer a critical financial lifeline during one of the most challenging times of life. Pancreatic cancer is known for its aggressive nature and late diagnosis, often leading to a limited prognosis. For many patients, accessing funds quickly is essential to cover medical bills, experimental treatments, travel, in-home care, or simply to reduce financial stress. A viatical settlement allows eligible individuals with a terminal diagnosis to sell their life insurance policy for a cash payout, often in a matter of weeks. Common Treatments for Pancreatic Cancer Pancreatic cancer treatment plans often depend on …See More

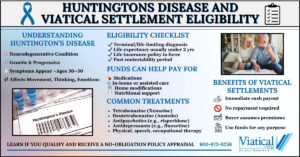

- Huntingtons Disease and Viatical Settlement Eligibilityby C.E. DeanUnderstanding the connection between Huntingtons Disease and viatical settlement eligibility can help patients and families access financial relief when it’s needed most. As this progressive neurological disorder advances, it can severely limit an individual’s ability to work, manage daily tasks, or maintain financial independence. For those with a life insurance policy, a viatical settlement may offer a way to convert that policy into immediate cash, helping to fund medical care, in-home support, or other critical expenses. What Is Huntingtons Disease? Huntingtons disease (HD) is a hereditary condition that causes the progressive breakdown of nerve cells in the brain. Symptoms usually …See More

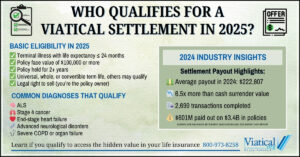

- Who Qualifies for a Viatical Settlement in 2025?by C.E. DeanIf you’ve been diagnosed with a terminal illness and have an active life insurance policy, you may be wondering: Who qualifies for a viatical settlement in 2025? This option, which allows individuals to sell their life insurance policy to a viatical settlement buyer for a lump-sum cash payment, continues to provide a critical financial lifeline for those facing high medical costs or needing to stabilize their finances during a difficult time. Viatical settlements are not new, but recent industry data shows that more people are turning to this option—and receiving significant payouts. Updated Market Data: What You Should Know According …See More

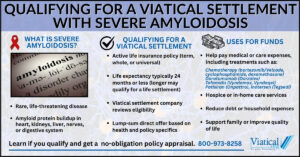

- Qualifying for a Viatical Settlement with Severe Amyloidosisby C.E. DeanQualifying for a viatical settlement with severe amyloidosis can provide critical financial support for individuals facing this rare and life-threatening condition. If you or a loved one is facing this difficult diagnosis, understanding your financial options can provide much-needed relief during a challenging time. What is Amyloidosis? Amyloidosis occurs when abnormal proteins, known as amyloid, build up in tissues and organs. These deposits interfere with normal organ function and can affect the heart, kidneys, liver, nervous system, and digestive tract. While amyloidosis is rare, it can progress rapidly and significantly shorten life expectancy, especially when the heart or kidneys are …See More

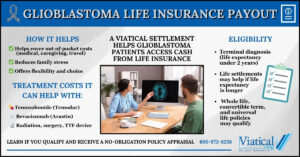

- Glioblastoma Life Insurance Payoutby C.E. DeanFacing a glioblastoma diagnosis is overwhelming. Between navigating treatment options, coping with physical changes, and preparing emotionally, financial concerns can add an extra layer of stress for patients and their families. Fortunately, a glioblastoma life insurance payout through a viatical settlement can offer critical financial support when it’s needed most, providing cash that can ease the burden and bring comfort during a difficult time. A viatical settlement allows someone with a terminal illness, such as glioblastoma, to sell their life insurance policy to a licensed buyer for a lump-sum cash payment. While even healthy individuals can sometimes qualify to sell …See More

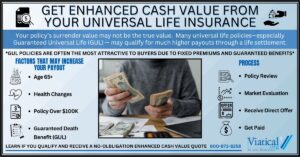

- Get Enhanced Cash Value from Your Universal Life Insuranceby C.E. DeanIf you’re looking to get enhanced cash value from your universal life insurance, you may be able to unlock significantly more than your policy’s surrender value—especially if you qualify to sell all or even a portion of your life insurance policy for cash, now while you are still alive. This financial option allows you to sell your policy to a third party for a cash payout that may far exceed what you’d get by simply canceling your policy. What Exactly Is Enhanced Cash Value from Universal Life Insurance? Enhanced cash value refers to the higher amount you may receive for …See More

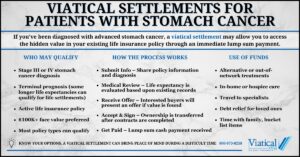

- Viatical Settlements for Patients with Stomach Cancerby C.E. DeanStomach cancer, also known as gastric cancer, can be an overwhelming diagnosis—not just physically and emotionally, but financially as well. For patients facing late-stage or terminal forms of the disease, the cost of care, travel, and loss of income can add up quickly. Viatical settlements for patients with stomach cancer offer a potential financial lifeline by allowing individuals to access cash now from their existing life insurance policies. What Is a Viatical Settlement? A viatical settlement is a financial transaction in which a person with a life-threatening illness sells their life insurance policy to a licensed buyer in exchange for …See More

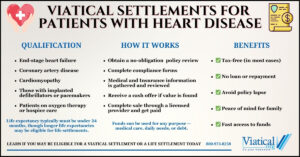

- Viatical Settlements for Patients with Heart Diseaseby C.E. DeanIf you’re researching options to cover the high cost of medical care, prescriptions, or daily living expenses while managing a serious cardiac condition, you may be wondering about viatical settlements for patients with heart disease. This option allows eligible individuals to sell their life insurance policy to a third-party buyer in exchange for a lump sum of cash, which can then be used however the seller chooses. Understanding Viatical Settlements A viatical settlement is a financial transaction in which a person with a life-threatening illness sells their life insurance policy for immediate cash. The buyer becomes the policy’s beneficiary and …See More

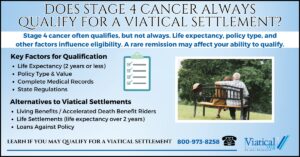

- Does Stage 4 Cancer Always Qualify for a Viatical Settlement?by C.E. DeanWhen diagnosed with stage 4 cancer, individuals often face overwhelming medical bills and financial pressures. One potential way to alleviate some of these burdens is through a viatical settlement. This type of settlement allows individuals with life-threatening conditions, including certain cancers, to sell their life insurance policy for a lump sum of cash. But does stage 4 cancer always qualify for a viatical settlement? Understanding Viatical Settlements A viatical settlement involves the sale of a life insurance policy to a third party for a lump sum that is a percentage of the death benefit. The buyer then assumes the responsibility …See More

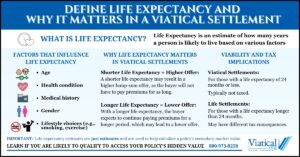

- Define Life Expectancy and Why It Matters in a Viatical Settlementby C.E. DeanIn the context of a viatical settlement, it’s important to define life expectancy and why it matters in a viatical settlement. Life expectancy is a key factor that helps determine the value of your life insurance policy in this type of transaction. It refers to the average number of years a person is expected to live, based on factors such as age, health, and gender. Understanding life expectancy is crucial for anyone considering selling their life insurance policy, as it directly impacts the amount of money you may receive in exchange. Life Expectancy and Its Role in Viatical Settlements In …See More

- Ways to Get the Most Cash for Your Life Insuranceby C.E. DeanIf you’re thinking about selling your life insurance policy, you’re likely wondering how to get the best deal possible. Fortunately, there are several proven ways to get the most cash for your life insurance, and understanding what affects your offer can help you walk away with a high payout. Whether you’re dealing with a term or permanent policy, this guide outlines what you can do to increase your chances of receiving a strong settlement. 1. Know What Type of Policy You Have Buyers evaluate life insurance policies differently depending on the type. In general: Knowing the details of your policy …See More

- Is Selling Your Life Insurance Worth It?by C.E. DeanWhen considering life insurance options, many policyholders ask themselves, “Is selling your life insurance worth it?” The answer depends on individual circumstances, including financial needs, the policy’s value, and the alternatives available. Life settlements offer policyholders the opportunity to sell their life insurance for a lump sum of cash, which can be used for various expenses such as healthcare, long-term care, or paying off debt. While this can be an appealing option for some, it’s essential to understand both the benefits and potential drawbacks before making a decision. What is a Life Settlement? A life settlement involves selling a life …See More

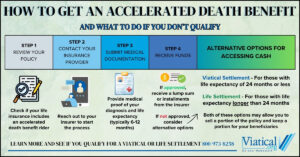

- How to Get an Accelerated Death Benefitby C.E. DeanIf you’re wondering how to get an accelerated death benefit, it’s important to understand that this provision allows you to access a portion of your life insurance policy’s death benefit early, in the event of a terminal or chronic illness. Many policyholders don’t realize that they may have this option available to them, which can provide financial relief during difficult times. Understanding the process of accessing this benefit, who qualifies, and other options available, like viatical settlements, can help you make informed decisions about which option may be best for you. What is an Accelerated Death Benefit? An accelerated death …See More

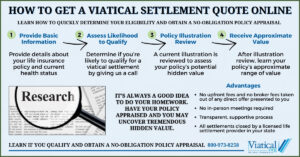

- How to Get a Viatical Settlement Quote Onlineby C.E. DeanIf you’re wondering how to get a viatical settlement quote online, you’re already on the right track to exploring your options. Many people facing a serious illness aren’t aware that life insurance policies can be sold for a lump sum — and even fewer know that you can begin the process entirely online, without leaving your home or meeting anyone in person. What Is a Viatical Settlement Quote? A viatical settlement quote is an estimate of how much money you may receive if you choose to sell your life insurance policy. It’s based on a number of factors, including: The …See More

- Stop Paying for Life Insurance You Don’t Needby C.E. DeanIf you’re still paying monthly or annual premiums for a policy that no longer serves your needs, you’re not alone—and you’re not stuck. It may be time to stop paying for life insurance you don’t need. Whether your original reasons for purchasing the policy have changed or your financial priorities have shifted, there are smarter ways to handle an unneeded policy than simply letting it lapse. Why You Might No Longer Need Your Policy Life insurance is a valuable tool, but it’s meant to serve a purpose. If that purpose has passed, the policy may no longer be worth keeping. …See More

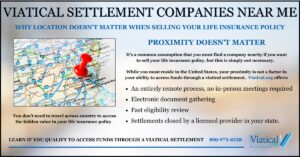

- Viatical Settlement Companies Near Meby C.E. DeanIf you’ve recently searched for viatical settlement companies near me, you’re not alone. Many people dealing with a serious illness or helping a loved one through one are looking for ways to access the value of a life insurance policy. While it’s natural to assume that working with a nearby company is necessary, the truth is that location doesn’t matter. With today’s technology — and our platform in particular — the entire process can be handled electronically and remotely, without ever needing to leave your home. Why “Near Me” Doesn’t Matter Anymore Traditionally, people may have looked for a local …See More

- Why Your Insurance Company Might Not Tell You About Life Settlementsby C.E. DeanIf you’ve ever wondered why your insurance company didn’t mention the option to sell your life insurance policy, you’re not alone. Why your insurance company might not tell you about life settlements comes down to one simple fact: it’s not in their financial interest to do so. Life settlements offer policyholders a way to receive more than the policy’s surrender value—but that means the insurance company may ultimately have to pay out a death benefit they were hoping to avoid. What Is a Life Settlement? A life settlement is the sale of an existing life insurance policy to a third-party …See More

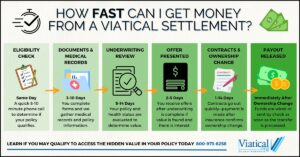

- How Fast Can I Get Money from a Viatical Settlement?by C.E. DeanIf you’re facing mounting medical bills, caregiving expenses, or other urgent financial needs, a viatical settlement could provide immediate relief. But you’re probably wondering “How fast can I get money from a viatical settlement?” The answer depends on several factors, including policy details, required paperwork, and the efficiency of the insurance carrier. In this post, we’ll break down the fastest and slowest timelines for viatical settlements, common delays, and how to help ensure you get paid as quickly as possible. How Quickly Can You Get Paid? The viatical settlement process can typically take as little as a few weeks, but …See More

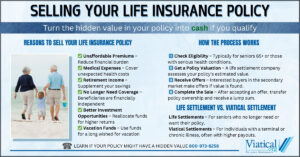

- Selling Your Life Insurance Policyby C.E. DeanMany policyholders find themselves wondering whether selling their life insurance policy is a viable financial option. Whether due to changing financial needs, an inability to keep up with premium payments, or a desire to access cash for immediate expenses, selling your life insurance policy can provide much needed funds. This process, known as a life settlement or viatical settlement, allows policyholders to receive a lump sum payment in exchange for their coverage. Why Consider Selling Your Life Insurance Policy? There are several reasons why someone might choose to sell their life insurance policy. Some common scenarios include: In addition to …See More

- Selling a Premium Financed Life Insurance Policy for Cashby C.E. DeanMany individuals and businesses use premium financing to fund large life insurance policies. While this strategy can provide financial flexibility, it may also lead to challenges if the policyholder can no longer afford loan payments or the policy is no longer needed. In such cases, a premium finance rescue, selling a premium financed policy for cash, may offer a way out—allowing policyholders to sell their policy, pay off the outstanding loan, and potentially walk away with cash in hand. What Is Premium Financing for Life Insurance? Premium financing is a method used to pay for life insurance premiums using borrowed …See More

- Should I Get a Life Insurance Loan for Cancer Treatment?by C.E. DeanA cancer diagnosis often brings not only emotional stress but also financial strain. As medical bills pile up, many individuals consider different options to cover the cost of treatment. One option some policyholders explore is borrowing against their life insurance policy. But should I get a life insurance loan for cancer treatment? While this may seem like an accessible solution, there are important factors to consider before making a decision. How a Life Insurance Loan Works A life insurance loan allows policyholders to borrow against the cash value of their permanent life insurance policy. Unlike traditional loans, this option does …See More

- How Do I Sell My Client’s Life Insurance Policy?by C.E. DeanIf you’re wondering, “How do I sell my client’s life insurance policy?” you’re not alone. Financial advisors, attorneys, trustees, and even life insurance agents often find themselves in situations where a client no longer needs or can no longer afford their life insurance policy. In such cases, a life settlement can provide a valuable alternative to surrendering the policy or allowing it to lapse. By selling a life insurance policy on the secondary market, your client may receive significantly more than the cash surrender value offered by the insurance company. Understanding Life Settlements A life settlement involves selling an existing …See More

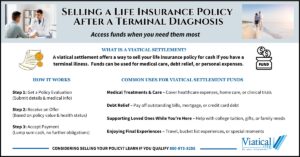

- Selling a Life Insurance Policy After a Terminal Diagnosisby C.E. DeanReceiving a terminal diagnosis can bring not only emotional challenges but also significant financial burdens. Selling a life insurance policy after a terminal diagnosis can be a practical solution for individuals seeking financial relief to cover medical expenses, improve their quality of life, or secure their family’s future. A viatical settlement allows policyholders to convert the hidden value in their life insurance into a cash payout, providing immediate funds during a difficult time. What Is a Viatical Settlement? A viatical settlement is the process of selling a life insurance policy to a third-party buyer for a lump sum payment. The …See More

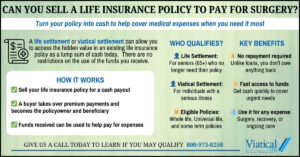

- Can You Sell a Life Insurance Policy to Pay for Surgery?by C.E. DeanIf you’re facing the high cost of surgery, you may be wondering: Can you sell a life insurance policy to pay for surgery? The answer is yes, you may be able to sell a policy for cash—many policyholders can sell their life insurance policy through a life settlement or viatical settlement, depending on their health status and policy type. This option can provide a much-needed financial lifeline for those struggling with medical expenses. The Origin of Life Settlements: Grigsby v. Russell The right to sell a life insurance policy was established over a century ago in the landmark 1911 U.S. …See More

- How to Find the Best Offer When Selling Your Life Insuranceby C.E. DeanIf you’re looking to sell your life insurance policy, your goal is simple: get the highest payout possible while working with a reputable, licensed buyer. But the life settlement market can be confusing, and not all buyers offer the same price. Some brokers take hefty commissions and knowing how to find the best offer when selling your life insurance is essential, as the offers you receive can vary widely based on factors like your policy type, health status, and market demand. So, how do you ensure that you’re getting the best deal? Let’s walk through the process, key considerations, and …See More

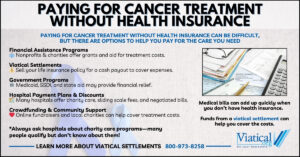

- Paying for Cancer Treatment Without Health Insuranceby C.E. DeanFacing a cancer diagnosis is challenging enough on its own, but navigating the costs of treatment without insurance can feel overwhelming. However, there are numerous avenues for financial assistance, creative payment solutions, and support resources available to help you get the care you need. Here’s how to go about paying for cancer treatment without health insurance: 1. Financial Assistance Programs and Charitable Organizations Several nonprofit organizations and charitable foundations provide financial assistance specifically for cancer patients without insurance. These organizations can help cover the costs of medical bills, prescription medications, travel expenses, and other related costs. Key Resources: To maximize …See More

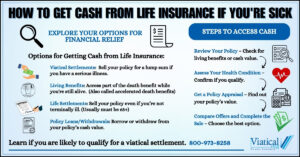

- How to Get Cash from Life Insurance If You’re Sickby C.E. DeanIf you’re sick and need cash, your life insurance policy could be a valuable resource. Knowing how to get cash from life insurance if you’re sick can help ease financial stress and provide much-needed funds for medical expenses, daily living costs, or other financial needs. In this article, we’ll explore the options available to you and how to make the most of your life insurance policy if you’re dealing with a serious health condition. Understanding Your Options There are several ways to get cash from your life insurance policy if you’re sick, including: How to Qualify for a Viatical Settlement …See More

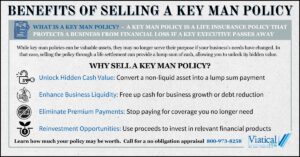

- Benefits of Selling a Key Man Policyby C.E. DeanIf your business no longer needs its key man life insurance policy, you might be wondering about the benefits of selling a key man policy for cash. Many business owners and financial professionals are unaware that key man policies can be converted into a lump sum payment through a life settlement. This strategic financial move can provide your company with immediate liquidity and unlock the hidden value of an otherwise dormant asset. What is a Key Man Policy? A key man policy is a life insurance policy purchased by a business to provide financial protection if a key executive, owner, …See More

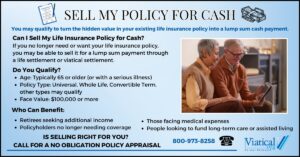

- Sell My Policy for Cashby C.E. DeanIf you’re wondering how to sell my policy for cash, you’re not alone. Many policyholders discover that they no longer need or can no longer afford their life insurance and want to unlock its value. Selling your life insurance policy through a life or viatical settlement can provide you with a lump sum of cash, often far more than surrendering the policy back to the insurance company. Can I Sell My Life Insurance Policy for Cash? Yes, in many cases, you can sell your life insurance policy for cash. This process is known as a life settlement or viatical settlement, …See More

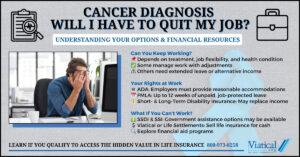

- Cancer Diagnosis Will I Have to Quit My Job?by C.E. DeanCancer Diagnosis Will I Have to Quit My Job? This question weighs heavily on many individuals after receiving life-changing news. The decision to continue working depends on factors such as your treatment plan, job flexibility, and financial situation. While some people manage to balance work with treatment, others may need extended leave or alternative income sources. In this article, we’ll explore your rights as an employee, workplace accommodations, and financial options—such as a viatical settlement or life settlements—if you can no longer work. Can You Keep Working After a Cancer Diagnosis? Many people with cancer continue working during treatment, while …See More

- Paying Off Bills with a Life Settlementby C.E. DeanIf you’re struggling with financial obligations, paying off bills with a life settlement can provide much-needed relief. A life settlement allows you to sell your life insurance policy for a lump sum of cash, which can be used to eliminate debt, cover medical expenses, or simply ease financial stress. One key advantage of selling a policy is that you are no longer responsible for premium payments—a significant financial burden that many policyholders struggle with as they age. While life insurance is a necessity for many, in some cases, a policy is no longer needed, and it just doesn’t make sense …See More

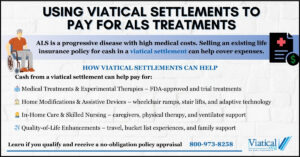

- Using Viatical Settlements to Pay for ALS Treatmentsby C.E. DeanAmyotrophic lateral sclerosis (ALS), also known as Lou Gehrig’s disease, is a progressive neurodegenerative disorder that affects nerve cells in the brain and spinal cord. As the disease advances, individuals with ALS often face significant medical expenses, including specialized care, assistive devices, and experimental treatments that may not be covered by insurance. Using viatical settlements to pay for ALS treatments can provide a financial solution that allows patients to access a lump sum of cash to help cover these costs. What Is a Viatical Settlement? A viatical settlement involves selling a life insurance policy to a third-party buyer in exchange …See More

- Selling Your Life Insurance with Congestive Heart Failureby C.E. DeanCan You Sell Your Life Insurance Policy If You Have CHF? Congestive Heart Failure (CHF) is a progressive condition that can lead to increasing medical costs and financial strain. If you or a loved one has been diagnosed with end-stage CHF, selling your life insurance with congestive heart failure can allow you to access an immediate cash payment through a viatical settlement. If your life expectancy is longer than two years, you may still be eligible for a life settlement, which offers similar benefits but typically provides a lower payout than a viatical settlement. Understanding CHF and Its Impact on …See More

- Viatical Settlements May Help You Access the Latest Treatmentsby C.E. DeanFor individuals facing serious illnesses, accessing cutting-edge treatments can be both life-changing and financially overwhelming. Viatical settlements may help you access the latest treatments by providing immediate funds from the sale of a life insurance policy. Whether you are managing advanced Parkinson’s disease, cancer, or another severe medical condition, a viatical settlement can offer financial relief to help cover the cost of new therapies, home care, and other medical expenses. New Treatment Advances and the Rising Cost of Care Medical breakthroughs are constantly expanding treatment options for serious illnesses. However, these treatments often come with high out-of-pocket costs, even for …See More

- The Role of AI in Life Settlement Valuationsby C.E. DeanThe role of AI in life settlement valuations is transforming how policies are assessed, priced, and transacted within the viatical and life settlements markets. Traditionally, underwriting and policy valuation relied on manual assessments, actuarial tables, and extensive human-driven analysis. Today, artificial intelligence (AI) and machine learning are streamlining these processes, leading to faster, more accurate, and data-driven decision-making. How AI is Revolutionizing Life Settlement Valuations Machine Learning and Predictive Analytics in Underwriting The Future of AI in the Life Settlement Industry Life settlement companies are already using AI to improve life expectancy predictions, enhance policy valuation accuracy, and streamline underwriting processes. …See More

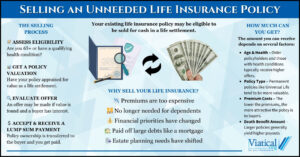

- Selling an Unneeded Life Insurance Policyby C.E. DeanMany policyholders find themselves in a situation where they no longer need or can no longer afford their life insurance coverage. Selling an unneeded life insurance policy can provide a financial solution by turning the policy into a lump sum of cash. Instead of surrendering it for a fraction of its value or letting it lapse, a life settlement or viatical settlement may allow you to receive significantly more. Why Sell a Life Insurance Policy? There are several reasons why a policyholder may no longer need their life insurance policy: Case Study: A Retired Couple Turns a Policy into Retirement …See More

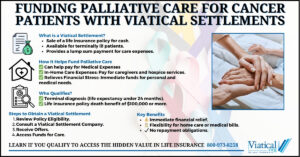

- Funding Palliative Care for Cancer Patients with Viatical Settlementsby C.E. DeanFor many individuals facing a cancer diagnosis, ensuring comfort and quality of life through palliative care is a top priority. Funding palliative care for cancer patients with viatical settlements offers a financial solution for those in need of immediate resources to cover medical and living expenses. By selling their life insurance policy, patients can access a lump sum payment to support their care journey without waiting for a death benefit. What Are Viatical Settlements? A viatical settlement is the sale of a life insurance policy to a third-party buyer for a cash payout. This option is available to individuals with …See More